Dabur India Ltd.'s share price fell over 2% during the morning trade on Thursday after its second-quarter profit decline triggered target price cuts by analysts.

The honey-to-packaged juice maker's net profit dropped 17.5% over the previous year's to Rs 418 crore during the July-September period, hurt by weaker demand in urban areas and heavy rains in parts of the country. It also missed the Bloomberg consensus estimate of Rs 446 crore.

Nuvama lowered its target price for Dabur India from Rs 760 to Rs 650, implying an 18.9% upside while maintaining a 'buy' rating. It explained that overall, domestic revenue decreased 7.6% year-on-year due to inventory rationalisation in GT to enhance distributors' return on investment.

Dabur's plan to acquire Ayurvedic hair care brand Sesa Care Pvt. for an estimated Rs 315–325 crore could help fill a gap in Ayurvedic oils, but Citi Research said the category has been facing challenges, with Emami leading the market through its Kesh King brand.

The brokerage maintained its "sell" rating for the stock and lowered the target price from Rs 570 to Rs 520, indicating a potential downside of 4.9%.

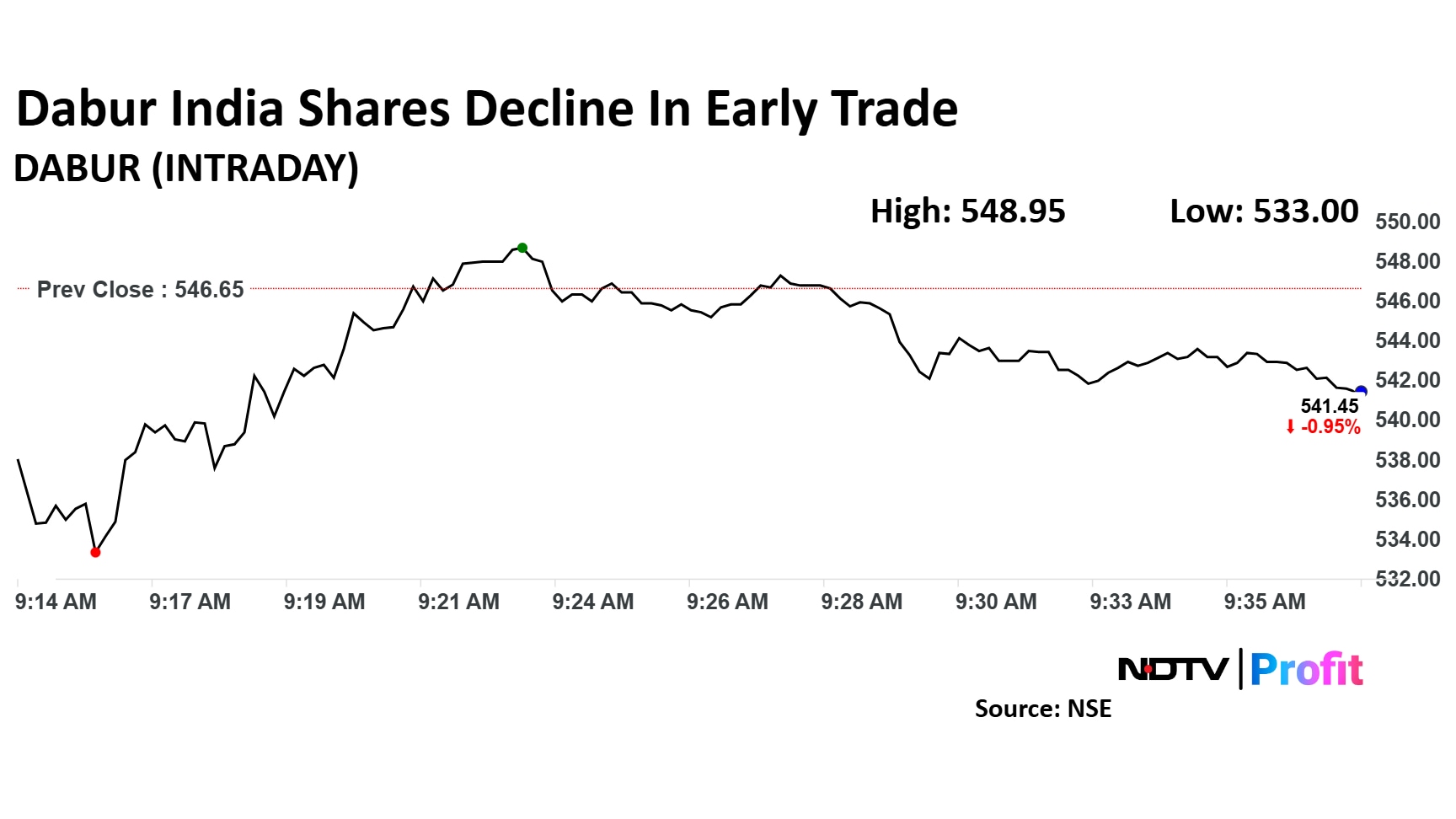

Dabur India Share Price Movement

Dabur India stock pared loss to trade 1% lower at Rs 541.45 apiece, as of 09:36 a.m., compared to a 0.4% decline in the NSE Nifty 50.

Shares of Dabur India fell as much as 2.5% to Rs 533 apiece. The scrip pared loss to trade 1% lower at Rs 541.45 apiece by 09:36 a.m., compared to a 0.4% decline in the NSE Nifty 50.

The stock has fallen 2% in the last 12 months and 3% on a year-to-date basis. The total traded volume stood at 2.9 times the 30-day average. The relative strength index was at 34.

Out of 44 analysts tracking the company, 26 maintain a 'buy' rating, 15 recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target of Rs 636 implies an upside of 17%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.