11_07_24.jpg?downsize=773:435)

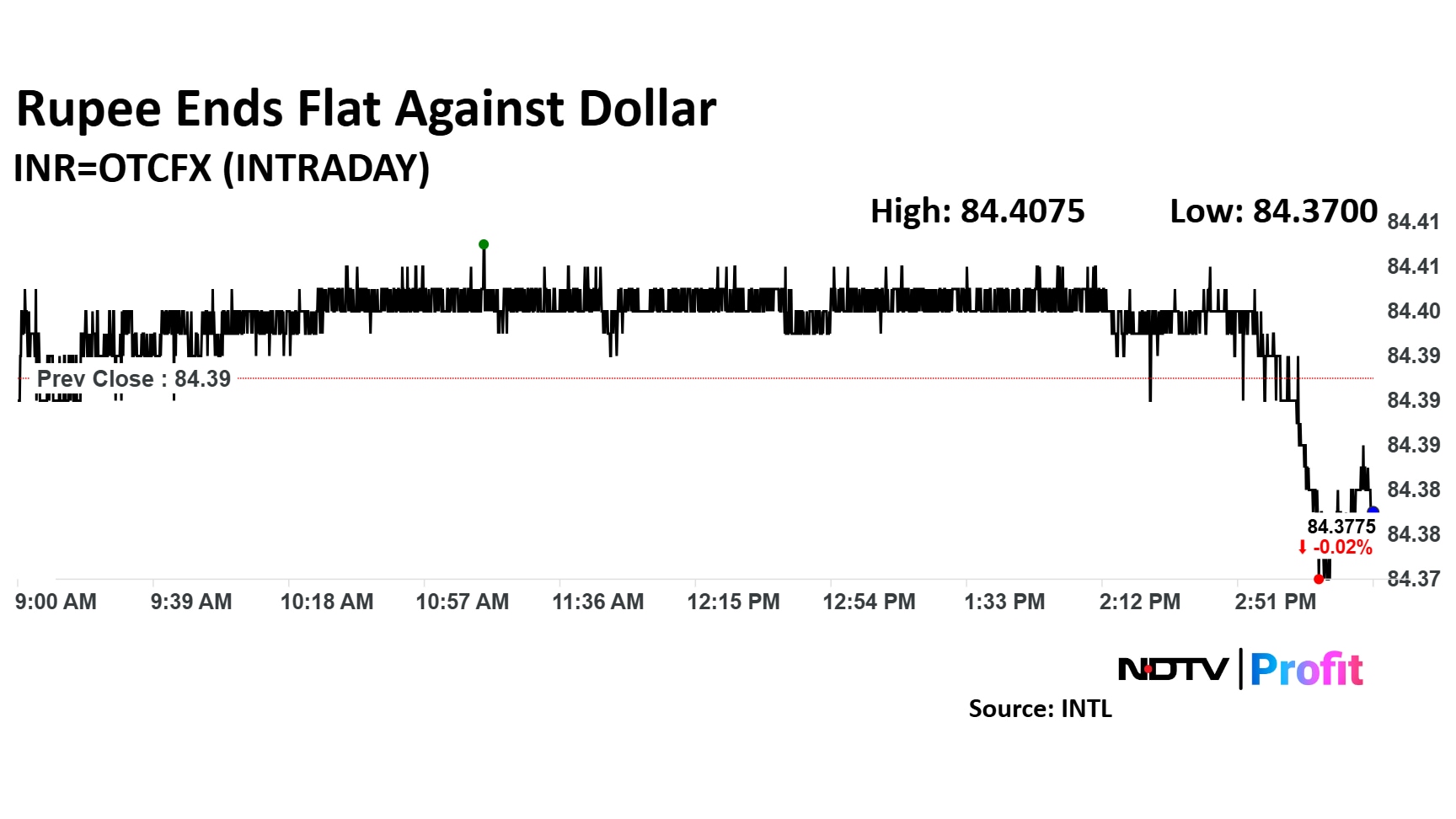

The Indian rupee closed flat at 84.38 against the US dollar on Wednesday, holding near its all-time low of 84.4162.

This comes as the Reserve Bank of India continues its efforts to stabilise the currency, according to both—Amit Pabari, managing director of CR Forex Advisors and Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

On Tuesday, the rupee had closed at the same level.

Rupee has come under pressure amid the strengthening of the US dollar following the presidential poll victory of Donald Trump. The dollar spot index remained firm at 105.94, marking a 6.5-month high.

“The dollar is reaping benefits from the election results as investors price in inflationary pressures from potential lower taxes and higher trade tariffs,” Bhansali said.

He also added that the RBI is actively supporting the rupee around the 84.40 level, though further weakening toward 84.50 remains possible. Foreign portfolio investors continued to offload Indian shares, selling approximately Rs 3,000 crore on Tuesday, which Bhansali expects, may persist through the day.

For exporters and importers, Bhansali said, “Exporters may wait with a stop loss at 84.25, while importers should consider buying on dips,” projecting a trading range between 84.30 and 84.50 for the day.

Recent declines in crude oil prices, down by nearly 5.5% over the past week, is a supportive factor for the rupee, according to Pabari. “Lower oil prices benefit India, the world's second-largest oil importer, by easing pressure on the Current Account Deficit,” Pabari said, adding that capital inflows could come from upcoming MSCI index adjustments and the anticipated NTPC IPO.

Despite sustained dollar sales by the RBI, India's forex reserves have declined for the fifth consecutive week, currently at $682 billion from a recent peak of $704 billion. Looking ahead, Pabari projected the rupee would trade in a range of 83.80 to 84.50, with a potential shift toward the lower end if inflows support the currency.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.