11_07_24.jpg?downsize=773:435)

The Indian rupee closed weaker against the US dollar on Tuesday amid expectations of a continued RBI intervention. Market participants are waiting on the sidelines for the release of US inflation data due Wednesday for insights on the scale of the Federal Reserve's anticipated interest rate cut.

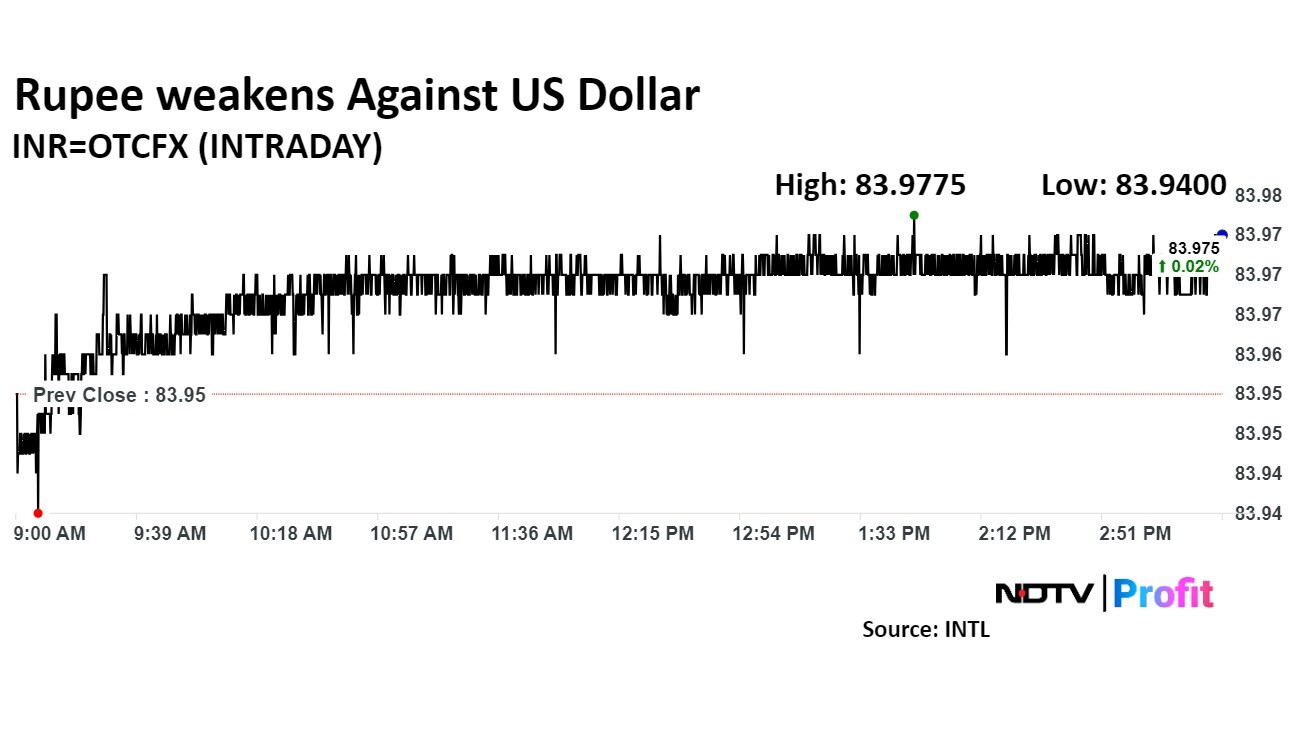

The rupee closed three paise weaker at Rs 83.98 against the US dollar, according to Bloomberg data. The domestic currency had closed at Rs 83.95 on Monday.

With foreign institutional inflows exceeding $21 billion in this financial year, alongside significant corrections in asset classes like the dollar index and crude oil prices, the RBI has maintained its strategy of absorbing the incoming flows to limit appreciation of the rupee, according to Amit Pabari, managing director of CR Forex Advisors.

The US dollar index was 0.03% higher at 101.58 at 3:31 p.m. Brent Crude was trading 1% lower at $71.12 per barrel at 3:32 p.m.

All eyes will be on the upcoming US CPI data, set to release on Wednesday. Expectations lean toward a softer reading, which could increase the likelihood of the Fed opting for a larger than the anticipated 25-basis-point rate cut, Pabari said. "Such a move could push the dollar index down to around 100, providing much-needed support for emerging market economies."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.