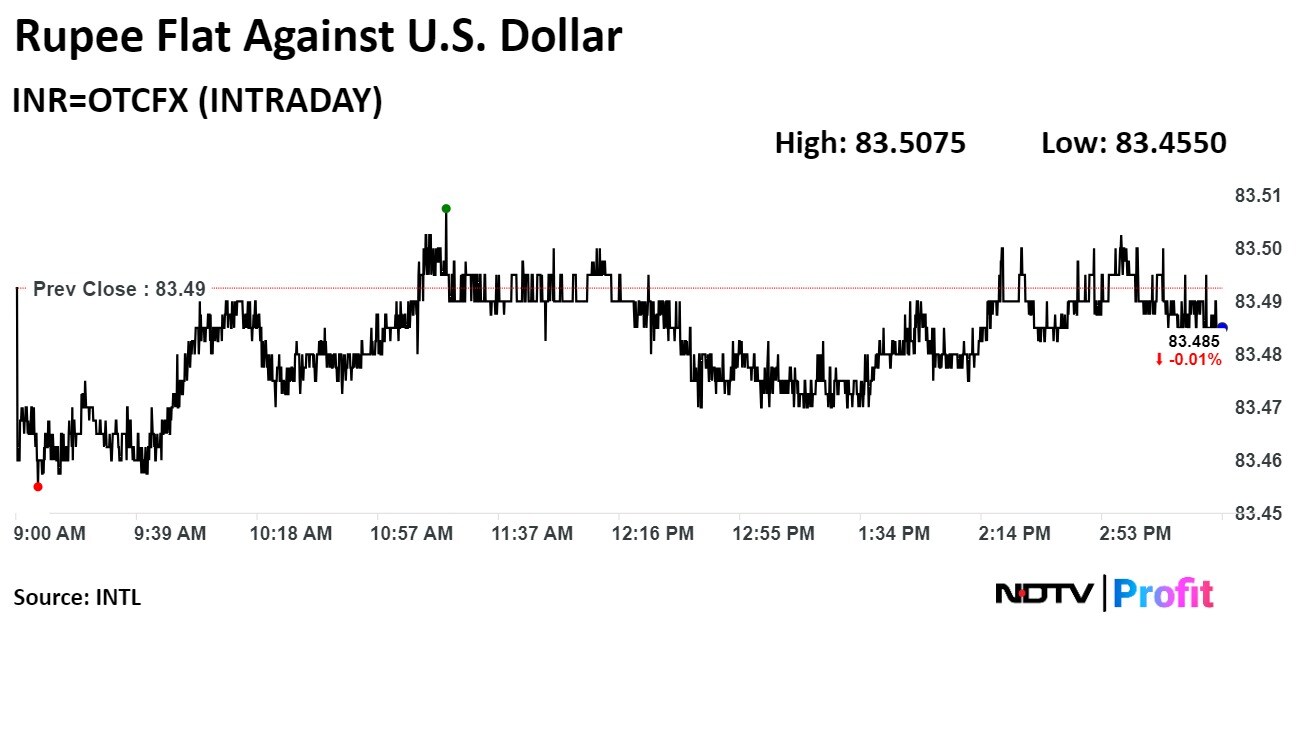

The Indian rupee pared gains to close flat against the greenback on Friday due to dollar demand from oil importers who rushed to shore up their oil reserves.

The local currency closed little changed at Rs 83.49 after opening at Rs 83.47 against the US dollar, according to Bloomberg data. The currency closed at Rs 83.50 on Thursday.

Analysts said that the pressure stems from oil marketing companies purchasing crude in anticipation of further price hikes, with Brent oil hovering around $87. Adding to this, latest data showed that US inventories last week dropped more than 12 million barrels, the biggest decline in almost a year, according to Bloomberg.

They also said that the RBI seems to be managing the rupee's volatility, capping both its upward and downward movements.

"The dollar index fell towards 105 levels and US 10-year bond yields dropped towards 4.35% as a series of economic data showed a cooling US economy, thereby heightening the expectations that the Fed will cut rates sometime soon," Amit Pabari, managing director of CR Forex Advisors, said.

"For now, the rupee is expected to remain stable, gradually gravitating towards the lower end of the Rs 83.10–83.70 range. Market watchers see Rs 83.10–83.20 as a buying zone, while Rs 83.50–83.70 is considered a selling zone," Pabari said.

"For the rupee, Rs 83.35 will act as a support and Rs 83.58 as a resistance," according to Kunal Sodhani, vice president at Shinhan Bank.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.