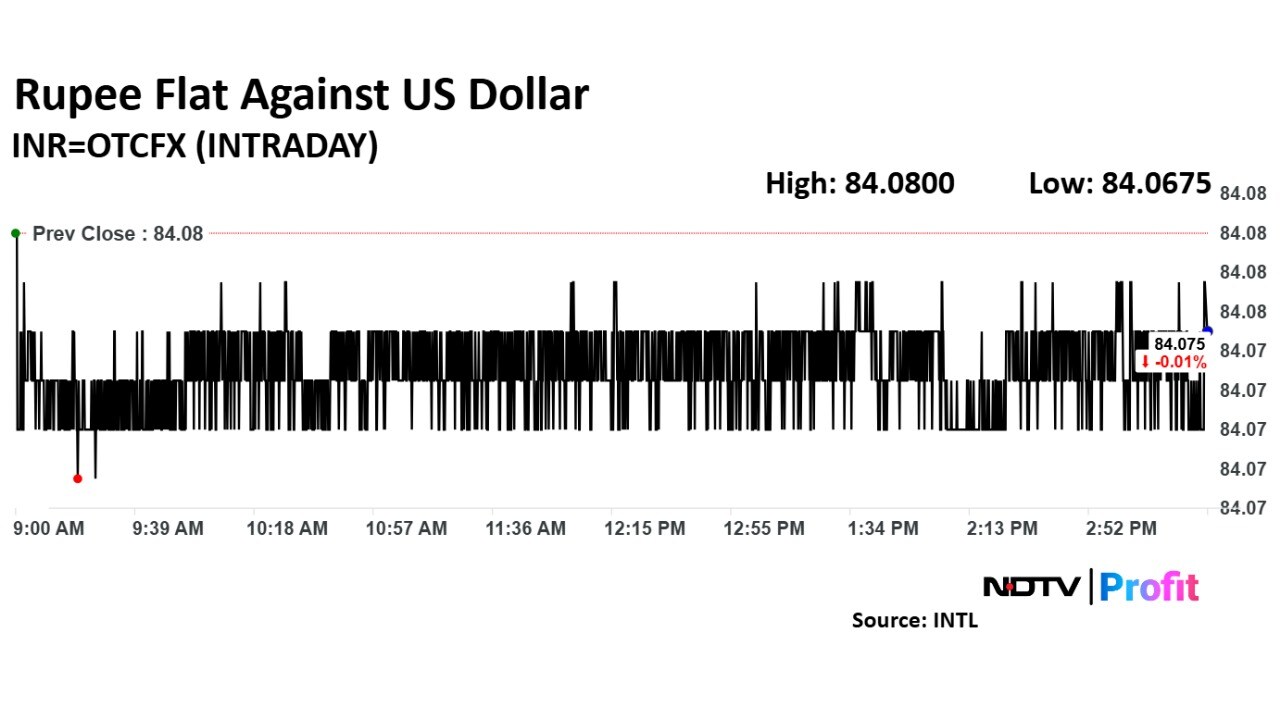

The Indian rupee closed little changed against the US dollar on Monday amid uncertainty about the Middle East tensions and US election, even as market participants kept track of any action from the Reserve Bank of India.

The local currency ended at Rs 84.07 per dollar, compared to the previous close of Rs 84.081.

The RBI is expected to keep the rupee in the Rs 84.00-84.20 range and protect it from any further fall, said Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

India's forex reserves fell for the third consecutive week, according to RBI data released on Friday. During times of volatility, the central bank deploys its dollar reserves to stabilise the local currency.

The heightened uncertainty surrounding the Middle East and the US presidential election supports the safe-haven dollar. Expectation of slower pace of Fed rate reductions also boosts the greenback, said forex analyst Kunal Sodhani of Shinhan Bank India.

The dollar traded near three-month high against major currencies. The dollar index, which measures the strength of the greenback against a basket of six currencies, stood at 104.24 (up 0.01%). The US 10-year bond yield was 2 basis points higher at 4.26%, pulling up the dollar index.

Brent crude oil prices fell nearly 6% to $71.47 per barrel, the lowest since the start of October, as the Israeli strike on Iran was less severe than feared, easing worries on supply. The risk premium is accordingly priced out of oil prices, Bhansali of Finrex Treasury said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.