The Indian rupee weakened sharply on Wednesday as the US dollar index rose and banks continued to buy the greenback for oil marketing companies and importers.

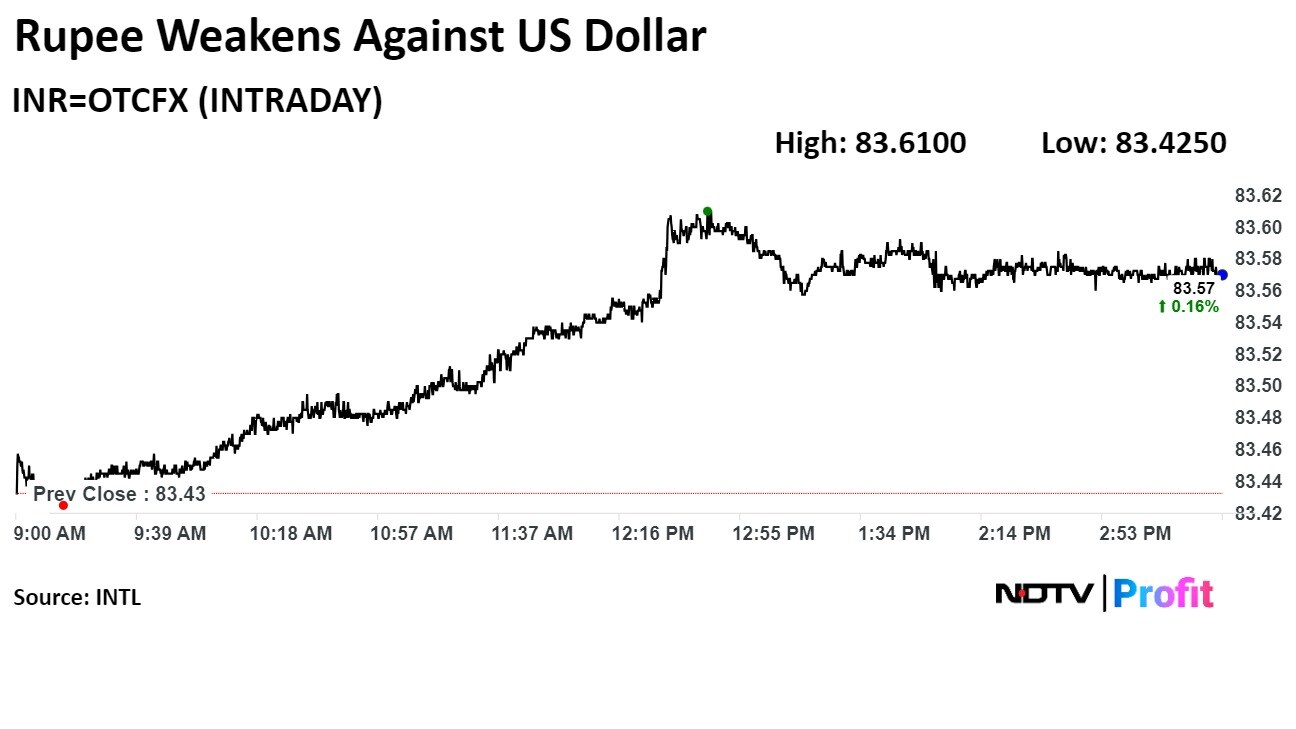

The local currency weakened 14 paise against the dollar to close at Rs 83.57, according to Bloomberg data. In the second half of the trade, it weakened 18 paise to Rs 83.61. The rupee had depreciated 2 paise to open at Rs 83.45 against the greenback, as compared with Tuesday's close of Rs 83.43 per dollar.

Intraday, the dollar index, which gauges the strength of the greenback against six major currencies, rose 0.24% to 105.8600. The index was at 105.93 as of 4:40 p.m., according to Bloomberg data.

The benchmark August contract of Brent crude on the Intercontinental Exchange was trading at $84.89 per barrel as compared with Tuesday's close of $85.01 per barrel, according to data on Bloomberg.

"The rupee is depreciating on the back of depreciation in Asian currencies, with CNH (Chinese yuan) trading at 7.2955, which is a seven-month high," Anil Bhansali, executive director at Finrex Treasury Advisors LLP, said.

Some gains in the dollar index ahead of the US Personal Consumption Expenditure and GDP data later in the week also pressured the local currency, Bhansali said.

The Reserve Bank of India may be selling dollars to protect the rupee. The market also waits to know the effect of the JPMorgan index induction from Friday, Bhansali said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.