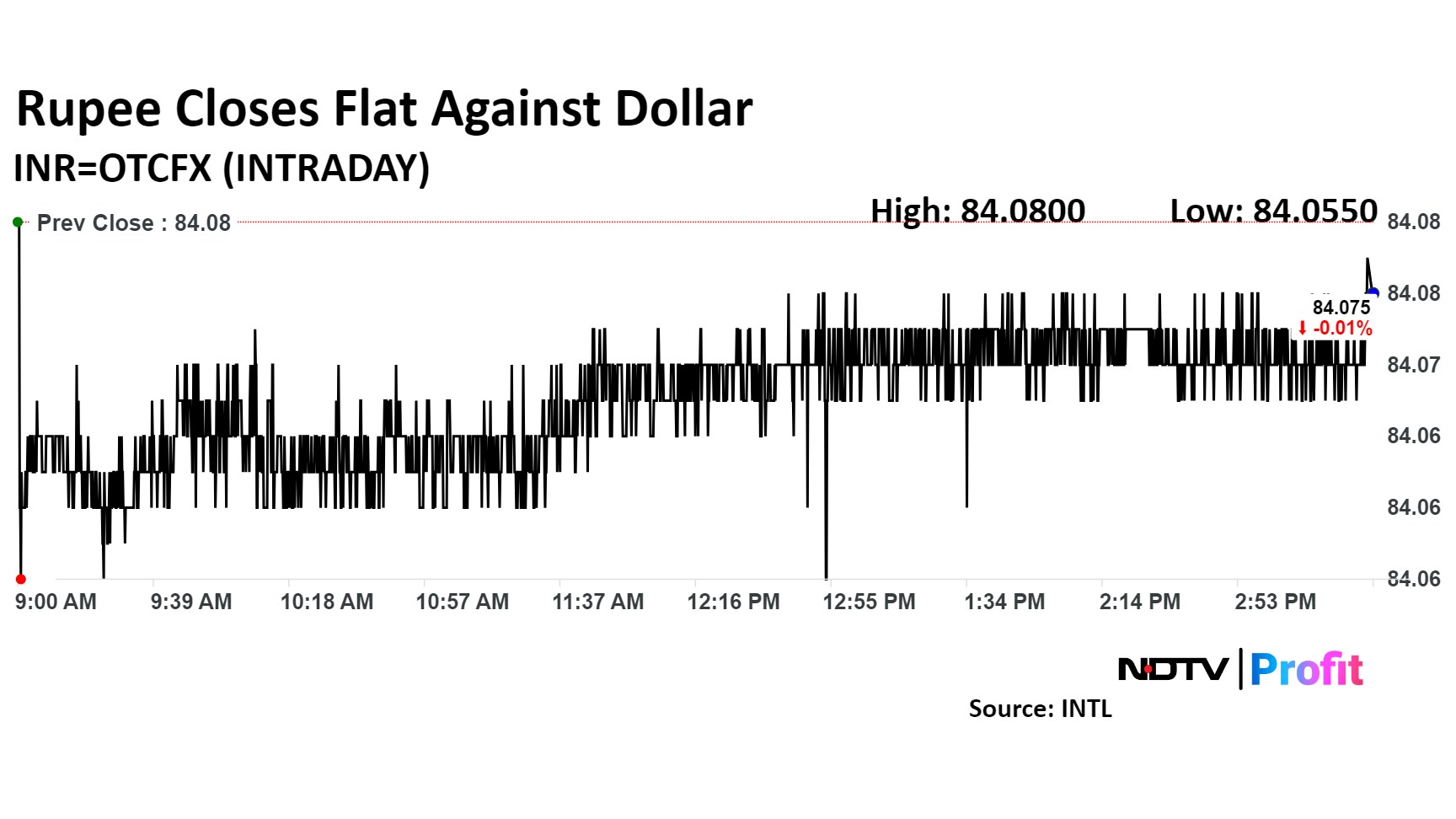

The Indian rupee closed flat against the US dollar on Thursday. The local currency ended at Rs 84.075, compared to the previous day's record low close of 84.082. The rupee traded within the range of 84.08-84.055.

The recent pressure on the rupee has come from foreign outflows from India and the greenback's strength globally. A rise in international oil prices also influenced the local currency.

Rupee remained range bound for the entire day moving within a range of 2 paise from 84.0550 to 84.0775 with RBI protecting the levels of 84.08, according to Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

"The RBI is sitting tightly on it while FPIs who have been sellers in equity buying dollars to send money to US till the impending elections are over," said Bhansali.

The dollar traded at a three month's high against major currencies on expectations of a slower Federal Reserve rate cut and growing bets of a second Trump presidency. The dollar index, which measures the strength of the greenback against a basket of six currencies, stood at 104.20 (down 0.22%) while US 10-year bond yield was steady but at its recent highs at 4.19%.

Brent crude oil prices edged higher by 2% to $76.48 per barrel and were on track to a weekly gain of 3% despite US inventories rising much more than expected. Worries also persist on Middle East tensions.

"We now await for the volatility in the first week of November as NFPR, US Elections and FOMC are all due then," said Bhansali.

Meanwhile, as the RBI protects the rupee, we expect the range to be between 84 to 84.15 tomorrow with no fresh inflows expected, he added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.