The rupee closed weaker against the US dollar on Wednesday, ahead of the Fed Manufacturing Index due on Thursday, due to dollar buying by oil companies and, to some extent, the stake sale of Indus Towers by Vodafone Inc.

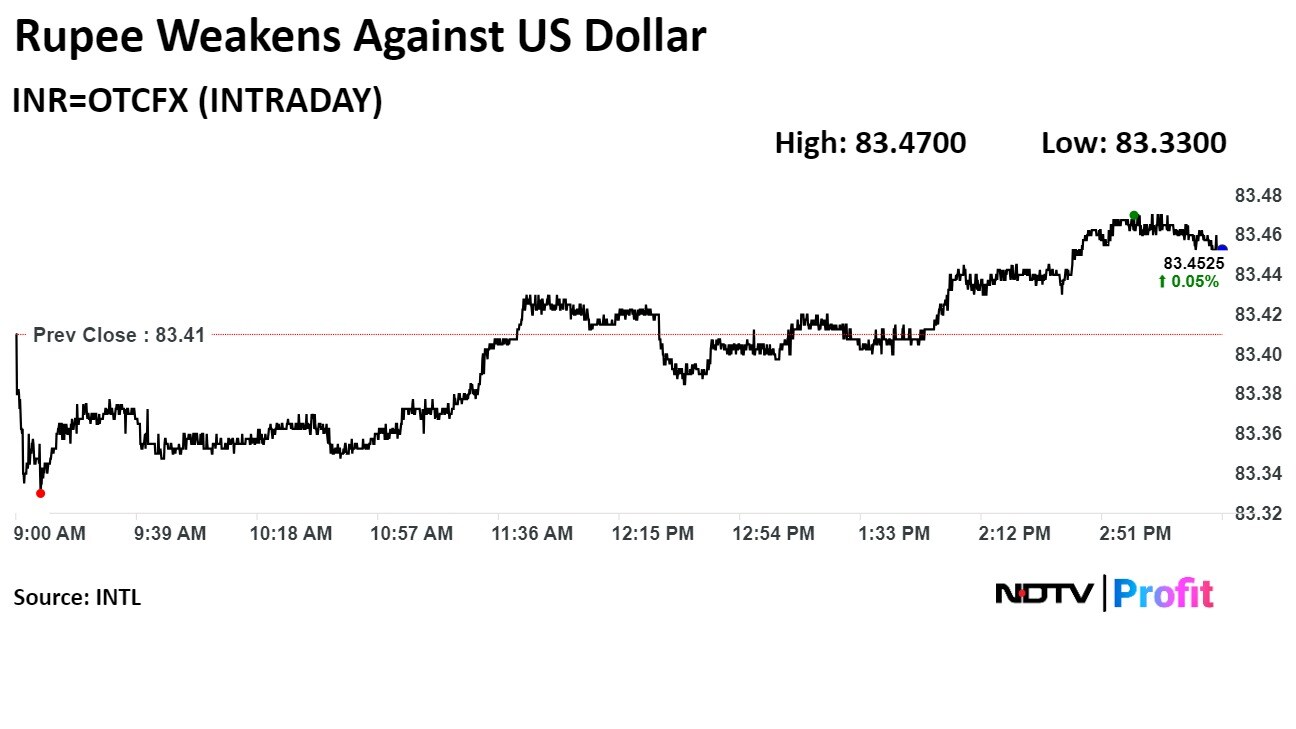

The local currency depreciated four paise to close at Rs 83.45 against the greenback. It closed at Rs 83.41 on Tuesday.

The dollar remained steady in the Asian markets after lower-than-anticipated US retail sales data. Brent crude increased by six cents, hitting $85.39 a barrel, its highest level in seven weeks.

Asian currencies were all generally weaker as the Chinese yuan fell to 7.2766. The Japanese yen was weaker at 157.93 after exports increased but falling volumes indicated softer demand.

The dollar index hovered at 105.25, while 10-year US bond yields were 4.22%.

The local currency strengthened by three paise to open at Rs 83.38 against the greenback, according to Bloomberg. It had closed at Rs 83.41 on Tuesday.

"With the US market closed for Juneteenth, the dollar is expected to remain in range during the evening session. Focus will shift to the weekly jobless claims and the Philadelphia Fed Manufacturing Index due on June 20, 2024," said Jateen Trivedi, VP Research Analyst, Commodity and Currency at LKP Securities.

"For USDINR, Rs 83.30 will act as a support, while Rs 83.50 is an immediate resistance," Kunal Sodhani, vice president of Shinhan Bank, said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.