11_07_24 (1).jpg?downsize=773:435)

Indian rupee closed little changed against the US dollar Monday on likely dollar selling by the Reserve Bank of India amid the continuous selling of domestic stocks by global funds.

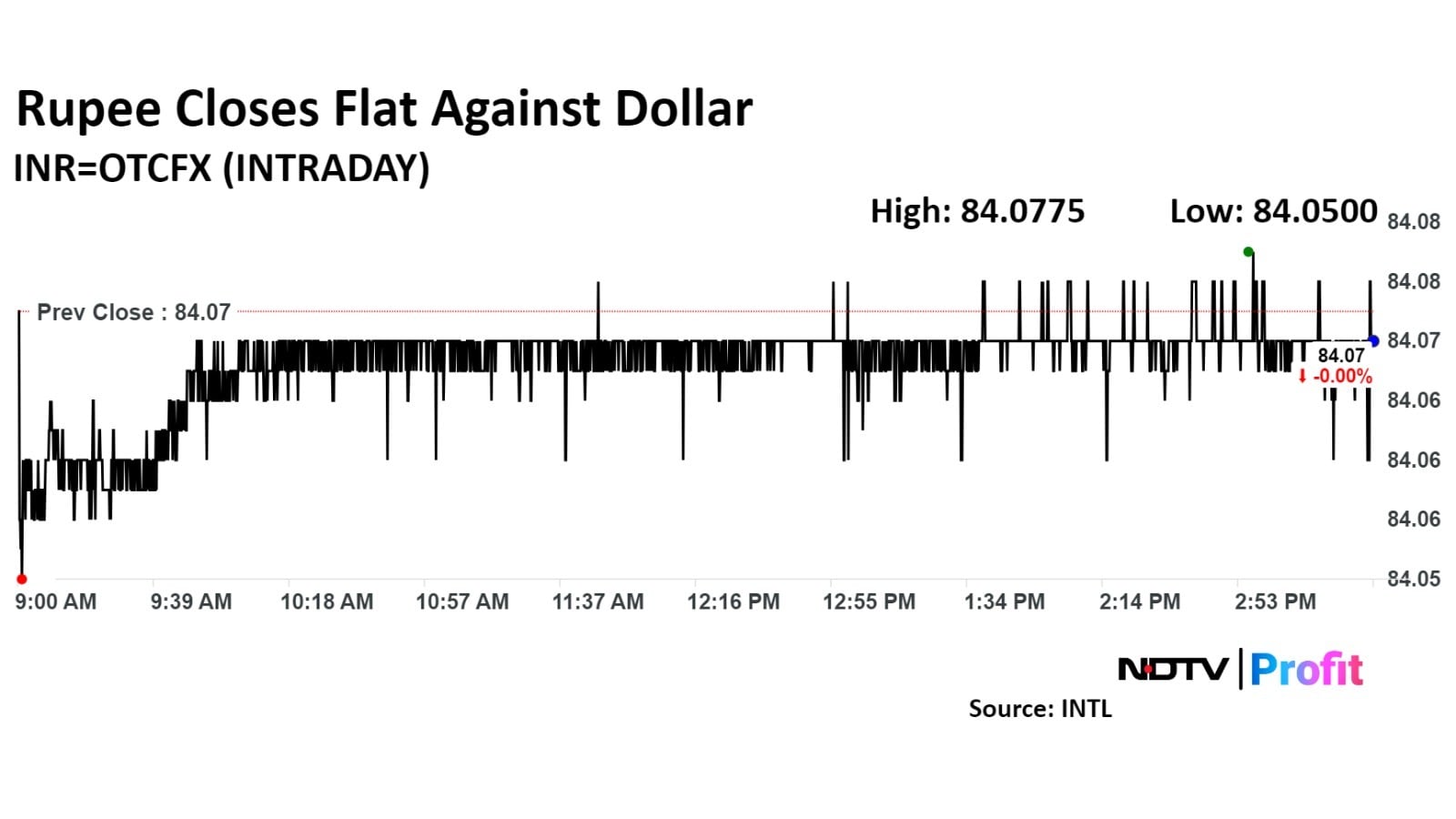

The rupee closed flat at Rs 84.066 against the dollar, according to Bloomberg data. The domestic currency had closed at Rs 84.07 against the greenback on Friday.

"The rupee was in a thin band of Rs 84.05-84.08 as FPI dollar purchases were offset by dollar sales from possibly the RBI," said Anil Kumar Bhansali, Head of Treasury and Executive Director, Finrex Treasury Advisors LLP.

Premiums were up slightly, as RBI Governor Das's speech on the right time to cut rates weighed on the market as India's 10-year government bond yield also fell to 6.8340%, Bhansali added.

Rupee closes little changed at Rs 84.066 on likely RBI intervention amid FPI outflows from domestic stocks

Oil was steady even as Israel vowed retaliation against Iran after it targeted the residence of Prime Minister Benjamin Netanyahu via a drone attack. This comes after Israel killed Hamas leader Yahya Sinwar.

As Israel intensifies its attacks, the rupee could come under pressure this week though RBI will be present all the time protecting, Bhansali said. Adding to this, the outflows of Hyundai IPO will start from tomorrow and that would cause the rupee to fall some more to Rs 84.10 in the coming days but the RBI should be there to protect the fall, he added.

However, with foreign exchange reserve falling by about $10 billion, the central bank has lower reserves to fight the dollar outflows, Bhansali said, who expects the rupee may likely trade in Rs 83.90-84.15 against the dollar on Tuesday.

Brent crude was trading 1.75% higher at $74.34 a barrel as of 9:14 a.m. The US Dollar Index was up 0.18% at $103.68.

The dollar index has the potential to rebound up to the 104 level, Amit Pabari, managing director of CR Forex Advisors. "However, looking further ahead, a correction below 100 seems likely as the Fed continues its rate-cutting cycle, shaping a more subdued medium- to long-term outlook for the index."

The Indian rupee may have been Asia's worst-performing currency last quarter, but it is poised to be the most resilient to the dollar's strength ahead of too-close-to-call US elections.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.