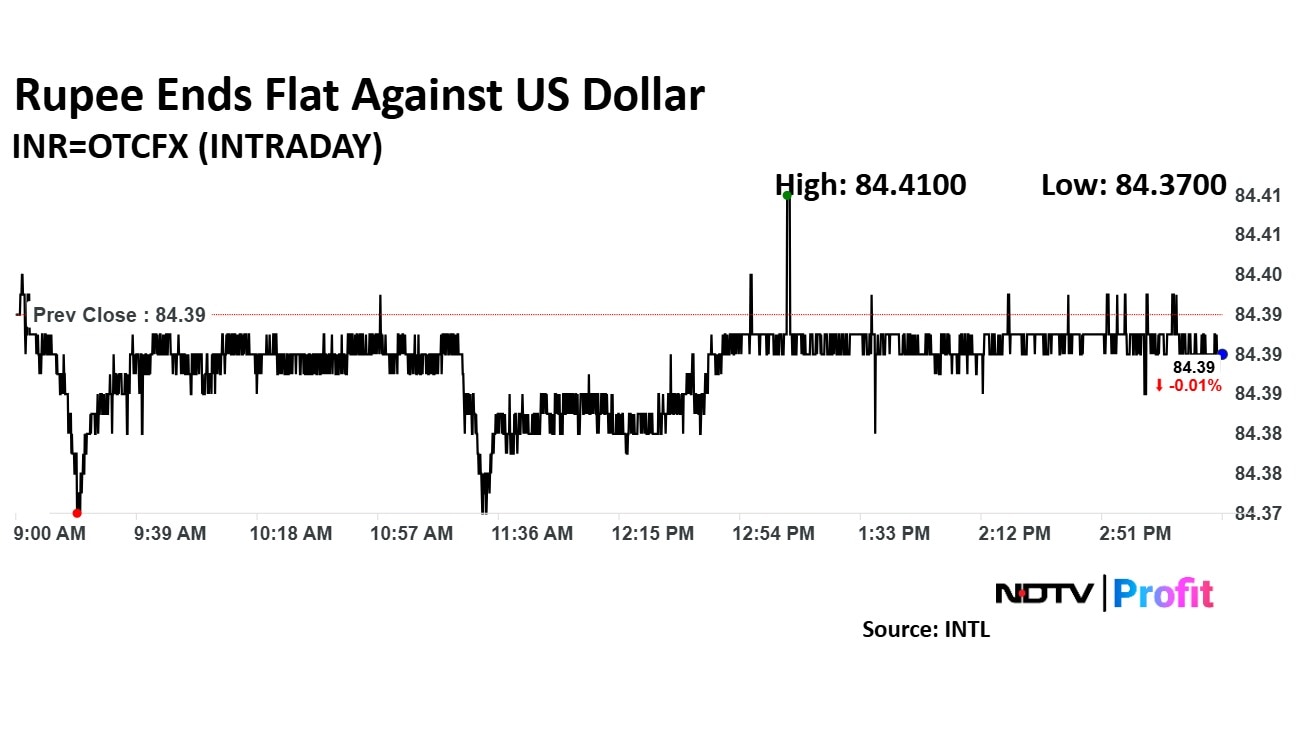

The Indian rupee closed little changed on Monday at Rs 84.39, according to Bloomberg data.

The currency had opened flat against the US dollar on Monday amid persistent pressure driven by continued FII outflows. It had closed at Rs 84.40 on Thursday.

Foreign institutional investor outflows in November contributed to a sharp correction of over 10.50% in the Nifty and 9.80% in the Sensex from their recent peaks.

"A slow and steady up move is what Reserve Bank Of India wants for the pair. It has sold $30 billion from its reserves to ensure that rupee stays well within the range and weakens gradually," said Anil Kumar Bhansali, the head of treasury and executive director of Finrex Treasury Advisors LLP.

The dollar index, which tracks the performance of the greenback against a basket of 10 leading global currencies, was trading 0.14% lower at 106.54 as of 03:40 p.m.

Recent reports indicate that CLSA plans to increase its India allocation to 20% overweight, a positive shift from the 10% allocation seen in October, said Amit Pabari, managing director at CR Forex Advisors.

"Additionally, the de-escalation of tensions in the Middle East has stabilised oil and gold prices, helping India maintain a balanced trade position," Pabari said.

"FPIs continue to be dollar buyers and equity sellers as they pulled out another Rs 1,850 crore on Thursday," he added.

International benchmark Brent crude oil was 0.84% up at $71.64. Oil rebounded following a weekly decline, driven by concerns over abundant supply and weaker demand from China, the world's top crude importer. Meanwhile, gold edged higher after experiencing its worst weekly drop since 2021, as the dollar softened and traders assessed the potential for future Fed rate cuts.

"Tomorrow the rupee is expected to be in the same range of 84.35 to 84.55 with a steady weakness creeping into it," Bhansali said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.