The Indian rupee recorded a fresh closing low against the US dollar on Friday, amid a continuing selloff in domestic stocks and is likely to remain in a tight range, according to analysts.

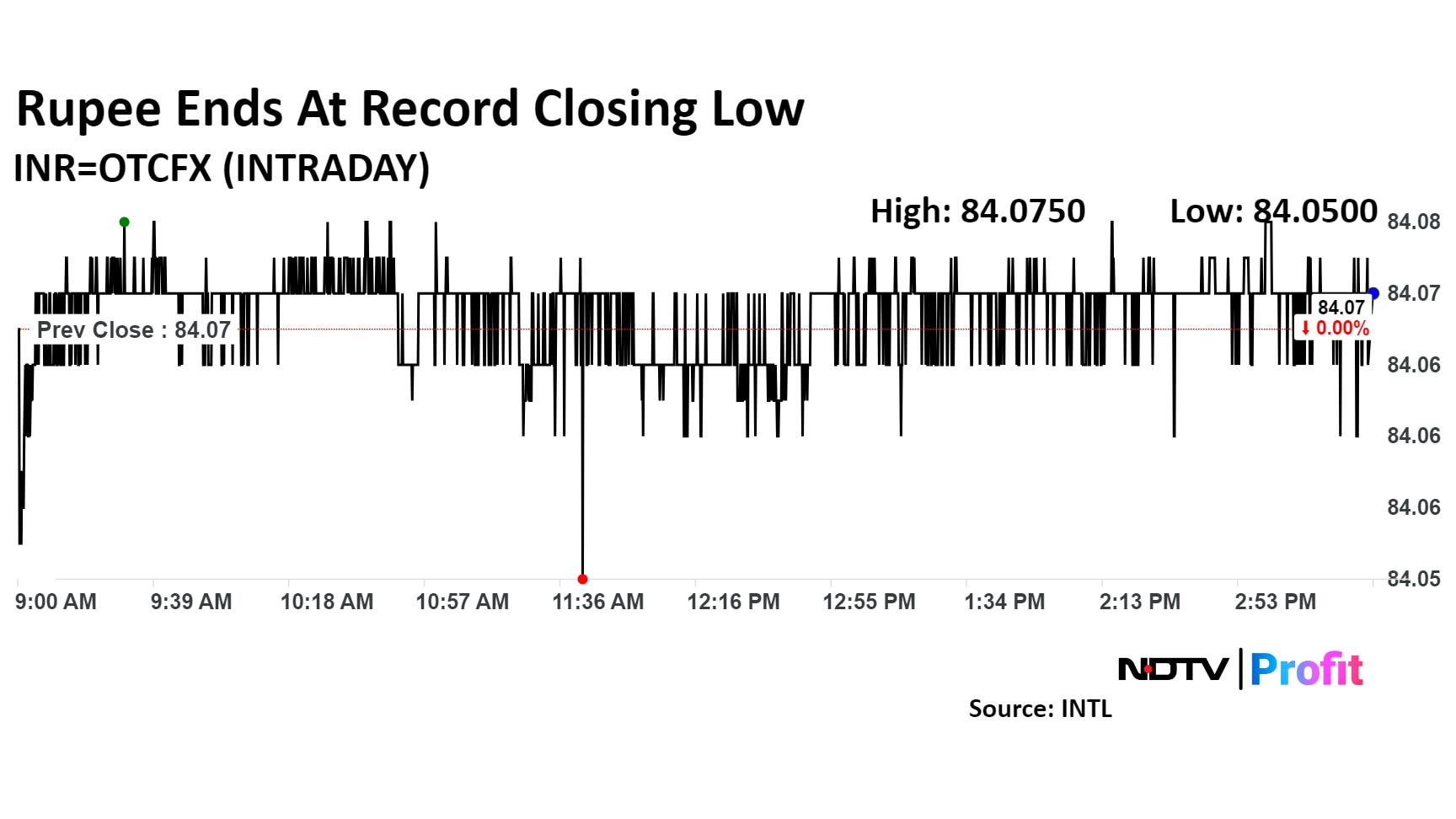

The domestic currency closed flat at 84.0737 on Friday, according to Bloomberg data. The Indian unit closed at 84.07 against the greenback on Thursday.

The Indian rupee was in a small range of 3 paise for the entire day as equities were sold off in the beginning of the session, but managed to gain towards the end after being oversold, said Anil Kumar Bhansali, head of treasury and executive director, Finrex Treasury Advisors LLP.

FPIs, who were sellers yesterday to the tune of Rs 7,500 crore, would have also been sellers today and would have been buying dollars to fund their equity sales, he said.

"But the RBI has been protecting the 84.08 area and has not allowed rupee to cross this level since last Friday," he added.

We expect the rupee to move in a range of 83.90 to 84.15 on Monday with a close watch on what RBI does, Bhansali said.

Crude oil prices were poised for increased volatility as tension escalated in West Asia, with Israel killing Hamas leader Yahya Sinwar—the mastermind of last year's Oct. 7 assault—in southern Gaza.

Brent crude was trading 0.54% lower at $74.05 a barrel as of 04:14 p.m. The US Dollar Index was down 0.18% at $103.64.

A strong dollar also limited oil recovery as strong US retail sales and lower jobless claims furthered bets that interest rates will fall by a slower pace in the coming months, stated Bhansali.

Oil's mild gains came after the data showed US inventories shrank while focus remain on Israel's retaliation against Iran over a strike in October, he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.