Cummins India Ltd.'s share price fell over 5% on Friday after Goldman Sachs downgraded the stock to 'sell', saying incremental market share gains will be at the expense of profitability.

The brokerage has a target price of Rs 2,900 per share, implying a 23% downside.

The transition to CPCB-IV has made diesel gen-sets more expensive by 15-25%, Goldman Sachs said in a note. Further, with competitors introducing more SKUs in high Kilo-volt-amperes gen-sets, the brokerage expects incremental market share gains to be at the expense of profitability.

The overall demand will reduce in the medium-to-long term with falling battery costs, the brokerage said.

Goldman Sach sees export growth rates lower versus the previous upcycle on stringent emission norms. The brokerage's downgrades are due to near-term margins coming under pressure and medium-term growth moderating, it said.

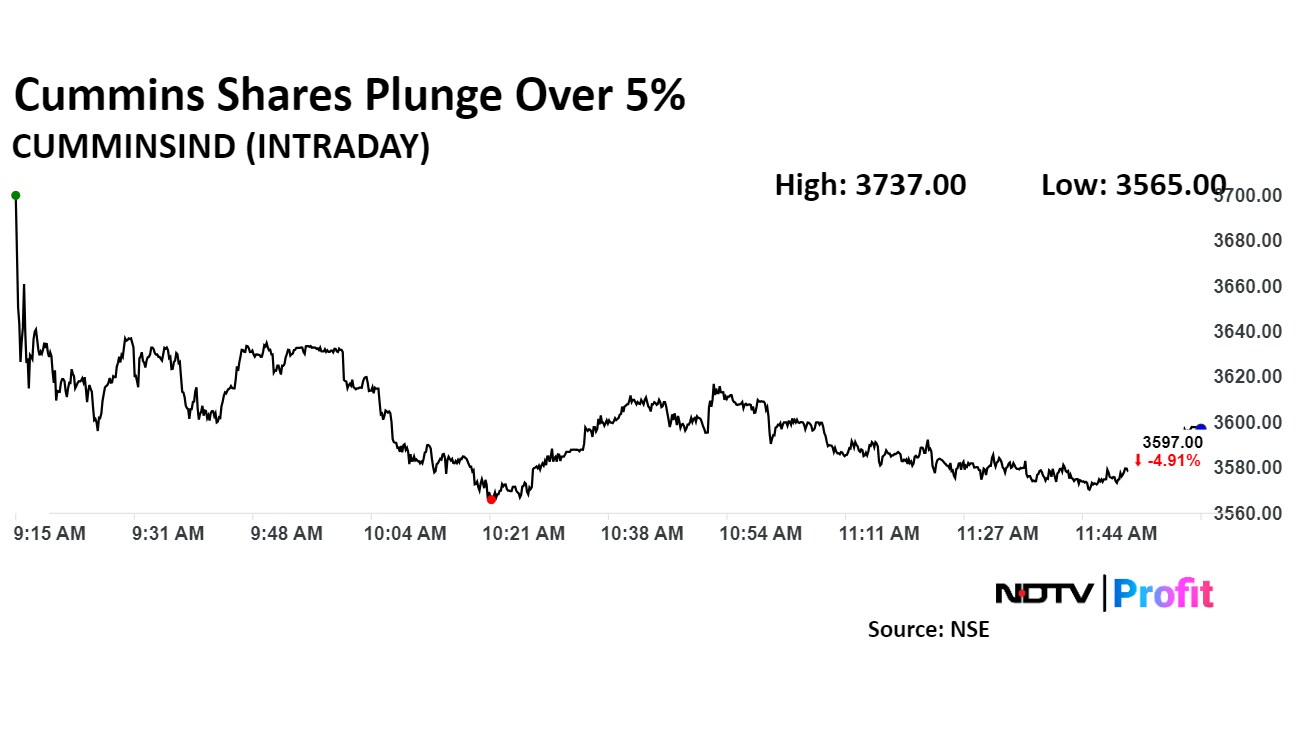

Cummins India Share Price Today

Cummins' share price fell as much as 5.75% during the day before paring some loss to trade 5.01% lower at Rs 3,593.2 apiece, compared to a 0.2% advance in the benchmark Nifty 50 as of 11:58 a.m.

The stock has risen 105% during the last 12 months and has advanced by 83% on a year-to-date basis. Total traded volume so far in the day stood at 6.1 times its 30-day average. The relative strength index was at 41.

Twelve of the 27 analysts tracking the company have a 'buy' rating on the stock, five suggest a 'hold' and 10 have a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 0.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.