Colgate Palmolive (India) Ltd.'s share price hit over three–month low on Friday, as its operating profit and overall margin missed analysts' estimates. Its Ebitda and margin declined due to expense in promotions and advertisement to battle high competition in the industry.

Colgate Palmolive's gross margin contracted 20 basis points on the year and 120 basis points sequentially. Ebitda fell 210 basis points on the year, as the company kept on increasing trade promotion and media spends, Citi Research said in a note Thursday. The operating expenditure rose 16% on an annualised basis in the quarter ended Sept. 30, 2024.

The margin will be under pressure in near term as Colgate Palmolive continues to prioritise brand development and category expansion initiative. Citi Research cut earnings estimates by 6–7% for the financial year 2025 and 2027.

Citi Research maintained 'sell' on the Colgate Palmolive shares and reduced the target price to Rs 3,000 from Rs 3,232.65. The current target price implies 6.6% downside from Thursday's closing price.

Similarly, Nomura cut Colgate Palmolive (India)'s EPS estimates by 3% for the financial years 2025–27, factoring in the Q2 margin miss.

Colgate Palmolive's operating profit margin fell 206 basis points on the year to 30.7%, because of the higher advertisement spends and investment in technology to improve its competitive advantage. The company is cycling a higher operating profit margin in the second half which might be challenging to expand on top of that, Nomura said.

Toothpaste and toothbrush portfolio is likely to remain a beacon of hope for Colgate Palmolive. Brush portfolio will keep on growing in double digits due to premiumisation trends, Nomura said.

The high growth in core brand of Colgate Maxfresh and Colgate Strong Teeth helped the company to report continuous high volume growth, Citi Research said.

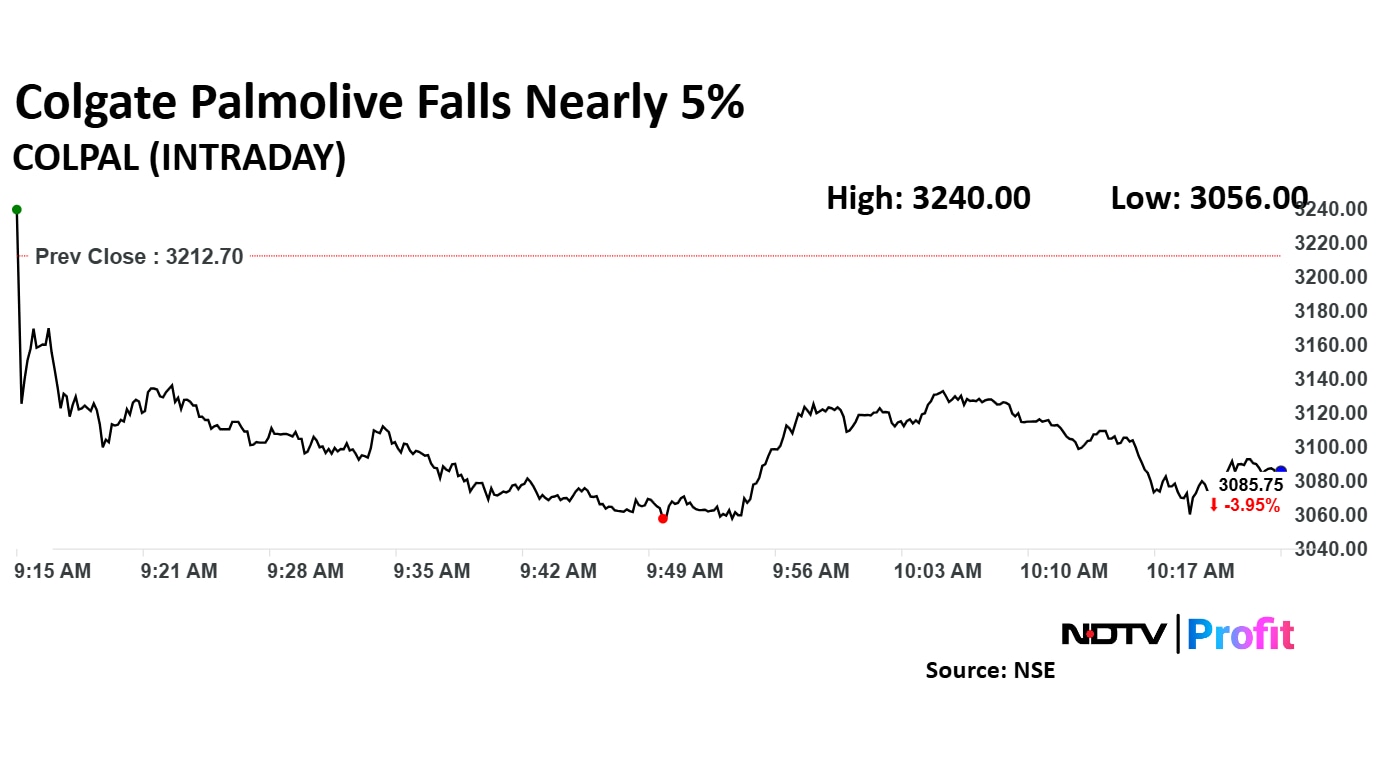

Colgate Palmolive Share Price Today

Colgate Palmolive fell 3.95% to Rs 3,085.75 apiece.

Colgate Palmolive (India) share price declined 4.88%, the lowest level since July 15, before paring loss to trade 2.76% lower at Rs 3,124.15 apiece as of 10:50 a.m. This compares to a 0.90% decline in the NSE Nifty 50.

The stock has risen 48.41% in 12 months, and 22.69% on year-to-date basis. Total traded volume so far in the day stood at 5.0 times its 30-day average. The relative strength index was at 20.27, which implied the stock is oversold.

Out of 35 analysts tracking the company, seven maintain a 'buy' rating, 14 recommend a 'hold' and 14 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 2.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.