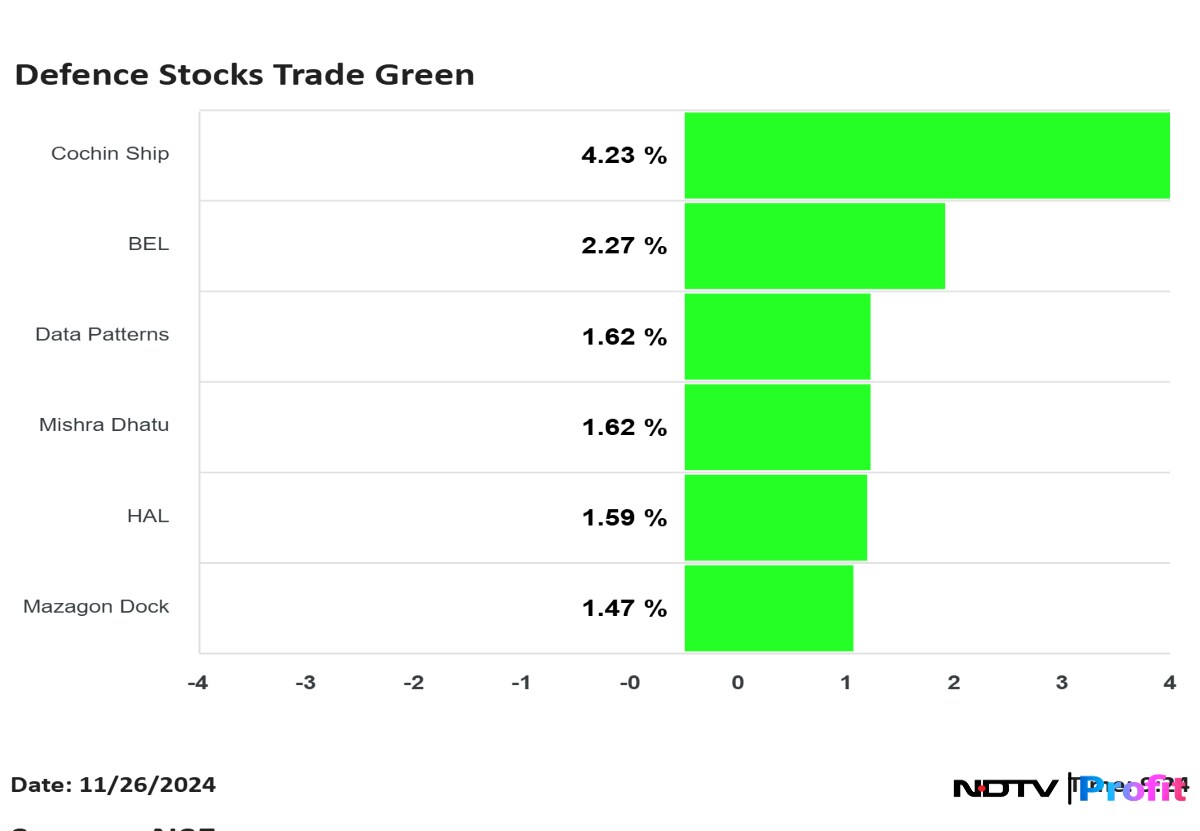

Major players in the country's defence sector including Cochin Shipyards Ltd., Bharat Electronics Ltd., and more are in the green in early trading hours on Tuesday.

This development arose amid JPMorgan's note highlighting the Indian defence sector as a promising avenue for long-term structural growth. JPMorgan stated that India's defense sector is still in its nascent stages of growth, noting a significant 46% compound annual growth rate in exports over the past seven years, alongside a strong upward trajectory in domestic production. This underlines the sector's potential for long-term expansion.

JPMorgan expects significant revenue growth for defence companies as the government enhances procurement policies and reduces reliance on imports. The firm projects a 12-15% compound annual growth rate for the sector over the next five years. It also highlighted that recent stock price corrections present appealing entry points for investors looking to capitalise on the industry's long-term growth potential.

Cochin Shipyards share price was up 4.38% to Rs 1,424 apiece, leading the rally. Second in line was Bharat Electronics, JPMorgan's preferred stock pick in the sector, trading 2.10% up at Rs 298.50 as of 09:27 a.m.

Share price of Mazagon Dock Shipbuilders and Mishra Dhatu Nigam Ltd. similarly posted gains of almost 2%, at Rs 4,256.70 and Rs 319.85 apiece respectively.

Data Patterns (India) Ltd. and Hindustan Aeronautics shares were trading 1.59% in the green in early trade. The Nifty India Defence index was trading 3.16% up, as compared to a 0.34% rise in the benchmark NSE Nifty 50.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.