Shares of shipbuilding companies led a rally in defence stocks on Monday, a day before Finance Minister Nirmala Sitharaman is slated to present Union Budget 2024, in what is widely expected to be a stay-on-course strategy in ambitious military modernisation and indigenisation goals.

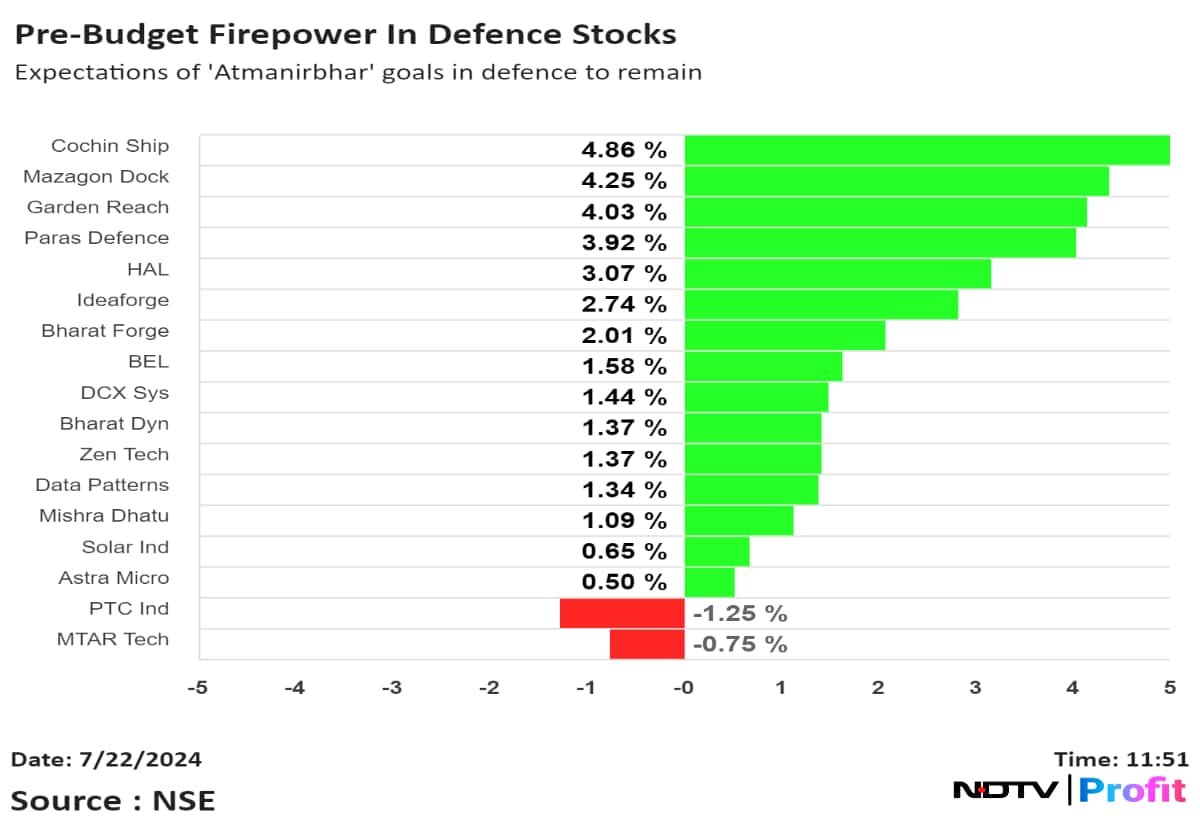

Cochin Shipyard Ltd., Mazagon Dock Shipbuilders Ltd., and Garden Reach Shipbuilders & Engineers Ltd. shares rose over 4% ahead of noon. This compared to a flat movement in the benchmark Nifty 50.

Garden Reach announced it has partnered with Bengaluru-based Merlinhawk Aerospace Pvt. for development of composite doors and hatches for use in naval ships, counter UAV solution, advanced surveillance and composite masts for Indian Navy ships and hydrogen fuel cells-based power generation for maritime applications.

The company also tied up with the Kerala State Electronics Development Corp. for development of core futuristic technologies in various fields to achieve self-reliance in certain areas of under water surveillance.

After taking office last month, Defence Minister Rajnath Singh said the government will continue to modernise the armed forces, setting ambitious goals that are expected to generate big business opportunities for domestic manufacturers.

Data from defence public sector undertakings, other PSUs manufacturing defence related products, and private companies indicated that the value of defence production in the country rose to a record Rs 1.26 lakh crore in fiscal 2024, reflecting a 16.7% increase over the previous financial year.

Defence exports touched a record-high of Rs 21,083 crore in 2023-24, reflecting a growth of 32.5% over the last fiscal, when it stood at Rs 15,920 crore.

In the last five years, the value of defence production has been increasing steadily, and grown by over 60%.

Sustained market interest has led to fund managers creating products like the HDFC Defence Fund, introduced last year and the recently launched Motilal Oswal Nifty India Defence Index Fund. Although, valuations have prompted concerns.

The exuberance around the defence sector has been built solely around strong order books for assigning high valuations, and do not take into account the risks from execution hiccups, rise in raw material costs, competitive pressures and cash flow generation, according to Nirmal Bang Institutional Equities.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.