Cochin Shipyard's share price fell on Wednesday following the news that government plans to sell 5% stake in the company through an offer-for-sale. As of quarter ending June Government of India held 72.9% stake in the company, according to BSE.

The Cochin Shipyard offer will open on Oct. 16 and close on Oct. 17, with the floor price set at Rs 1,540 per share, according to an exchange filing on Tuesday.

As the promoter of Cochin Shipyard, the government will sell up to 65.77 lakh equity shares of a face value of Rs 5 each for a base offer of 2.5%, Cochin Shipyard said in its exchange filing. The OFS will include an oversubscription option of additional 2.5% and 25,000 equity shares or 0.19% of the offer shares of the company, may be offered to eligible employees of the company.

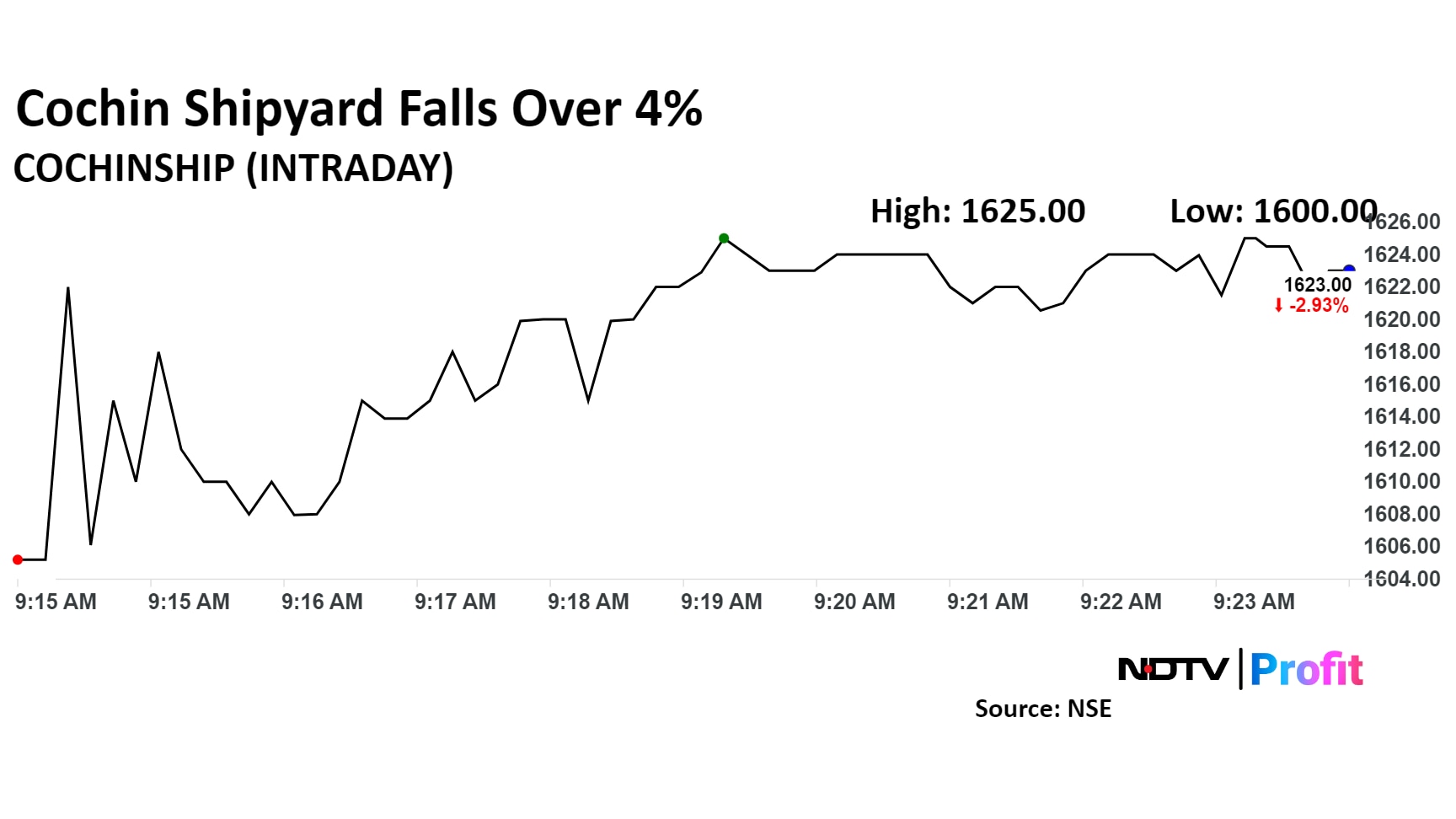

Cochin Shipyard's stock was back in the red after rising on Tuesday, before which it had fallen in two consecutive sessions.

The scrip fell as much as 4.30% to Rs 1,600 apiece, the highest level since Oct. 8. It pared gains to trade 2.6% lower at Rs 1,630 apiece, as of 9:27 a.m. This compares to a 0.1% fall in the NSE Nifty 50 Index.

It has risen 140.48% on a year-to-date basis and 242.65% in the last 12 months. Total traded volume so far in the day stood at 0.1 times its 30-day average. The relative strength index was at 40.26.

Out of the five analysts tracking the company, three maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 41.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.