Coal India Ltd.'s share price tumbled over 5% on Monday following rather weak financial results for the second quarter of fiscal 2025, which fell short of analysts' expectations.

The coal giant reported a consolidated profit of Rs 6,275 crore for the July-September quarter, marking a 22% decline from Rs 8,048 crore in the same period last year. Analysts polled by Bloomberg had forecasted a profit of Rs 8,444 crore.

The company's revenue was down 6.42% to Rs 30,672 crore, compared to Rs 32,776 crore last year (Bloomberg estimate: Rs 31,207 crore).

Ebitda also fell 14.16% to Rs 8,615 crore, down from Rs 10,037 crore (Bloomberg estimate: Rs 10,577 crore).

Coal India's margin decreased to 28.08% from 30.62% (Bloomberg estimate: 33.9%).

The decline in revenue can be attributed to several factors, including a 3.5% drop in production volumes due to weaker power demand and adverse weather conditions from heavy rainfall. Additionally, the company experienced a 6% reduction in blended realisations, driven largely by falling e-auction prices, which decreased by Rs 366 per tonne to Rs 2,472 per tonne, according to Nuvama.

The decline in revenue growth further impacted Ebitda, which fell by over 14% in Q2 FY25. Additionally, the company experienced a slight 2% increase in costs per tonne, rising to Rs 718

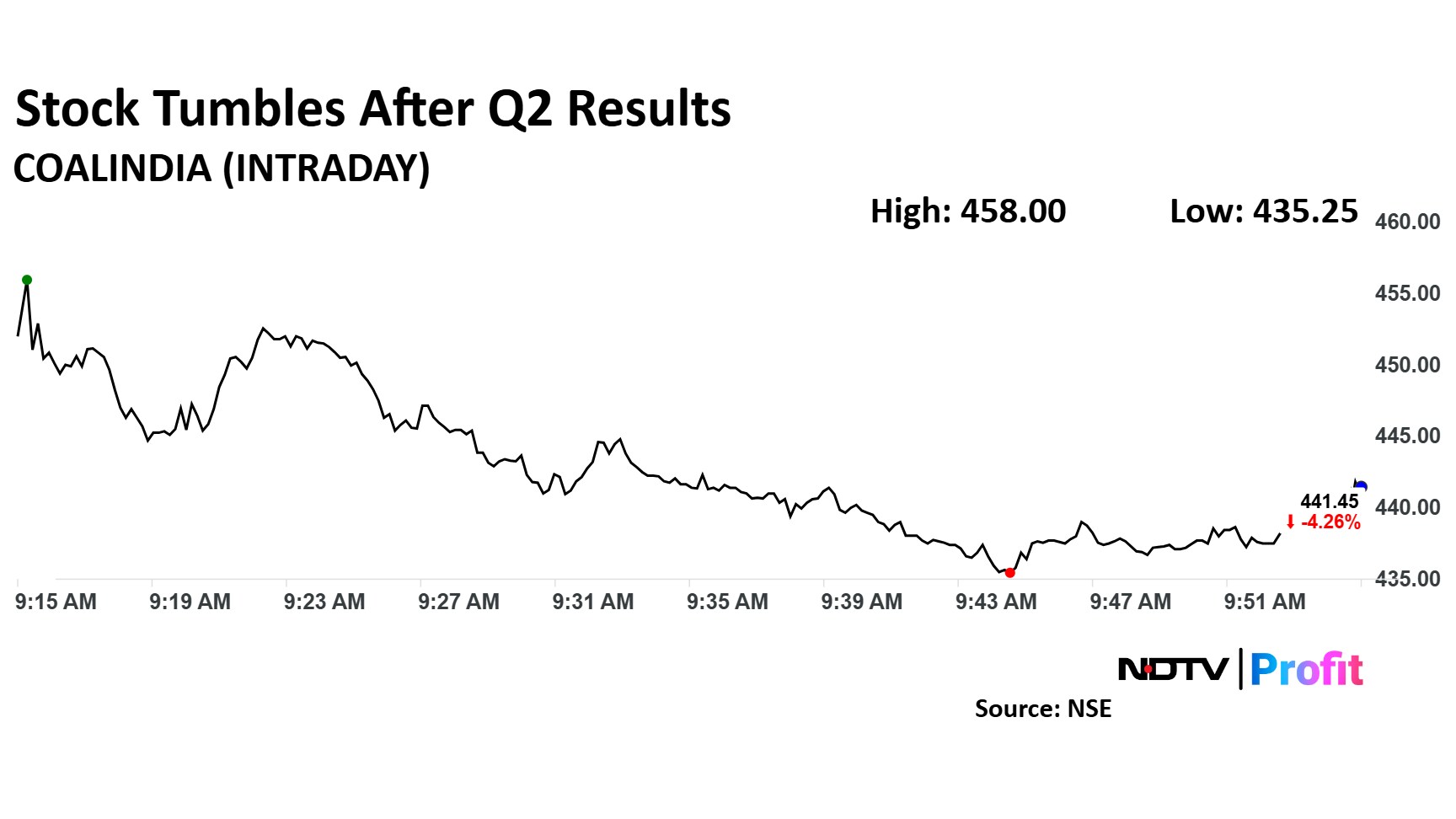

The scrip fell as much as 5.61% to Rs 435.25 apiece. It pared losses to trade 5.14% lower at Rs 437.60 apiece, as of 10:03 a.m. This compares to a 0.36% advance in the NSE Nifty 50 index.

It has risen 38.82% in the last 12 months. Total traded volume so far in the day stood at 6.6 times its 30-day average. The relative strength index was at 26.9.

Out of 26 analysts tracking the company, 19 maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.