(Bloomberg) -- Investor positioning in US technology stocks is so bullish that any selloff could trigger a wider rout, according to Citigroup Inc. strategists.

Wagers on declines in tech-heavy Nasdaq 100 futures have been completely erased, leaving investors overwhelmingly expecting further gains. “The large consensus positioning is a risk that could amplify a turn in the market,” strategists led by Chris Montagu wrote in a note dated Feb. 5.

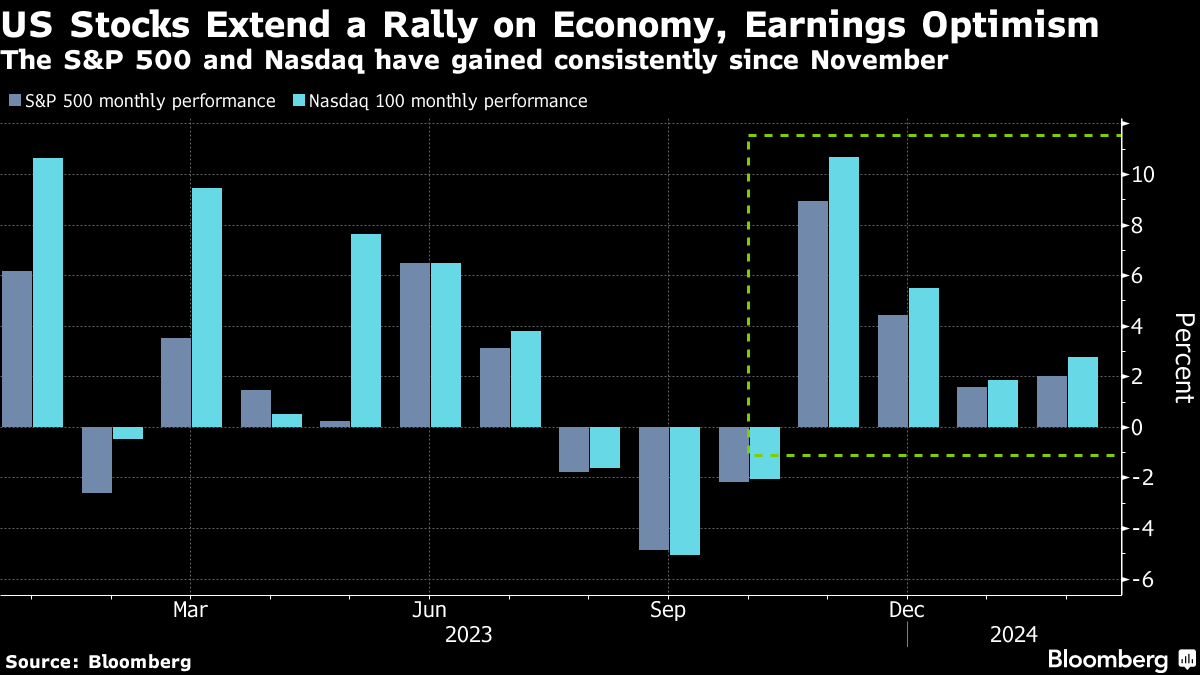

US stocks have rallied this year, with the S&P 500 hitting a record high for the first time since 2022, on optimism around a stronger-than-expected economy. Upbeat fourth-quarter earnings from tech mega-caps have also lifted sentiment.

Still, investors are turning more cautious after signals from policymakers that the Federal Reserve may not cut interest rates as early as March. JPMorgan Chase & Co. strategist Marko Kolanovic said on Monday he doesn't expect monetary easing to begin until mid-year.

Read more: Goldman Sachs' Rubner Says US Stock Market ‘Could Go Down a Lot'

Bullish trends in S&P 500 futures stalled last week, although positioning remains net-long, Montagu said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.