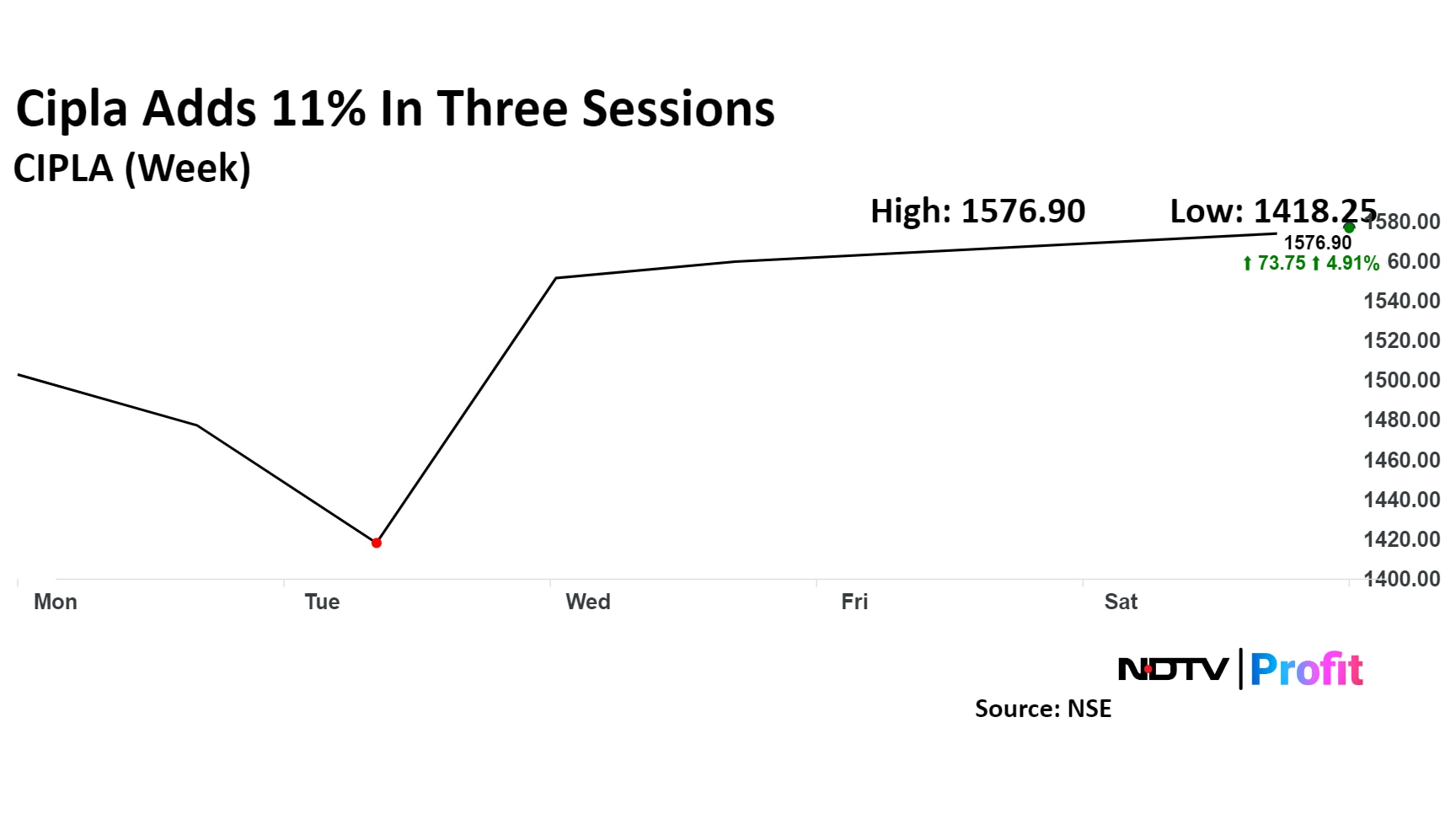

Cipla Ltd.'s share price has added around 11% in three sessions of gains after US Food & Drug Administration tagged the company's Goa facility as 'voluntary action indicated'.

This is an important development for the company as Citi Research's post earnings report had said in a report that pancreatic cancer treatment drug Abraxane's approval was contingent upon the Goa unit clearance.

Before this, the stock had fallen after the company's September quarter results, as analysts cut their target price on the stock, citing weaker than expected domestic business and challenges in its key products.

However, in its recent report, Nomura upgraded Cipla's stock to 'buy' and raised the target price to Rs 1,800 from Rs 1,580.90 per share, implying a 16% upside. Goa facility cleared by FDA as VAI is boosting potential approval for limited-competition gAbraxane, it said.

Despite the stock rising 29% over the past year, it has lagged behind Nifty Pharma's 54% gain, the brokerage noted. "Risk-Reward View Favors Cipla with expected returns of 6-21% in one year," it said, while noting downside risks such as lower-than-expected growth in India, weaker US revenue, and higher pricing pressure.

Cipla Share Price Today

On Monday, the stock extended its gains to a third session and rose as much as as 2.78% to Rs 1,602.95 apiece, the highest level since Oct. 15. It pared gains to trade 1.12% higher at Rs 1,576.85 apiece, as of 10:07 a.m. This compares to a 1.25% decline in the NSE Nifty 50.

It has risen 26.6% on a year-to-date basis and 35% in the last 12 months. Total traded volume so far in the day stood at 0.52 times its 30-day average. The relative strength index was at 53.12.

Of the 38 analysts tracking the company, 23 maintain a 'buy' rating, eight recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 2.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.