Shares of Cholamandalam Investment and Finance Co. gained on Thursday after Jefferies raised the target price for the stock, citing its strong automobile loan franchise and a likely doubling of return-of-assets in the new business segment.

The brokerage maintains a 'buy' rating on the stock, with the target price raised to Rs 1,800 apiece from Rs 1,685 apiece.

"We see loan growth holding up at 27% in fiscal 2025 despite softer trends in select auto segments. We see multiple tailwinds to net interest margins," it said.

In view of the likely initiation of the RBI's rate cut cycle in the coming period, Jefferies believes Cholamandalam is better positioned to benefit as compared to its peers. "With 43% of bank borrowings linked to T-bills, gains from easing rates should be more upfront versus peers," it said.

As operations leverage unfolds, new business return-on-assets can rise by 100 basis points, lifting group return-on-assets by 22 basis points, Jefferies added. The earnings per share should grow at a 29% CAGR from fiscal years 2024 to 2027, it said.

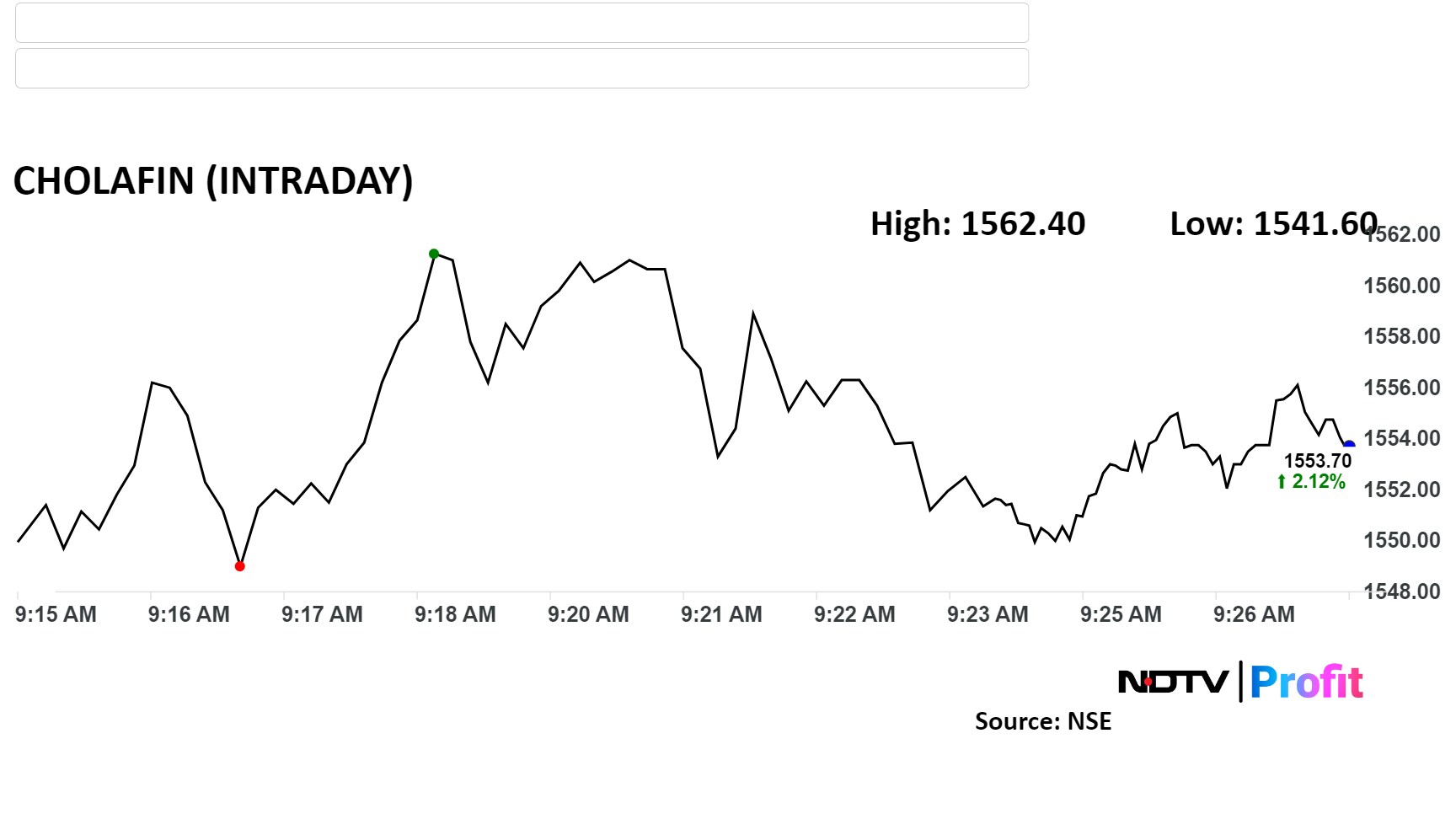

Shares of the company rose 1% to Rs 1,549.95 apiece on the NSE. In comparison, the benchmark Nifty 50 opened 0.5% higher.

Cholamandalam has risen by 32.9% during the last 12 months and has advanced by 23.1% year-to-date. The stock's relative strength index stood at 61.7

Thirty out of the 41 analysts tracking the company have a 'buy' rating on the stock, five suggest a 'hold' and six have a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 1.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.