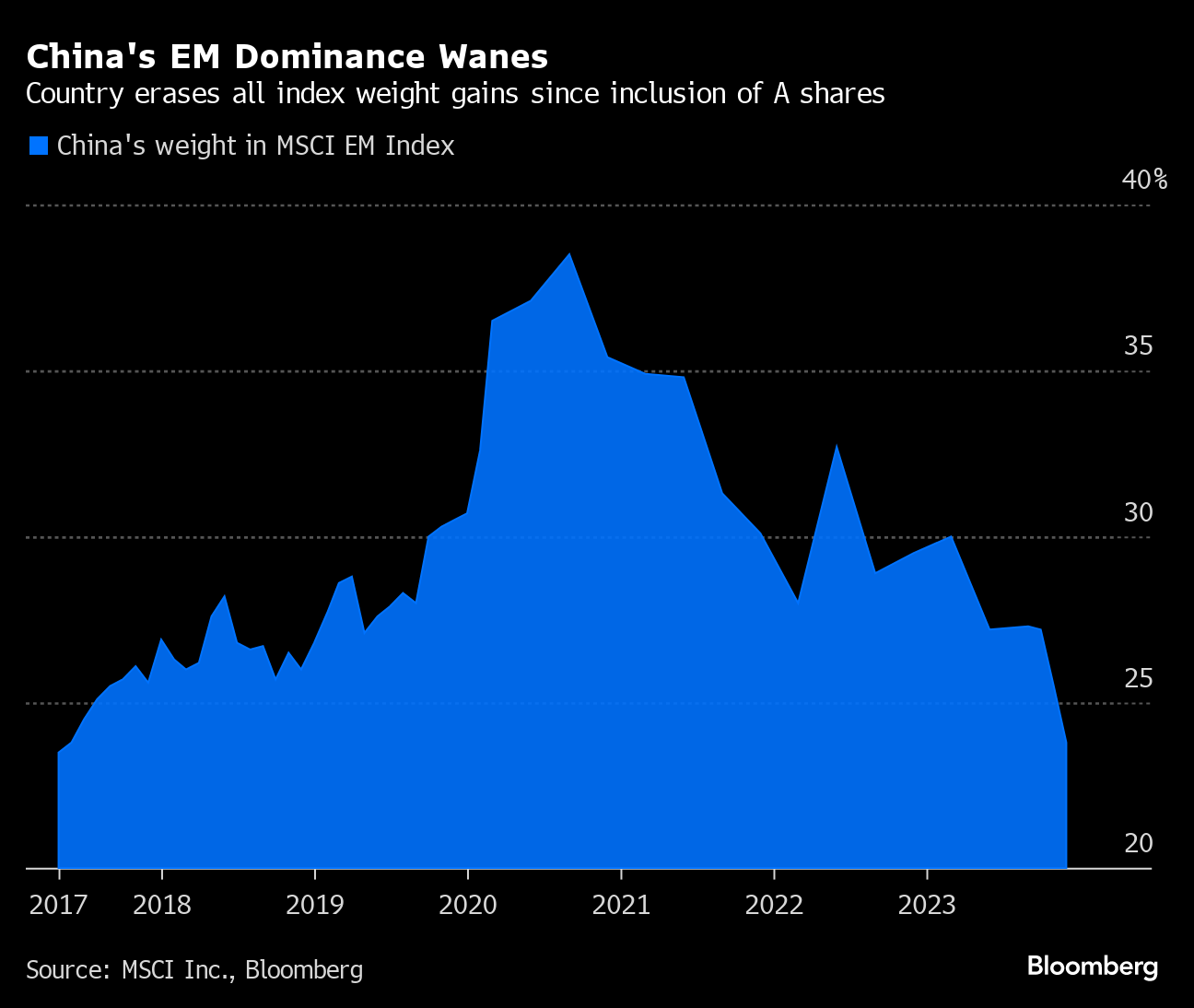

(Bloomberg) -- China's share of a key emerging-market equity benchmark dropped to a record low, highlighting how a bearish outlook for the world's second-largest economy is diverging from the rest of an asset class it once dominated.

The Chinese stock market accounted for 23.77% of the MSCI Emerging Markets Index as of Dec. 31, according to Bloomberg calculations, while Goldman Sachs Group Inc. put the latest weight at 26.4%, citing FactSet data. Either way, this is the lowest since 2017, when the New York-based firm announced the addition of China's mainland stocks, so-called A shares, to the index. The current weight is about 16 percentage points below the country's peak weight in 2020.

“China's impact on emerging markets has declined on several fronts,” said Caesar P. Maasry, the head of EM cross-asset strategy research at Goldman Sachs in New York. “The most obvious is the decline in representation within the MSCI EM index, but equally important, China's economic ‘spillover' effects to other emerging markets also appear to be waning. Accordingly, we find investors are more willing to express views within the EM complex without requiring an underlying bullish China view.”

Watch: China Stocks Caught in a Downward Spiral (Video)

Global investors are reducing their exposure to Chinese stocks as the economy struggles to recover from a pandemic slump, regulatory flip-flops raise the risk of investing in the country, and domestic confidence remains subdued after a debt crisis battered the property sector. The nation's stocks have erased almost $4 trillion in value since 2021, ranking among the world's worst performers last year in a trend that's continued into the start of 2024.

China's “lower weighting in EM benchmark indices is a reflection of the poor market performance, reduced investor positioning and significant capital outflows,” said Nenad Dinic, an equity strategist at Bank Julius Baer in Zurich. “Continued weak economic data and regulatory crackdowns over the holidays have cast a shadow over the outlook for Chinese equities.”

Read more: China Stocks Slump to Five-Year Low in a Dismal Start to 2024

Unexpected Decline

China's decades-long campaign to integrate with global markets bore fruit in 2017, when MSCI said it would add mainland shares to an index that already included Hong Kong-listed Chinese equities. The inclusion began on June 1, 2018 and was carried out over several phases. At that time, MSCI's global head of index research, Sebastien Lieblich, said China's weight in the emerging-market gauge was expected to reach 42% eventually.

The nation seemed to be on track to achieve that milestone as asset allocators began pumping in billions of dollars to rebalance their portfolios and gain more exposure to China. Citigroup Inc. predicted $48 billion of annual inflows to A shares, while MSCI said the initial inclusion itself could channel about $17 billion in passive funds, rising to $35 billion in later years.

The rally that followed MSCI's inclusion helped add $8 trillion to Chinese stocks between 2018 and 2021. The country came to dominate emerging markets so much that money managers complained about the lack of attention and capital left for other developing nations.

But the Covid pandemic disrupted the rally and subsequent developments have caught many China bulls off guard. President Xi Jinping's Common Prosperity program raised regulatory risks for Western companies operating in the country while the nation's ultra-strict Covid Zero policy, geopolitical standoffs with the US, and a property crisis that has already sparked several bankruptcies all contributed to a turnaround in market sentiment.

Those factors have pushed China's index weight to the lowest ever in the period since the A-share inclusion. The weighting was lower before mainland shares were included.

Extended Weakness

Bank of America Corp. said that by December 2023, China had become the least loved stock market in Asia. So far, this year has been no better: the Hang Seng China Enterprise Index has slid 5% already, the second-worst performance in the world after Lebanon. The A-share benchmark, the Shanghai-Shenzhen CSI 300 Index, is down 4.2%.

Read more: Worst Thing About Chinese Stocks Is There's No Clear Catalyst

China's loss in index weights is being compensated with gains in other major emerging markets. India has increased its share to a record 16.7% of the MSCI Index, more than double the 7.7% weight it had in March 2020. Taiwan, at 16%, South Korea, at 12.9%, Brazil, at 5.8%, and Saudi Arabia, at 4.2%, all increased their weightings last month.

Any rebound is likely to be tactical, with little to arrest a long-term decline, according to Julius Baer's Dinic.

Read more: China Can Be the Next Big Reversal Trade: Markets Live 2024

“Both valuations and investor positioning in Chinese equities are approaching historical lows, which suggests that the market trough may be near,” he said. “Nevertheless, we believe tactical rebounds will be short-lived.”

(Updates second paragraph with Goldman Sachs data, adds quote in a new third paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.