(Bloomberg) -- The Indian rupee is stable and inexpensive compared to its emerging market peers, making it a favorite for carry traders, according to Bank of America Corp.

“If you hold it for the carry, you don't have much risk that it will depreciate a lot, which would be a greater risk in some of the other carry trades,” David Hauner, head of global EM fixed-income strategy at the bank, said in an interview.

The rupee has become one of the least volatile currencies in emerging markets, aided by a long interest-rate pause by the Reserve Bank of India and record foreign exchange reserves.

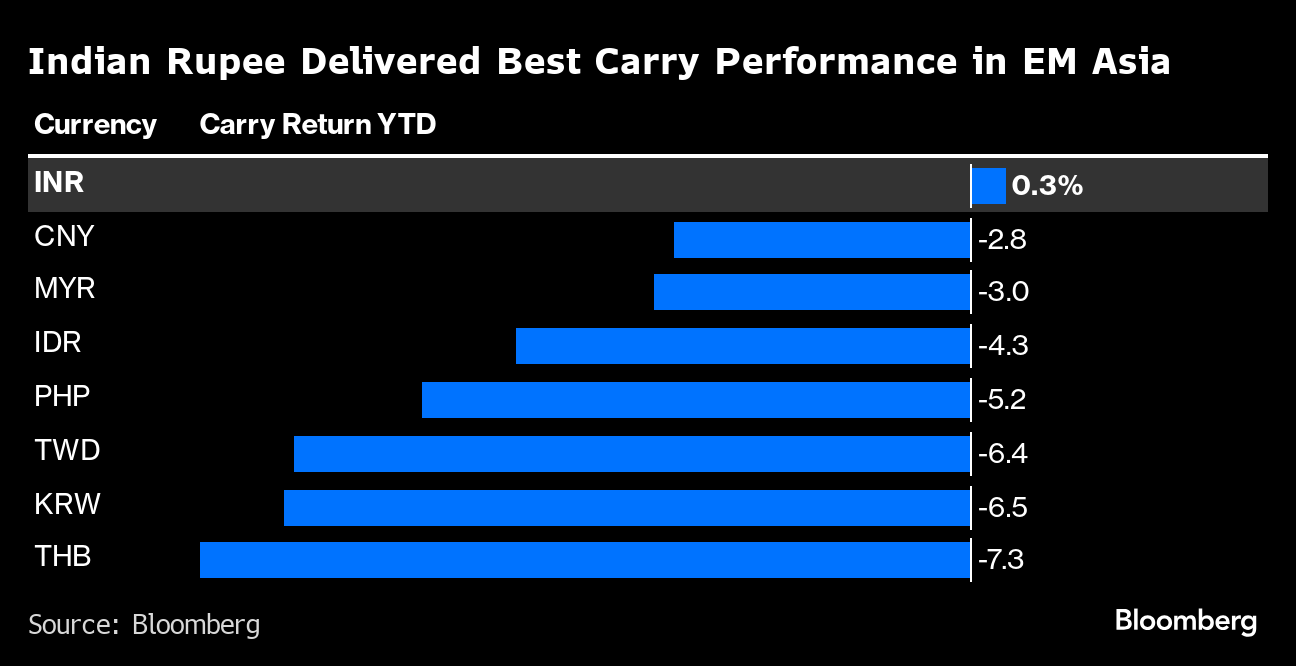

Going long the rupee is the only carry trade to give positive returns against the dollar in Asia this year, data compiled by Bloomberg show. The one-month implied volatility in the dollar-rupee hit the lowest in a decade this year amid RBI's iron grip over the currency.

The rupee doesn't pay as much yield as the Mexican peso or Turkish lira but the risk of a correction is lower, Hauner said. He sees its fair value at around 82.50 to a dollar, more than 1% higher than the current levels.

The rupee's relative stability bears testimony to the country's sound and resilient economic fundamentals, financial stability, and improvement in the external outlook, RBI Governor Shaktikanta Das said at a press briefing Friday after rate setters left borrowing costs unchanged for an eighth straight meeting.

The rupee's popularity as a carry currency has also led to overcrowding in the trade, with JPMorgan Chase & Co. awaiting better levels to re-engage. Its carry attractiveness gets boosted further when paired with euro and Chinese yuan short positions, Goldman Sachs Group Inc. analysts wrote in a recent note.

BofA has also been recommending clients to go long on the rupee funded by some of the currencies in North Asia, Hauner said. India has higher interest rates and is also driven by stronger domestic demand unlike China, he added.

--With assistance from Ronojoy Mazumdar.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.