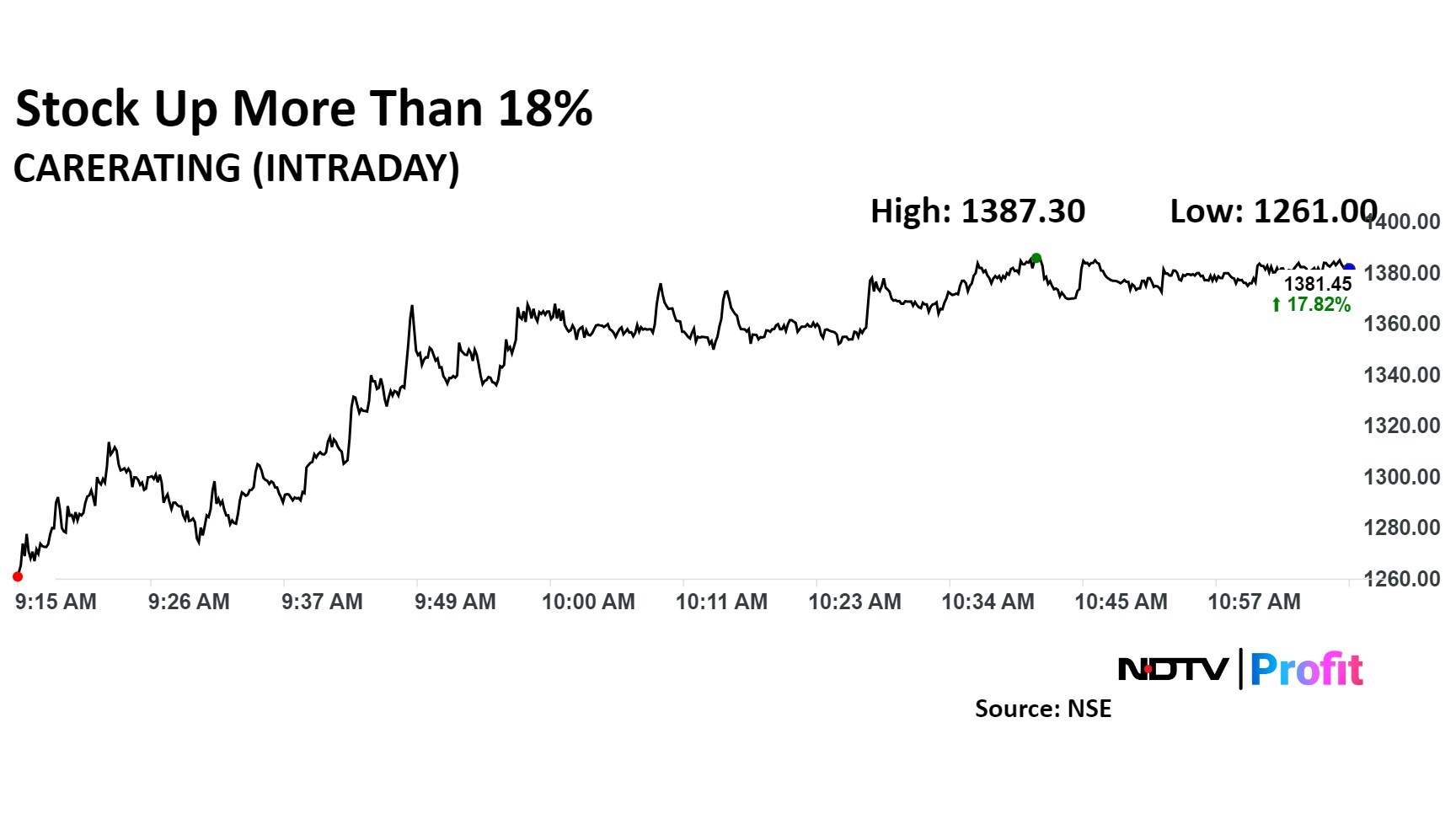

CARE Ratings Ltd.'s share price soared over 18% on Thursday after the company announced its quarteraly earnings on Wednesday. The stock was trading at a six year high, with the level last seen in September of 2018.

CARE Ratings financial results for the quarter and half year ending September 30, 2024, showcased strong growth.

In the ratings business, the company reported a year-on-year increase of 19%, generating revenues of Rs 177.63 crore. The non-ratings business also demonstrated growth, achieving a year-on-year increase of 37%, with revenues reaching Rs 18.66 crore.

Standalone financials highlights for the first half of FY25 reported a revenue of Rs 101.51 crore, up 19% year-on-year basis, ebitda was at Rs 56.92 crore, up 26% on y-o-y basis and profit after tax stood at Rs 49.64 crore, up 22% y-o-y.

The consolidated results for the first half of FY25 show revenue from operations grew 18% year-on- year basis at Rs 166.85 crore, ebitda stood at Rs 79.09 crore, up 21% y-o-y and profit after tax rose to Rs 73.65 crore, up 18% y-o-y.

The company was founded in 1993 and is in the business of offering ratings across a diverse range of industries, including manufacturing, infrastructure, and the financial sector, which encompasses banking and non-financial services.

The company's stock rose to a six year high at 18.32% rise to 1,387.30 apiece. It pared gains to trade 17.53% higher at Rs 1,378 apiece, as of 10:51 a.m. This compares to a 0.06% advance in the NSE Nifty 50 Index.

It has risen 27.71% in the last 12 months. Total traded volume so far in the day stood at 31 times its 30-day average. The relative strength index was at 73.

Two analysts maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.