BSE Ltd.'s share price extended gains to a fifth consecutive session to hit its lifetime high on Monday after its subsidiary Asia Index Pvt. announced the launch of three indices namely BSE Sensex Sixty 65:35, BSE Sensex Sixty, and BSE Power and Energy.

However, the stock fell after hitting its lifetime high, snapping its four-day winning streak.

These indices can be used for benchmarking of PMS strategies, MF schemes and fund portfolios, according to an exchange filing. They can also be used for running passive strategies such as ETFs and index funds, as well as gauging the performance of companies in the aforesaid sectors, it said.

"Investors can now access a broader spectrum of market opportunities, further enriching their investment strategies with the latest additions to BSE's suite of indices," the filing said.

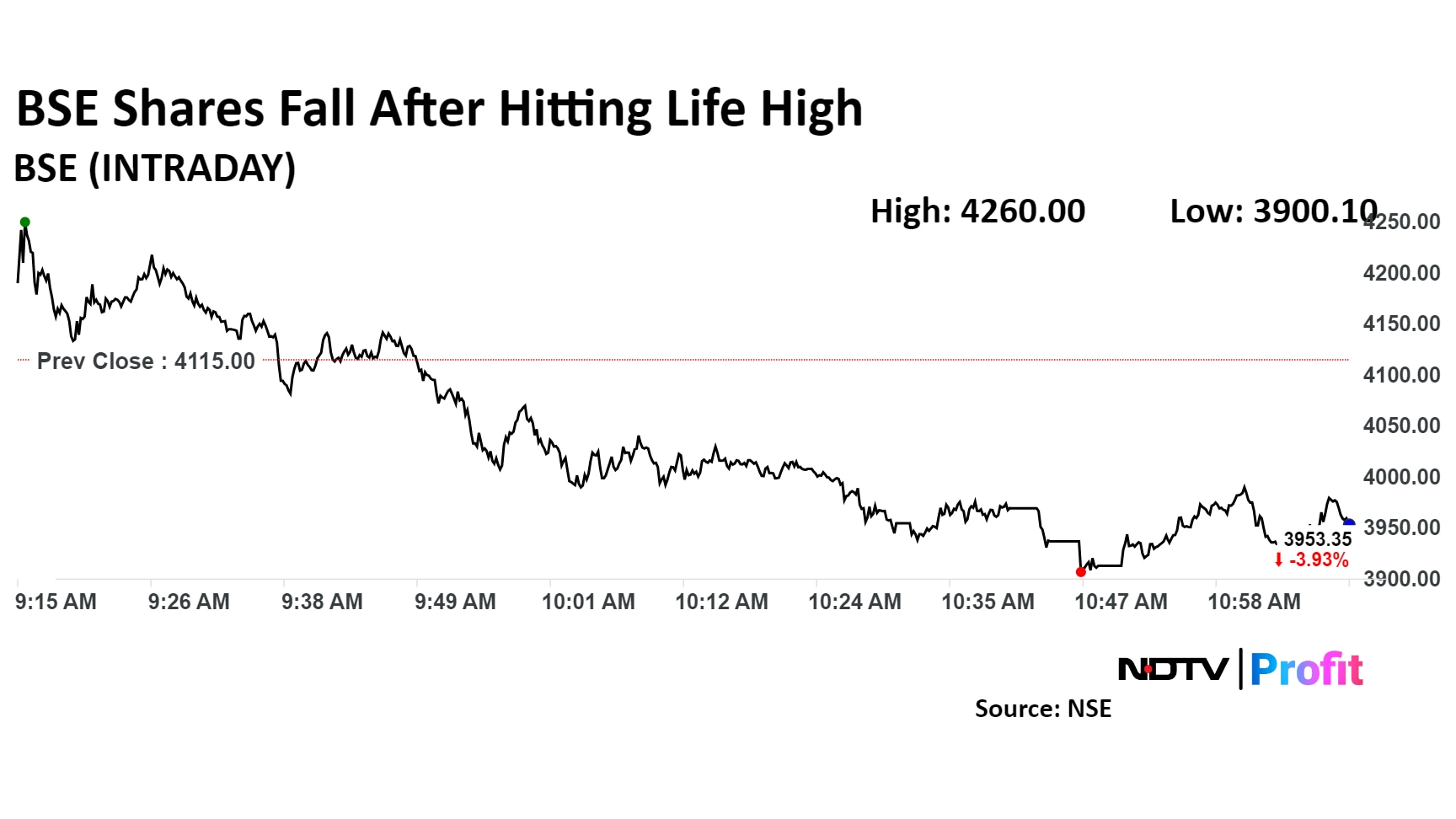

BSE Share Price

Shares of BSE Ltd. rose as much as 3.70% to its lifetime high of Rs 4,260 apiece, before falling as much as 5.06% to a low of Rs 3,900 per share. They pared loss to trade 3% lower at Rs 3,983.50 apiece, as of 11:16 a.m., compared to a 0.4% decline the NSE Nifty 50.

The stock has risen 79.3% year-to-date and 113.8% in the last 12 months. Total traded volume so far in the day stood at 0.82 times its 30-day average. The relative strength index was at 66.4.

Of the seven analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 22.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.