Asia Index Pvt., a wholly owned arm of BSE Ltd., on Friday launched three new indices—BSE Power and Energy, BSE SENSEX Sixty 65, and BSE SENSEX Sixty.

Among them, the BSE Power and Energy is a thematic index that will measure the performance of 30 companies that are present in the BSE 500 and belong to the energy and utilities sectors.

"The index has a base value of 1,000, and the first value date is Dec. 31, 2013. The index is reconstituted semi-annually and rebalanced quarterly," a release stated.

The weight of the stocks in the index is based on their free-float market capitalisation, with the weight of each stock in the index capped at 15%. The index has a USD variant, namely BSE Power and Energy USD.

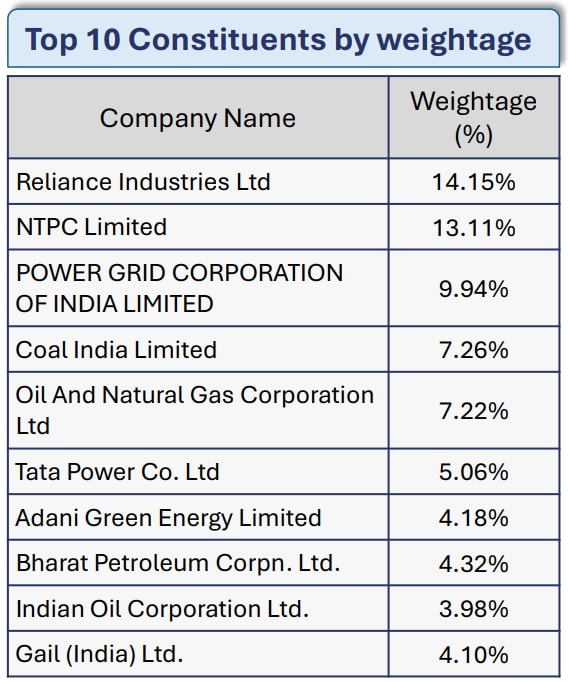

The top 10 stocks part of the index, in terms of their weightage, are Reliance Industries Ltd., NTPC Ltd., Power Grid Corporation of India Ltd., Coal India Ltd., Oil And Natural Gas Corporation Ltd., Tata Power Co., Adani Green Energy Ltd., Bharat Petroleum Corporation Ltd., Indian Oil Corporation Ltd., and Gail (India) Ltd.

Source: Asia Index

Among the other two indices launched is BSE Sensex Sixty 65:35. It is a "strategy index" comprising of the constituents of BSE SENSEX and BSE SENSEX Next 30 in the ratio of 65:35, respectively, the release noted.

The index will include a total of 60 stocks, representing over 55% of the total free float market capitalisation of all listed entities in India, it added.

The third index launched is BSE SENSEX Sixty, which includes 60 stocks comprising constituents of the BSE SENSEX and the BSE SENSEX Next 30 in order of their free float market capitalisation.

Both the indices have a base value of 10,000, and the first value date is June 23, 2014. They will be reconstituted semi-annually and rebalanced quarterly.

The launch of new indices is "in line with the broader philosophy of the BSE group of listening to the voice of customers and creating products that resonate with investors and asset managers alike," Asia Index Chief Executive Officer Ashutosh Singh said.

The indices can be used for benchmarking portfolio management service strategies, mutual fund schemes, and fund portfolios, the release said. They can also be used for running passive strategies such as ETFs and index funds, as well as gauging the performance of companies in the aforesaid sectors, it added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.