Britannia Industries Ltd.'s share price declined to over six–month low on Thursday, as Food Safety and Standards Authority of India asked the company to prohibit the sale of one batch of one of its product. The notice came after the food authority noticed Britannia Industries used preservatives above the prescribed limit in the mentioned batch of the product.

The authority sent the notice post quality analysis of samples of the product, according to an exchange filing on Tuesday.

Britannia Industries did not disclose the name of the product. The bourbon biscuit maker received the food authority's email on Nov. 12. The company analysed facts before intimating the exchanges about the FSSAI's notice.

The notice will not have any material impact on the company's financials, operations or account of notice, the filing said.

Britannia Industries Share Price Today

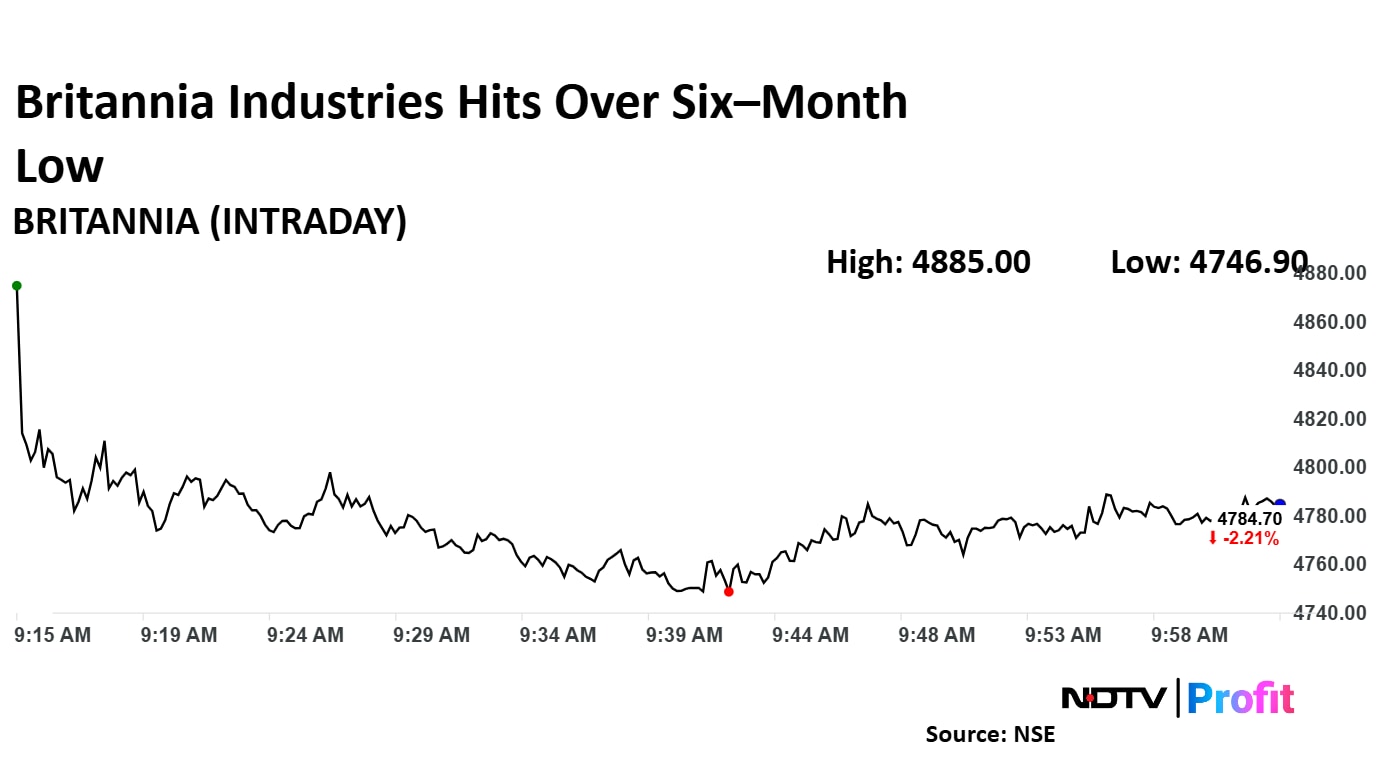

Britannia Industries share price declined 2.21% to Rs 4,784.70 apiece.

Britannia Industries' share price declined 2.98%, the lowest level since May 3, before paring some loss to trade 2.29% down at Rs 4,780.55 apiece as of 10:02 a.m. This compares to a 0.83% decline in the NSE Nifty 50.

The stock gained 1.35% in 12 months, and declined 10.36% year-to-date. Total traded volume so far in the day stood at 3.8 times its 30-day average. The relative strength index was at 19.49, which implied the stock is oversold.

Out of 38 analysts tracking the company, 19 maintain a 'buy' rating, 14 recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 16.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.