Bharat Petroleum Corp. shares gained over 7% on Friday as international crude oil prices declined amid weak global economic growth and high US production.

Brent oil prices have declined by over 3% so far this month, dropping from a high of $77 per barrel at the start of the month to $71 on Friday.

Oil marketing companies are significant beneficiaries of the crude oil price decline. Their earnings primarily rely on two segments: refining and marketing. The refining segment involves transforming crude oil into valuable products like petrol, diesel, and jet fuel, while the marketing segment focusses on the distribution and sale of these refined products.

BPCL, along with other state-run peers, kept their retail prices for petrol and diesel unchanged for the past 28 months. Consequently, the fluctuations in oil prices and refining margins now closely influence their marketing margins. With oil prices on a downward trend and global refining margins recovering, this situation is favourable for oil marketing companies.

According to a report by ICRA, OMCs could lower petrol and diesel prices by Rs 2-3 per litre if international crude prices remain stable. The rating agency highlighted that the recent drop in crude oil prices has enhanced margins on retail auto fuels, enabling state-owned firms to contemplate price reductions.

Last week, BPCL approved a capital expenditure of Rs 1,138 crore for pipeline expansion projects.

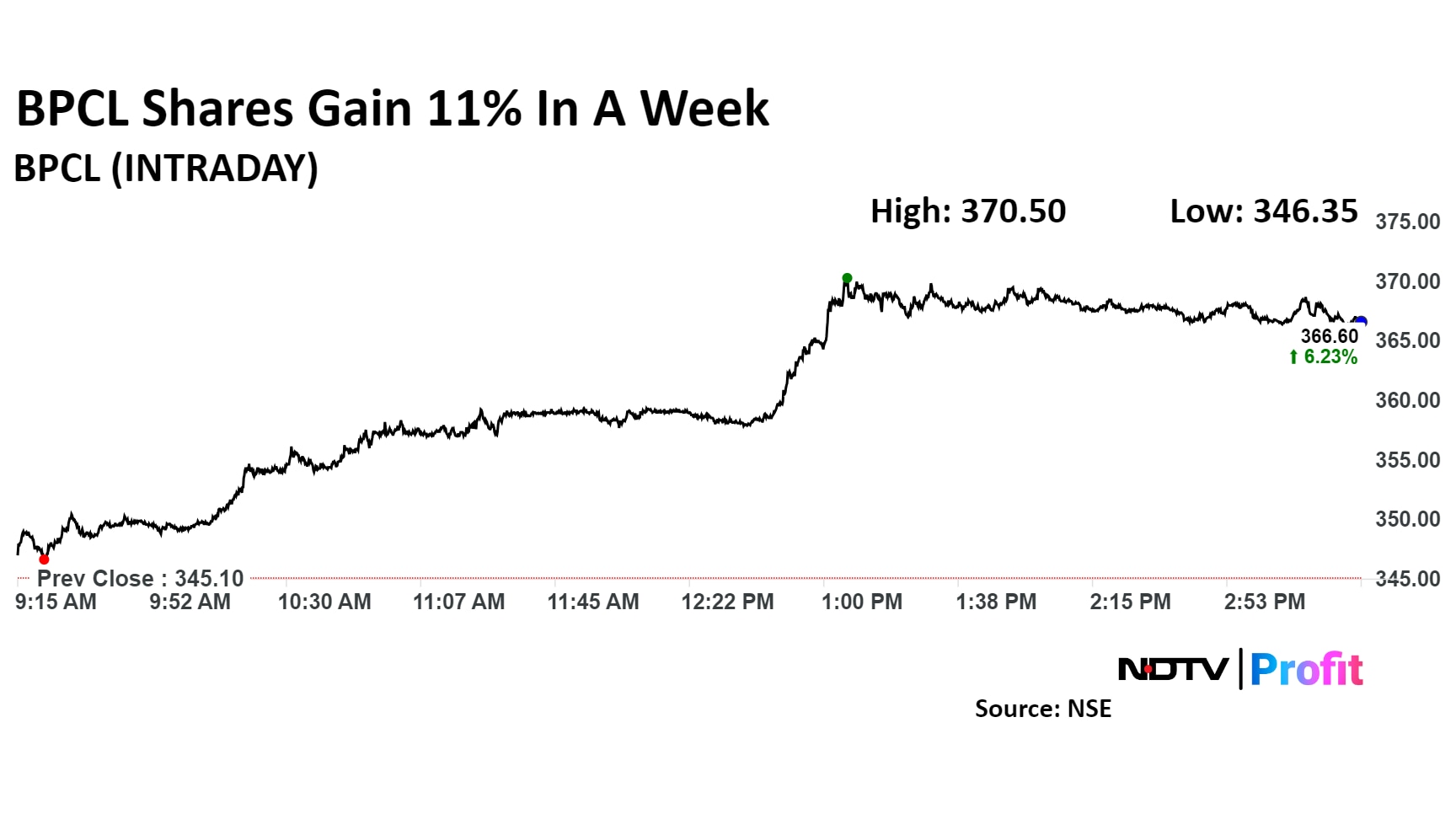

Shares of BPCL gained as much as 7.4% intraday to a 52-high of Rs 370.5 apiece. It closed 6.4% higher at Rs 366.6, compared to a 0.1% decline in the Nifty 50.

Sixteen out of the 32 analysts tracking BPCL have a 'buy' rating on the stock, six recommend a 'hold' and ten suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 334.5 implies a potential downside of 9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.