(Bloomberg) -- Buy the yen, sell Japanese bonds, snap up Indian and Indonesian stocks: those are some of the top trades recommended by Asian fund managers for 2024.

While making the case for those bets, money managers in the region also say determining asset allocations for the year ahead has rarely been so challenging. The past 12 months have seen a plethora of surprises including the fizzling of China's recovery, Treasury yields surging to 16-year highs, and global political tensions stoked by two wars.

At the same time, the Federal Reserve's cash rate target of more than 5% is sapping the appeal of many historically popular high-yield trades, especially in Asia which features the two largest emerging-market economies. That said, many say Asia may be a bright spot next year given its growth prospects and relatively accommodative policy settings.

“We think Asia might be well positioned for the return of positive bond returns — and the return of the negative correlation tailwind — in 2024 as many countries in the region are further along in their tightening cycles versus Europe and the Americas,” said Wylie Tollette, chief investment officer at Franklin Templeton Investment Solutions.

Here are some of the top recommendations made by fund managers at Allianz Global Investors, Fidelity International, Principal Asset Management, Janus Henderson Investors and others:

Buy Yen

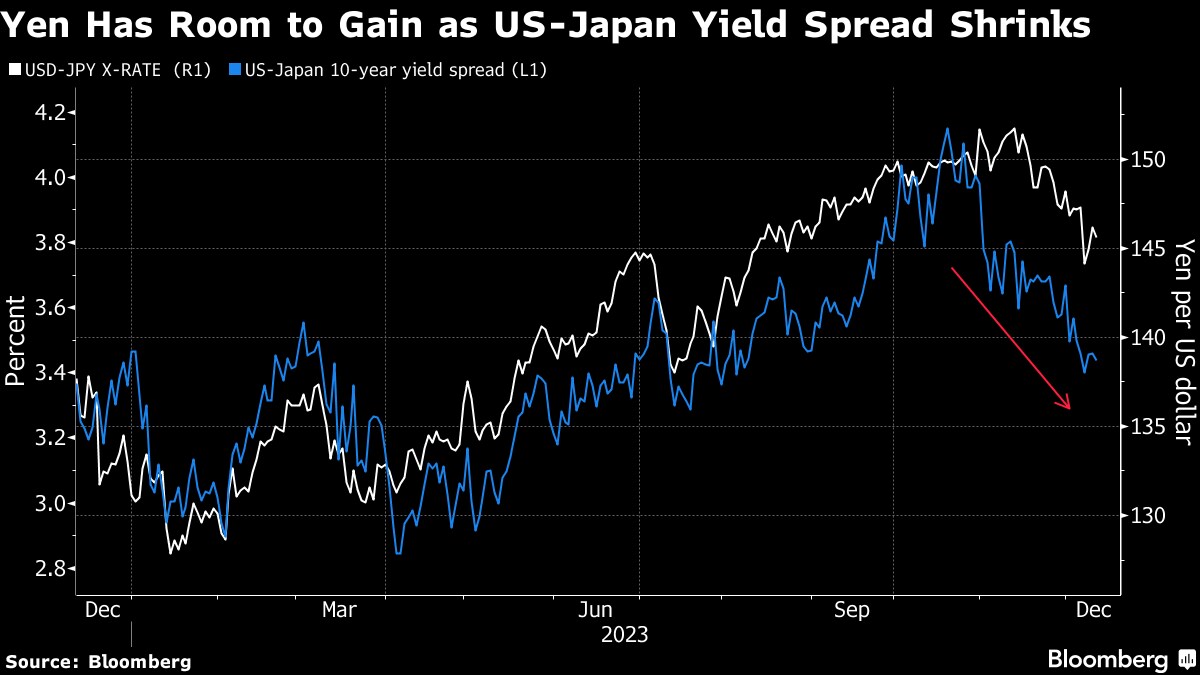

Many investors were bullish on the yen a year ago, only for the currency to slide around 10% in 2023 as the Fed signaled interest rates will stay higher for longer. Money managers are betting 2024 will be different with the Bank of Japan eventually forced to end its negative rate policy.

“The yen's extremely cheap valuation has sustained for so long — we believe there ought to be a turning point,” said Zijian Yang, head of multi-asset Asia Pacific at Allianz Global Investors, who has an overweight position on the yen versus the greenback.

Allianz isn't the only bull. Pacific Investment Management Co. said last month it's buying yen on a bet the BOJ will be pressured into tightening policy as inflation quickens, while RBC BlueBay Asset Management has also tipped the currency to appreciate.

Short Japan Bonds

The flip-side of a higher yen is lower Japanese bond prices. Yields on the securities have been rising in recent months as the BOJ relaxed its yield-curve-control policy, albeit in baby steps.

Speculation is growing that the so-called “widow-maker trade” of shorting Japanese debt may actually start to work in 2024 as quickening inflation puts pressure on the BOJ to keep tightening monetary policy.

It was “something that was the case for Japan in the past 20 years — never short JGBs — I think that's something that can be different going forward,” said George Efstathopoulos, a fund manager at Fidelity International in Singapore, who's opting not to hold any Japan bonds as part of his strategy.

Buy India Stocks

Indian equities have powered ahead this year, with both the Nifty 50 Index and Sensex climbing to a series of records. Many investors are betting they will keep rising due to strong earnings growth, increasing private investment and expectations Prime Minister Narendra Modi will win re-election in nationwide polls next year.

“The key plus-point for India is the fundamental outlook for growth,” said Seema Shah, chief global strategist at Principal Asset Management in London. “There is a lot of investor optimism and confidence now, which I think hasn't existed.”

Indian financial markets are much more dependent on domestic developments rather than global ones, which will provide some defensive upside if there are further concerns about China, she said.

Buy Indonesia Banks, Metal Producers

Indonesia — like India — is seen as a structural growth story, though here investors are advised to be more selective.

Bank stocks are among sectors that look attractive for Janus Henderson Investors. Indonesian banks have “a strong deposit franchise and ample liquidity,” said Sat Duhra, a portfolio manager in Singapore. “At this stage, Indonesian banks are the easiest thing to buy.”

Meanwhile, the nation's wealth of metal producers — from nickel to aluminum — should also get a boost from the transition toward green energy and rising electric-vehicle sales, he said.

Short China Property, Banks

China stocks have been beaten down in 2023 and many analysts expect further losses in at least some sectors during the coming year.

Morgan Stanley sees broader Chinese shares performing in line with the region but recommends investors stay underweight on property developers and banks.

The recent pickup in housing sales seems to be short-lived, while “uncertainty around further developer defaults in the offshore high-yield bond market could also add more volatility to the real estate sector,” analysts including Laura Wang in Hong Kong and Jonathan Garner in Singapore wrote in their 2024 China equity outlook report published last month.

Short High-Yield Bonds

Asia's high-yield bonds have been through a tough few years amid the collapse of China's property sector, and declines may not be over just yet.

Although Chinese developers now represent a smaller proportion of the market, many investors say the spreads on offer on Asian high-yield debt still fail to sufficiently compensate them for the risk of holding the securities. A bumpy path to lower interest rates also means weaker issuers will face higher refinancing risks.

“Asia high-yield is out of favor, and we view the asset class as less attractive amidst macro uncertainties and concerns regarding idiosyncratic risks,” RBC Wealth Management analysts Kennard Ling and Shawn Sim in Singapore wrote in the firm's 2024 global outlook report released last month.

--With assistance from Harry Suhartono, Chiranjivi Chakraborty and Michael G. Wilson.

(Updates with Templeton's comments in the fourth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.