Citi initiated coverage on Bharti Hexacom Ltd. with a 'buy' call, driving stocks as much as 5% higher. The brokerage has set a target price of Rs 1,405 apiece, implying a potential upside of 20% over the previous close.

The pure-play regional telecom operator owned by Bharti Airtel Ltd. has scope for better growth and subscriber mix, Citi said in a note on Friday. The company provides services under the Airtel brand in Rajasthan and the North East, with the majority of its revenue derived from mobile broadband.

Both these circles have a higher share of rural mobile subscribers, lower wireless tele-density, and a higher share of prepaid subscribers. Moreover, Rajasthan has lower internet penetration than the pan-India average. This lends Bharti Hexacom a healthier outlook for subscriber growth and subscriber mix improvement, Citi said.

The brokerage forecasts operating profit, or Ebitda, to grow by 26% on a compounded annual basis in three years.

In terms of risk, adverse developments in Hexacom's two circles and overhang from the balance 15% stake sale by government-owned Telecommunications Consultants India Ltd. can be factors.

Citi said it is positive on India's telecom sector, driven by the recent tariff action, improved likelihood of future tariff hikes, signs of waning competitive intensity, and steps taken towards 5G monetisation.

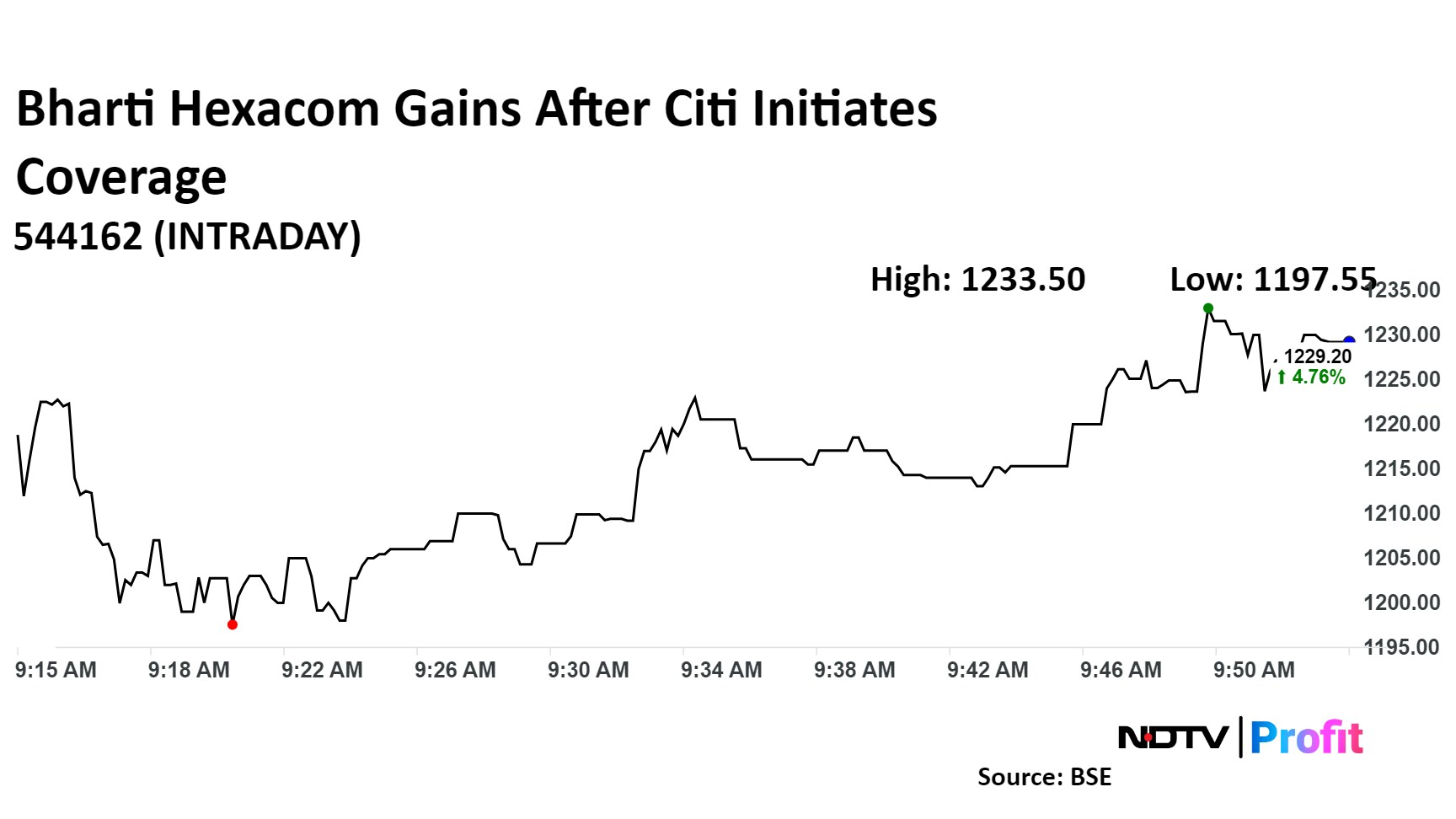

Shares of Bharti Hexacom advanced 5% to Rs 1,234.3 apiece. The stock has since pared gains to trade 4.3% higher at Rs 1,226 apiece as of 9:50 a.m. The benchmark NSE Nifty 50 was trading 0.25% higher.

The stock has risen 115% since listing in April. The total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index is 65.

Eight of the nine analysts tracking Bharti Hexacom have a 'buy' call and one recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 8.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.