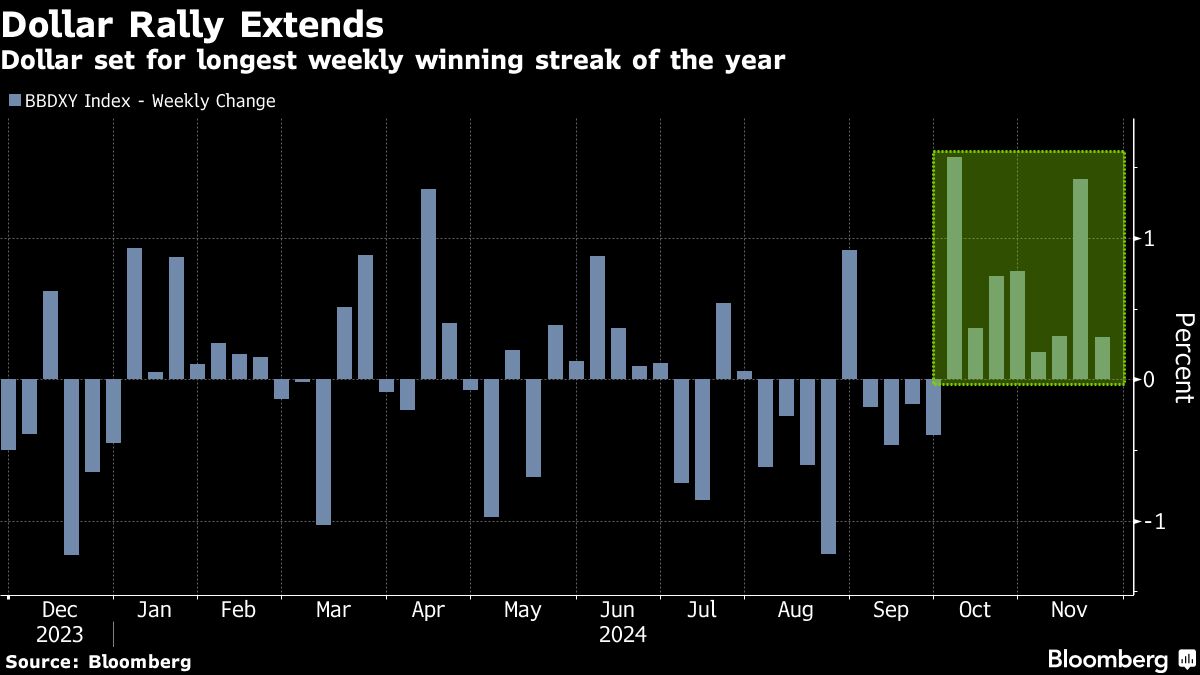

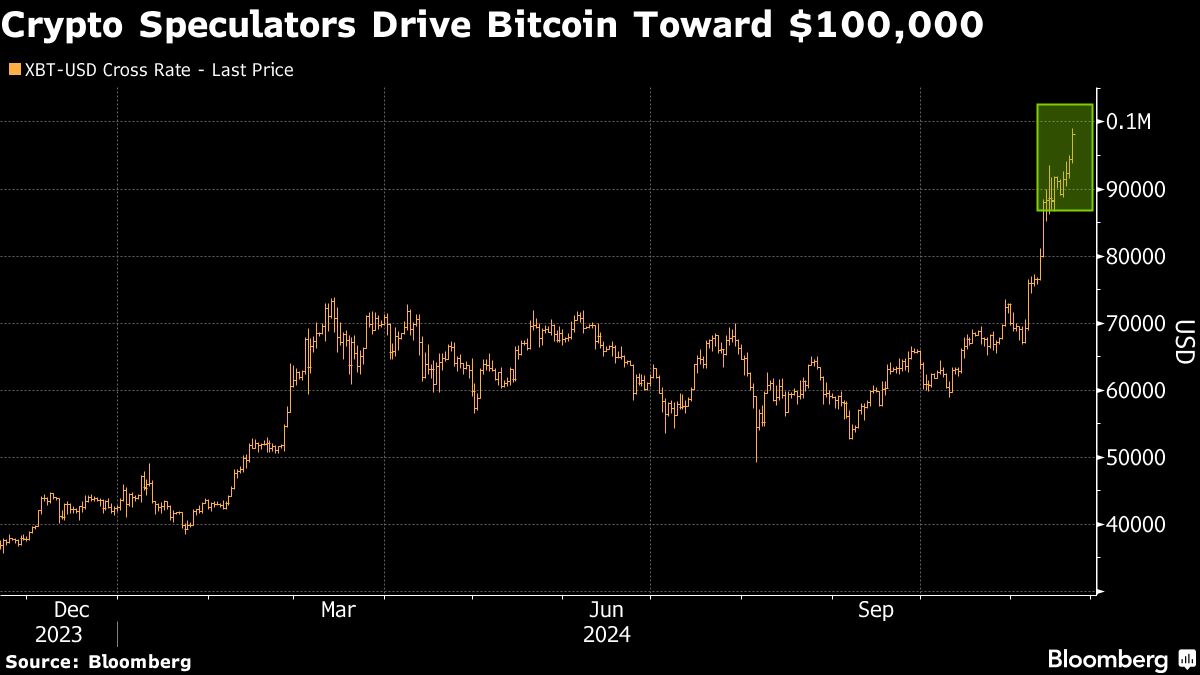

Beneficiaries of the incoming administration's looser regulation and business-friendly stance put forth strong showings this week. Stocks gained while Bitcoin crushed doubters and the dollar extended gains into an eighth week, the currency's longest run of the year.

Blue chips and small caps led Friday's equities advance as this year's big tech winners struggled to gain ground. The S&P 500 rose 0.3% while an equal-weighted version of the gauge — where Walgreens Boots Alliance Inc. has the same influence as Nvidia Corp. — climbed 0.8%, on track for an all-time closing high.

The Dow Jones Industrial Average rose 1% while an index of bank stocks climbed to the highest in more than two years, the Russell 2000 jumped 1.8%. The small-cap index climbed 4.5% this week while the biggest technology stocks, like Nvidia, Alphabet Inc. and Facebook-parent company Meta Platforms Inc., lagged.

Fundstrat's Thomas Lee sees room for more gains in small-caps and cyclicals given President-elect's plans for deregulation and general “animal spirits.” He also sees a “Trump put” keeping the broader market buoyant. Faith that the government and Donald Trump won't let the economy knuckle under is helping bolster stocks, at least for the moment.

“When sentiment reaches a ‘bullish extreme' is when we see equities priced to ‘perfection,'” according to Lee. “By several measures, we are not there at that point yet.”

To Bank of America Corp. strategists the Nasdaq 100, which has rallied more than 4% this month, is approaching a level versus the S&P 500 that could trigger the unwinding of the trade favoring US equities. The tech-heavy gauge ended Friday up 0.2% with a 1.9% weekly gain.

Meanwhile, data on Friday showed S&P Global flash November composite output index for service providers and manufacturers advanced to 55.3 — the highest level since April 2022. The yield on the 10-year Treasury dropped around one basis point to 4.41%.

“The US flash PMIs for November were bullish in aggregate thanks to strength in services,” according to Vital Knowledge's Adam Crisafulli, who said the details suggested a goldilocks scenario, “with favorable growth developments and cooling price pressures.”

The dollar registered its longest streak of weekly wins since September 2023. A Bloomberg gauge of the currency's strength has risen around 2.6% so far this month, adding to October's gains of nearly 3%.

“The US dollar's run can continue,” said Peter McLean, head of multi-asset portfolio solutions at Stonehage Fleming. “We also have those geopolitical tensions, which are escalating at the moment. It's natural for investors to seek refuge in the dollar.”

Bouts of volatility, driven by escalations in the war in Ukraine earlier in the week, eased Friday. The ongoing conflict helped to push WTI crude above $71 a barrel while gold traded at over $2,700 an ounce, and had its best week since March 2023.

The rally in Bitcoin set a fresh high Friday as the world's biggest cryptocurrency races toward $100,000.

The latest developments included Securities and Exchange Commission Chair Gary Gensler's decision to step down in January. His tenure was marked by a flurry of crypto enforcement actions, which the industry expects will peter out under Trump.

In Europe, S&P Global's composite Purchasing Managers' Index for the euro area dipped back beneath a level that indicates contraction in November. The region's sovereign bonds rallied while the euro dropped to a two-year low.

Asian equities are on pace for their first back-to-back monthly losses this year amid dollar strength and lingering concerns over the Chinese economy. Still, the region's more favorable valuations versus the US market are aiding recovery in some assets.

Elsewhere in Asia, Adani Group companies advanced after a $27 billion rout on Thursday following a US indictment against Gautam Adani over allegations of bribery. The company denied the allegations.

Corporate Highlights:

Ally Financial Inc. is exploring a sale of its credit card arm, according to people familiar with the matter, after getting back into that business through an acquisition three years ago.

Gap Inc. stock soared after it raised its full-year outlook as the apparel retailer attracts wealthier shoppers seeking value.

Nvidia Corp.'s surging share price has created a challenge for Jensen Huang's charitable foundation: As the stock climbs, so does the amount of money it has to give away.

Walmart Inc.'s corporate employee bonuses are set to surpass targets again this year as the company's stock soars and sales outperform its retail rivals.

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.3% as of 4 p.m. New York time

The Nasdaq 100 rose 0.2%

The Dow Jones Industrial Average rose 1%

The MSCI World Index rose 0.3%

The Russell 2000 Index rose 1.8%

S&P 500 Equal Weighted Index rose 0.8%

KBW Bank Index rose 1.6%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.6% to $1.0414

The British pound fell 0.5% to $1.2530

The Japanese yen fell 0.2% to 154.82 per dollar

Cryptocurrencies

Bitcoin rose 1.2% to $99,246.81

Ether fell 1.6% to $3,294.58

Bonds

The yield on 10-year Treasuries declined one basis point to 4.41%

Germany's 10-year yield declined eight basis points to 2.24%

Britain's 10-year yield declined six basis points to 4.39%

Commodities

West Texas Intermediate crude rose 1.5% to $71.18 a barrel

Spot gold rose 1.4% to $2,706.96 an ounce

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.