A surge in share supply from initial public offerings and sales to institutions is adding pressure on Indian equities, which are already grappling with weak earnings and selling by overseas investors.

Hyundai Motor India Ltd. raised $3.3 billion in the nation's largest IPO on Thursday, and further listings worth $6 billion have been approved by the regulator, according to data from primedatabase.com.

This supply overhang coincides with slowing corporate earnings and withdrawals of over $7 billion this month by global funds. While aggressive purchases by local institutions have buffered the outflows, the stock market is still set for its worst month in more than two years.

“Given the increase in supply, strong domestic fund flows might not be sufficient to ensure that the market is only in an uptrend,” said Ashish Gupta, chief investment officer at Axis Mutual Fund, which has $37 billion in assets.

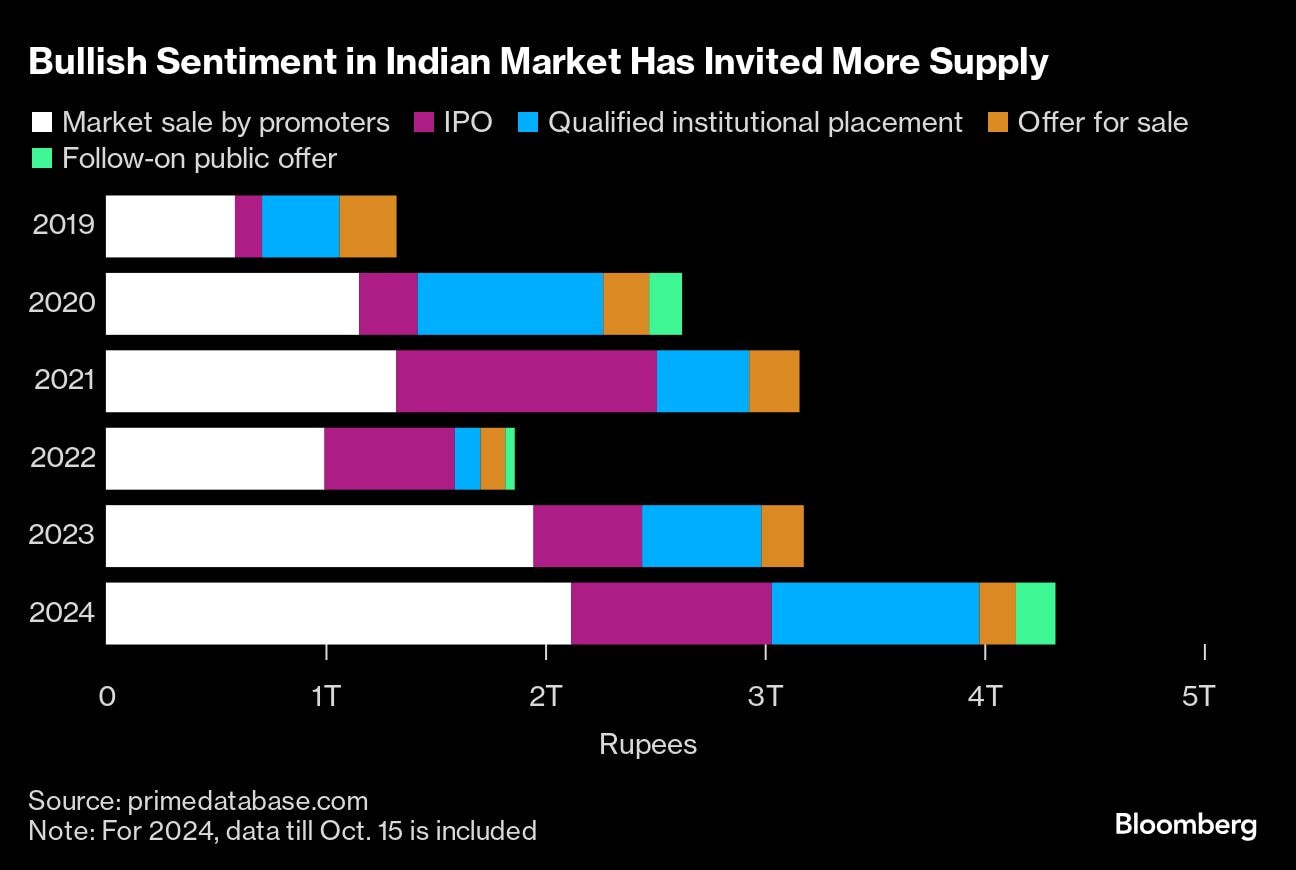

With Hyundai's proceeds, Indian IPOs will have raised more than $12 billion in 2024, surpassing volumes for the past two years. Adding to this influx are share sales of $25 billion by company founders — the most in at least five years — and institutional placements of over $11 billion, according to primedatabase.com.

Some company founders are cashing in on high equity valuations by selling to institutions, according to Pranav Haldea, managing director at PRIME Database Group. To be sure, the supply is being absorbed by domestic investors.

“Not only are mutual funds sitting on a huge cash pile, there's also a lot of ‘FOMO' money waiting to be deployed at corrections,” he said.

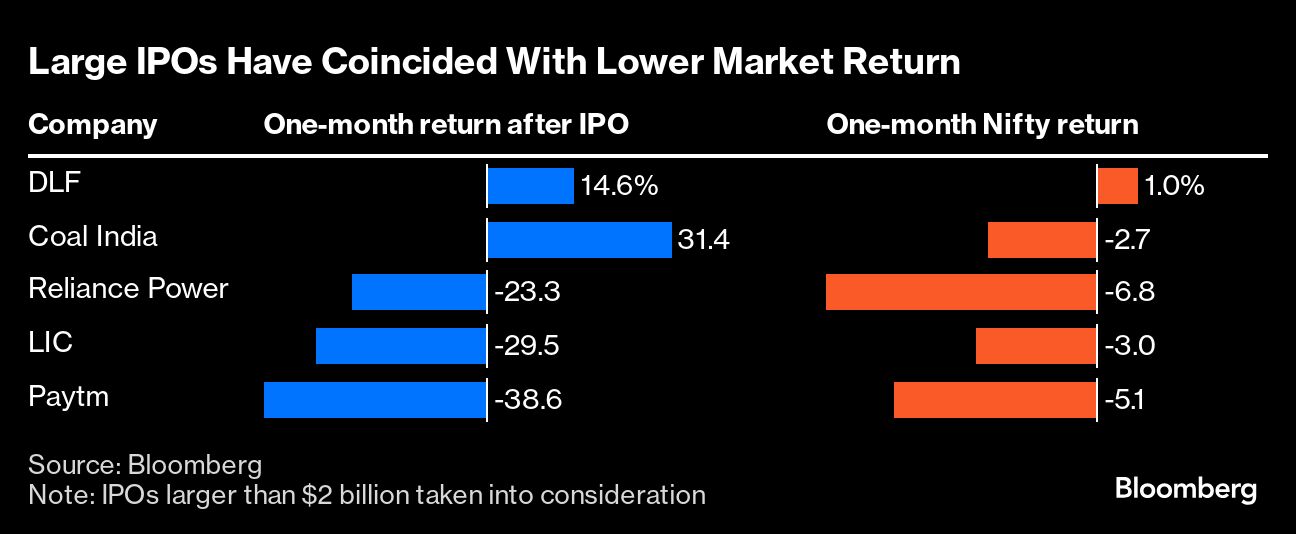

Still, history suggest caution with large share sales. Of the five IPOs worth at least $2 billion since 2007, only two — DLF Ltd. and Coal India Ltd. — delivered positive returns within a month of listing. Mega offerings also tend to coincide with market peaks, with broader indexes typically declining in the weeks after these stocks start trading.

The benchmark NSE Nifty 50 Index has declined more than 5% from its Sept. 26 peak ahead of Hyundai's record India IPO.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

:max_bytes(150000):strip_icc():focal(722x523:724x525):format(webp)/Savannah-Guthrie-mother-Nancy-Guthrie-020226-02-0368cb6ddb864bf09919fd100fe546b0.jpg?im=FeatureCrop,algorithm)