Shares of Bansal Wire Industries Ltd. jumped over 6% on Monday after brokerage firm Investec initiated coverage on the stock with a ‘buy' rating. The brokerage raised the target price to Rs 440 per share, indicating an upside of nearly 25%, from Friday's closing price of Rs 352.35 apiece on the BSE.

“Bansal Wire has created a niche for itself in the commoditised steel/stainless steel wire market by reducing costs (via scale, automation, high-capacity utilisation), offering the widest product range and reducing customer/industry concentration," Investec said.

The company has undertaken two more initiatives that are expected to give a sharp profit uptick and also entail higher capex versus other conventional businesses.

Bansal Wire is now foraying into steel cords and backward integrating stainless steel rods. It has also established a large new manufacturing plant at Dadri, the brokerage observed.

All this will drive a more than 40% Ebitda CAGR over FY24-27E, with high teens post-tax return on capital employed, Investec said.

The brokerage values the stock at 24 times FY26E PE/17 times FY27E PE, which is considered attractive, in the context of Bansal Wire's growth potential, rising scale advantages, optionality of entry into new categories and impressive return ratio profile, it said.

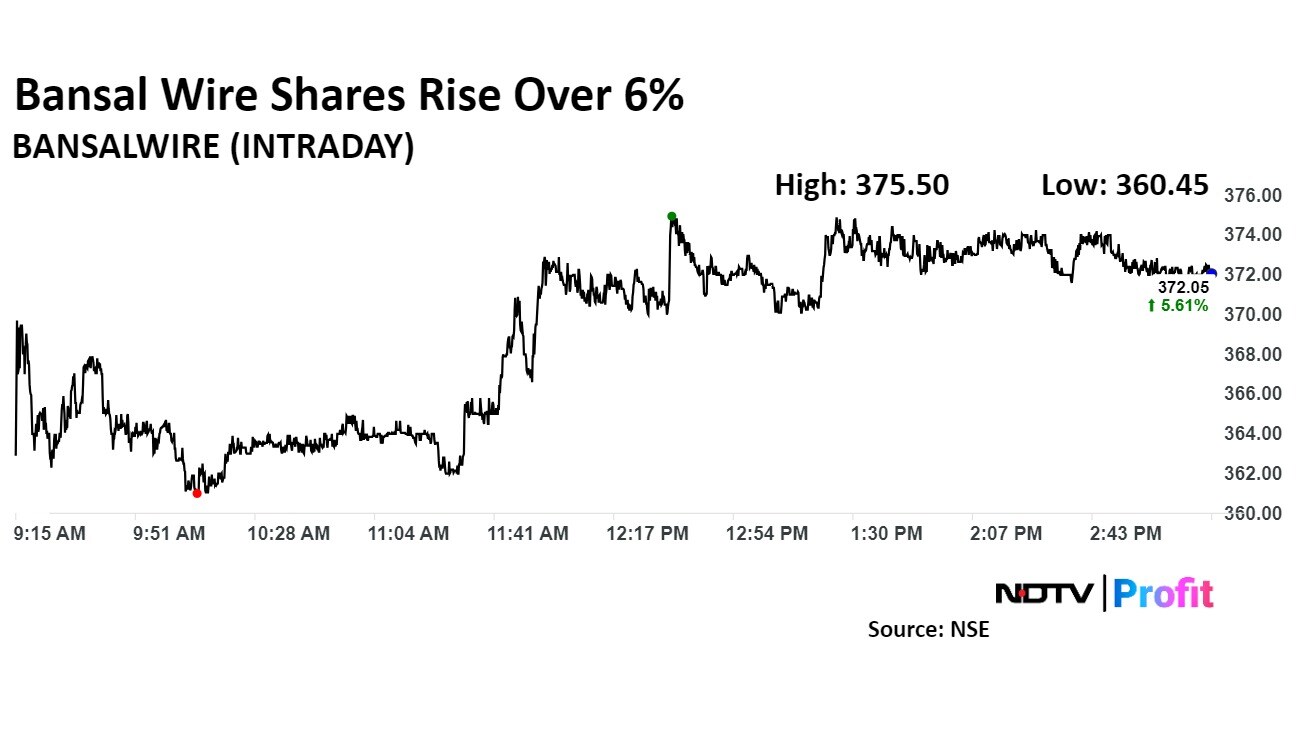

Bansal Wires stock rose as much as 6.59% before paring gains to trade 5.65% higher at Rs 372.2 apiece, compared to a 0.75% advance in the benchmark Nifty 50 as of 3:18 p.m.

It has risen 6.24% since its listing on July 10. The total traded volume so far in the day stood at two times its 30-day average. The relative strength index was at 61.

One analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 18%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.