Bank of America has downgraded Nykaa to an 'Underperform' rating, cutting its price target for the company as it foresees slower-than-expected growth in key areas, particularly in the beauty, personal care segment and quick commerce. Nykaa's parent company is FSN E-Commerce Ventures Ltd.

The investment bank has lowered its target price to Rs 150, implying an 11% downside from Nykaa's current market price of Rs 169, marking a significant shift from its previous Neutral rating. Bank of America's revised estimates reflect slower margin improvements and challenges from competition in the BPC space.

The firm believes that increased competition from quick commerce players that deliver BPC products faster than Nykaa with multiple options to choose among brands for products poses as a challenge for the company to catch up. Currently the company delivers products from their outlets in 1-2 business days depending on the location of the store and order place.

Key Concerns for Nykaa's Growth

Bank of America's analysts have cited several key factors leading to the downgrade:

Slower Margin Expansion: The bank estimates Nykaa's growth to be 16-40% below consensus estimates, especially in the BPC segment, where margin improvements are expected to be slower than initially forecasted. Despite Nykaa's strong brand and inventory-led model, the competitive pressures from newer entrants such as Shein, and growing investments in other areas like fashion and international markets, could weigh on the company's profitability.

Quick Commerce Risks: Nykaa's venture into quick commerce, offering faster delivery for beauty and personal care products, is also under scrutiny. While the company has seen improved selection and quicker delivery times, analysts believe the growth potential in this space might take longer to materialise. With the rise of other quick commerce platforms and the increasing focus on faster delivery models, Nykaa's revenue momentum in this segment may be slower than anticipated.

Higher Competition and Pressure on Margins: As new players like Shein enter the market, Bank of America expects Nykaa to face rising competition in the BPC segment. Despite Nykaa's dominance in the Indian market, the rapid expansion of quick commerce and growing competition could make it difficult for the company to balance growth with profitability.

Cutting Earnings and Price Target

Bank of America has revised its earnings estimates for Nykaa, cutting its FY25-27 EPS projections by 11-41%. Additionally, the bank has lowered its target EV/Ebitda multiple from 15x to 10x, reflecting the evolving business model and increasing risks in the quick commerce sector. The revised target price of Rs 150 is based on a combination of SOTP (Sum-of-the-Parts) and DCF (Discounted Cash Flow) models.

Despite the downgrade, Bank of America acknowledges Nykaa's strong position in the BPC space, citing its established brand and ability to drive sales through its inventory-led model. However, it also notes that the company's valuation remains high, trading at a premium compared to global internet peers, which raises concerns about the sustainability of these multiples.

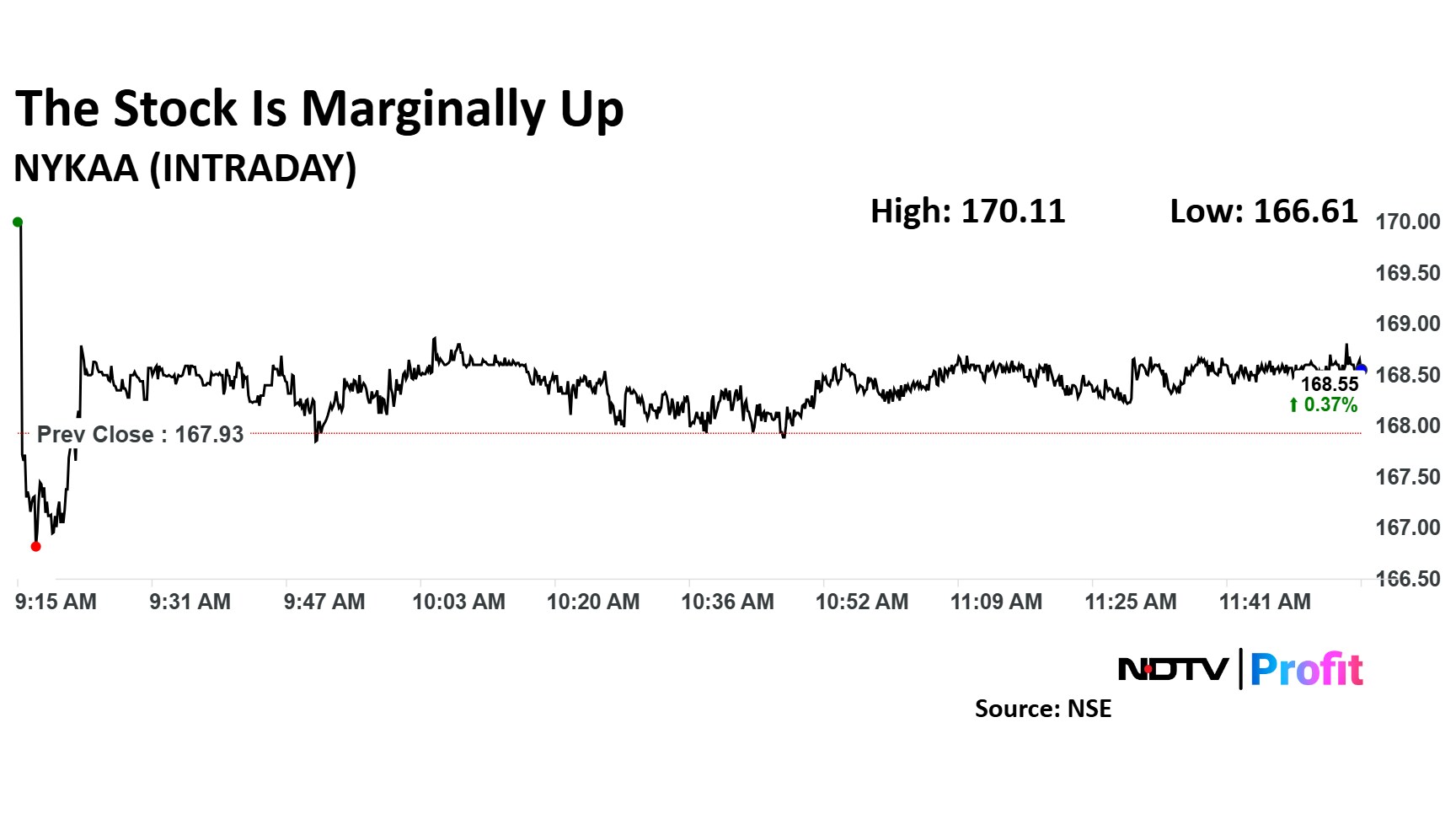

The scrip rose as much as 1.30% to Rs 170 apiece. It pared gains to trade 0.37% higher at Rs 168.55 apiece, as of 12:03 p.m. This compares to a 1.03% advance in the NSE Nifty 50 Index.

It has fallen 1.92% in the last 12 months. Total traded volume so far in the day stood at 0.15 times its 30-day average. The relative strength index was at 32.6.

Out of 24 analysts tracking the company, 14 maintain a 'buy' rating, four recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.