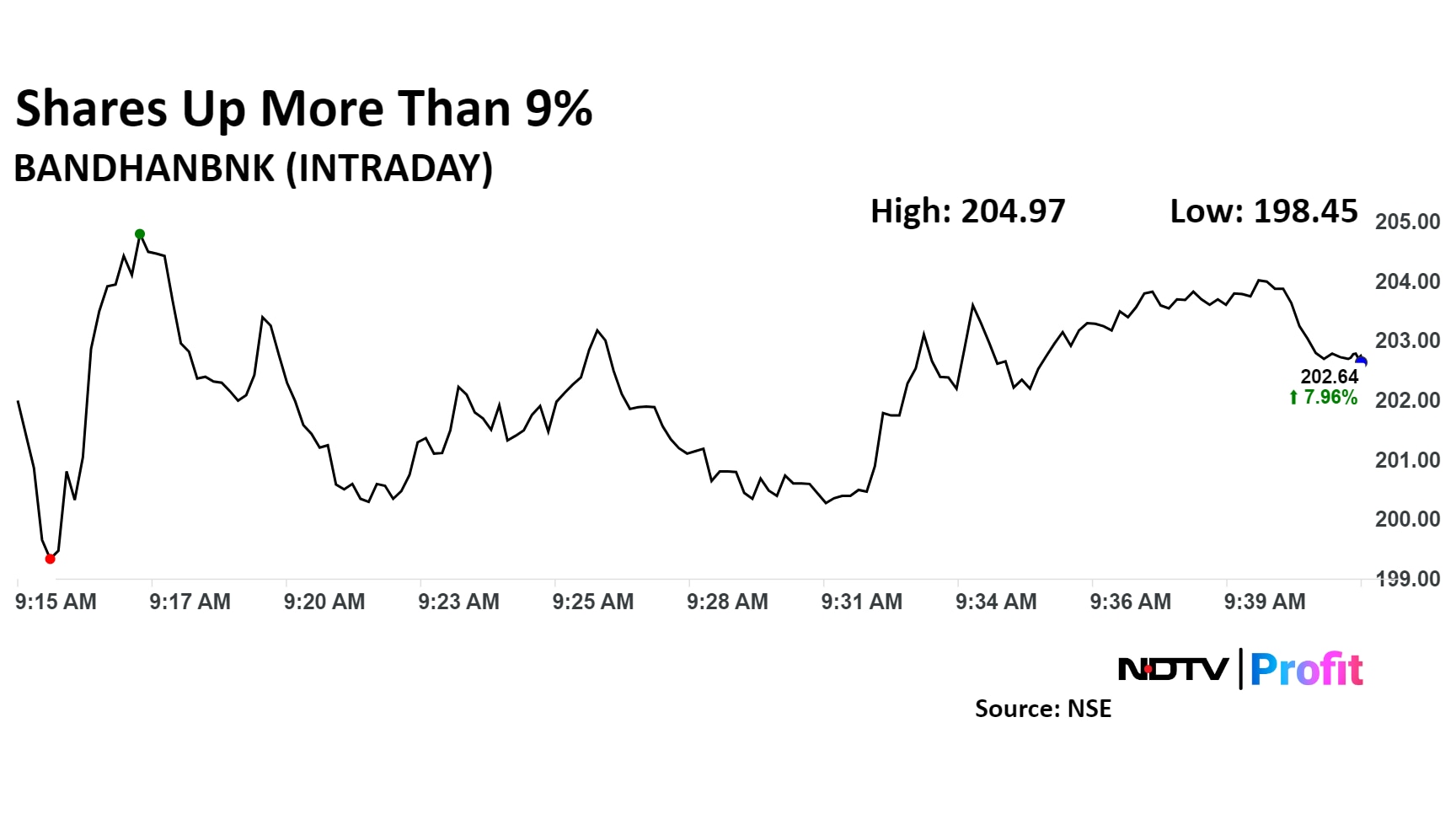

Bandhan Bank share price soared nearly 13% following a significant leadership change as the lender announced the appointment of Partha Pratim Sengupta as its new Managing Director and Chief Executive Officer, following approval from the Reserve Bank of India. Sengupta's banking experience spans nearly four decades, including his recent role as MD & CEO of Indian Overseas Bank until December 2022.

The bank also got a positive outlook from Jefferies, which maintained a 'buy' rating with a target price of Rs 240 per share. This indicates a potential upside of 27% from the previous close, boosting investor confidence amid recent developments.

The surge in Bandhan Bank's stock is further supported by the completion of a forensic audit by the National Credit Guarantee Trustee Company. The bank announced it will receive a payout of Rs 314.68 crore from NCGTC, a revised amount that considers the exclusion of certain adjusted accounts. This decision reflects a conservative approach taken by Bandhan Bank, particularly in light of operational challenges faced during the Covid-19 pandemic in fiscal 2020-21.

Jefferies highlighted several factors contributing to its optimistic view on Bandhan Bank. The firm noted that the recovery from credit guarantees enhances the bank's credibility, and it expects asset quality to perform better compared to other microfinance institutions. Additionally, Jefferies anticipates a 15% return on equity for the bank, emphasising that its current valuations are attractive at 1.1 times the financial year 2026 price-to-book value.

The scrip rose as much as 12.84% to Rs 211.80 apiece. It closed 12.02% higher at Rs 209.44 apiece. This compares to a 0.14% decline in the NSE Nifty 50 index.

It has fallen 13.24% in year-to-date and 15.8% on a year-to-date basis. Total traded volume so far in the day stood at 7.18 times its 30-day average. The relative strength index was at 38.08.

Out of 27 analysts tracking the company, 14 maintain a 'buy' rating, eight recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.9%.

What's Powering Bandhan Bank Shares|Watch

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.