Bandhan Bank Ltd.'s share price jumped over 8% in early trade on Monday after its standalone net profit surged 30% in the second quarter, meeting analysts' estimates.

The private sector bank's bottom line stood at Rs 937 crore during the July–September period, compared to Rs 721 crore in the year-ago quarter, according to an exchange filing. This was in line with the Rs 896 crore consensus estimate by analysts tracked by Bloomberg.

Net interest income, which measures the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors, rose 21% to Rs 2,948 crore.

On the other hand, the ratio of gross non-performing assets widened to 4.68% from 4.23% in the previous quarter. Likewise, the net NPA rose to 1.29% from 1.15% in the June quarter.

CLSA said Bandhan Bank's asset quality fared better than feared. While operating profit in the second quarter was a slight miss, credit costs were lower than expected, leading to a 24% profit beat.

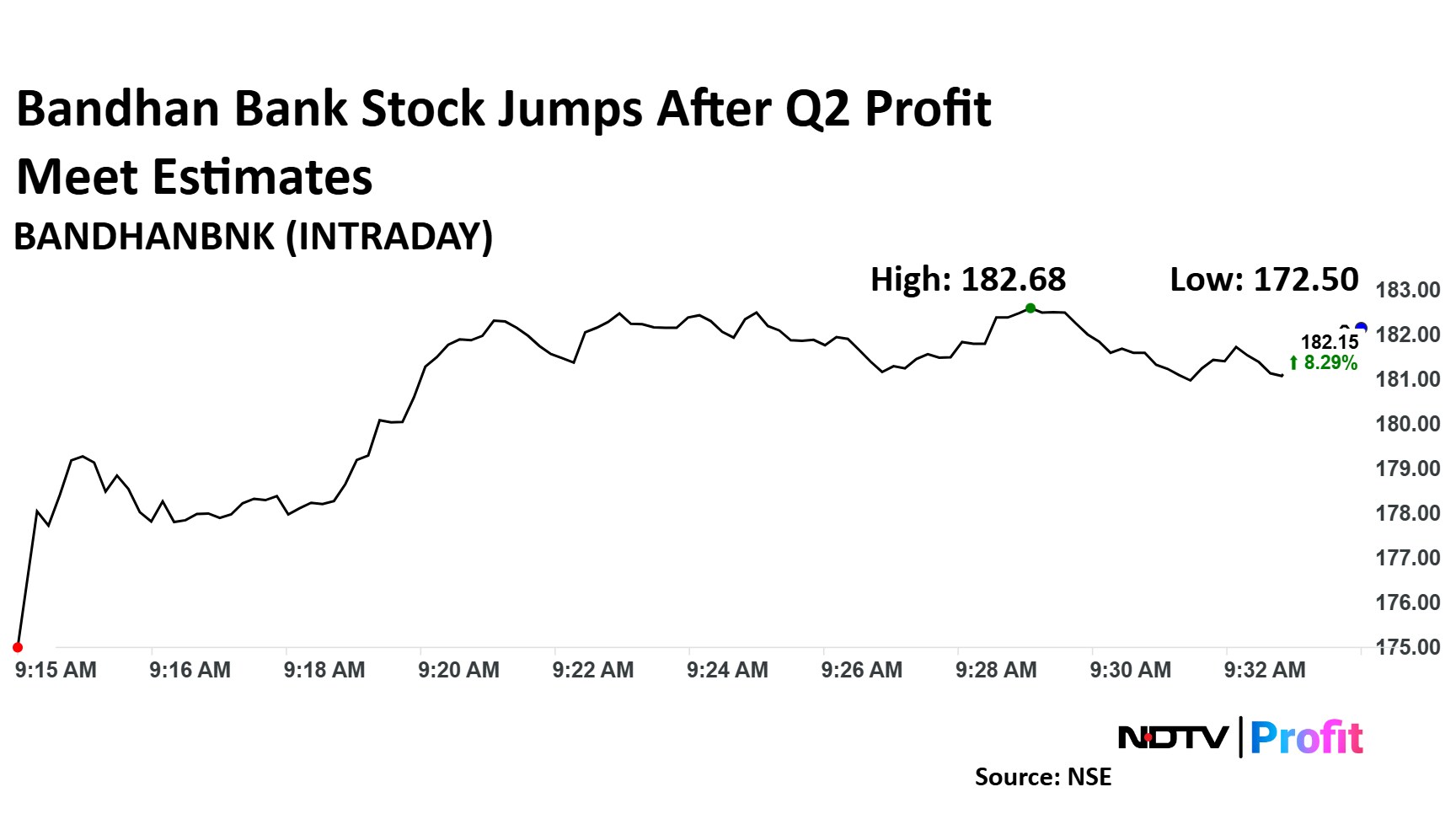

Bandhan Bank share price advanced 8.5% intraday to Rs 182.6 apiece.

Bandhan Bank's share price jumped 8.5% intraday to Rs 182.6 apiece. The stock was trading 8.3% higher by 9:33 a.m. The benchmark NSE Nifty 50 was up 0.08%.

The stock has fallen 15% in the last 12 months and 25% on a year-to-date basis. The total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 55.

Sixteen out of the 28 analysts tracking Bandhan Bank have a 'buy' rating on the stock, eight recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 214 implies a potential upside/downside of 18%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.