Bajaj Housing Finance Ltd. is poised for a downside of 27% as the lender's growth and margins are likely to compress, HSBC Global Research said while initiating coverage on the stock with a 'reduce' rating.

The brokerage has a target price of Rs 110 per share against the previous close of Rs 150 apiece.

"The market is valuing Bajaj Housing Finance for strong growth, which will likely moderate," HSBC said. The street is valuing the lender for its strong asset under management growth performance that is driven by non-home loan segment.

The share of housing-related loans required to maintain the housing finance licence is 61%, versus a minimum requirement of 60%. Hence, growth in non-home loans would gradually converge to the level of growth in home loans.

While the growth in home loan would still be higher than the system, further acceleration would be challenging. "We estimate AUM growth to slow to 26% CAGR over FY24-27e."

Further, the return on asset is at a peak and earnings per share growth would slow due to lower AUM growth, pressure on net interest margin, and normalised credit costs, HSBC said.

Return on assets compression can be mitigated by low credit costs, faster operating leverage and minimum NIM compression if cost of funds moderates quickly, the brokerage said. An asset under management growth of 30% year-on-year, if sustained, would support the valuation multiple, it said.

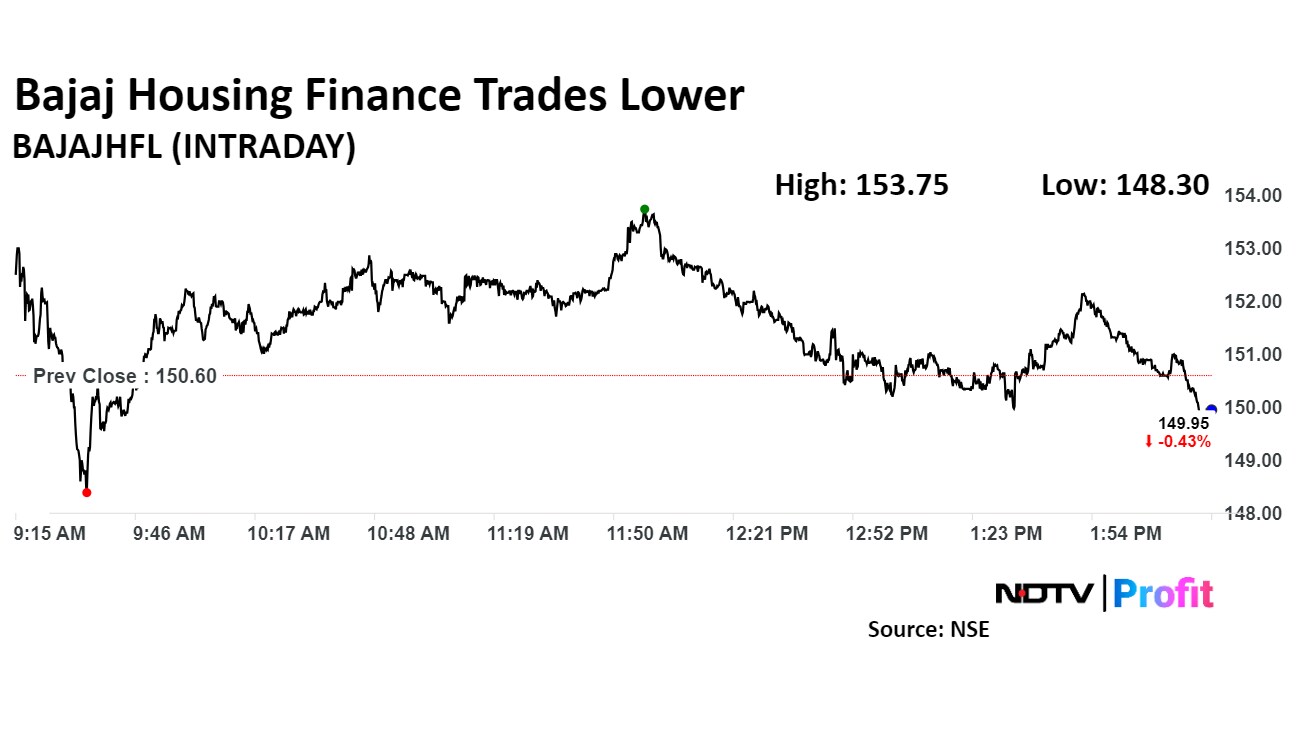

Bajaj Housing Finance Share Price

Bajaj Housing Finance stock fell as much as 1.53% before paring loss to trade 0.52% lower at Rs 149.8 apiece, compared to a 0.94% decline in the benchmark Nifty 50 as of 2:23 p.m.

It has declined by 9% since its listing on Sept. 16. The relative strength index was at 38.

Of the two analysts tracking the company, one has a 'buy' rating on the stock, while the other has a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.