Bajaj Housing Finance Ltd.'s share price rose over 4% on Tuesday after its consolidated net profit surged 26% year-on-year for the quarter ended September 2024.

The company's consolidated net profit stood at Rs 546 crore during the July-September quarter of fiscal 2025, compared to Rs 451 crore in the year-ago period, according to an exchange filing.

The net interest income, which is the difference between interest earned and interest paid, grew 13% to Rs 713 crore. The NII stood at Rs 632 crore in the same quarter last year.

Bajaj Housing Finance's revenue from operations grew to Rs 2,410 crore during the July–September period, a jump of 26% from Rs 1,911 crore posted in the corresponding quarter of the previous fiscal. The assets under management during the quarter under review totalled to Rs 1.03 lakh crore, up 26% from Rs 81,215 crore in the year-ago period.

The company's asset quality slipped in the September quarter. The gross non-performing assets ratio widened to 0.29% as compared to 0.24% in the year-ago period. In the same period, the net NPA ratio expanded to 0.12% from 0.09%.

Bajaj Housing Finance announced the results a day before its parent company, Bajaj Finance Ltd., would release its quarterly performance.

Bear Case

HSBC said the healthy profit growth was driven by income from assignment and low credit costs, even as core earning performance was muted.

The firm maintained 'reduce' rating on the Bajaj Housing Finance stock with a target price of Rs 110, a potential downside of 20% over previous close, noting the risk-reward is unfavourable.

It expects earnings-per-share growth to slow down due to lower AUM growth, NIM pressure, and normalised credit costs.

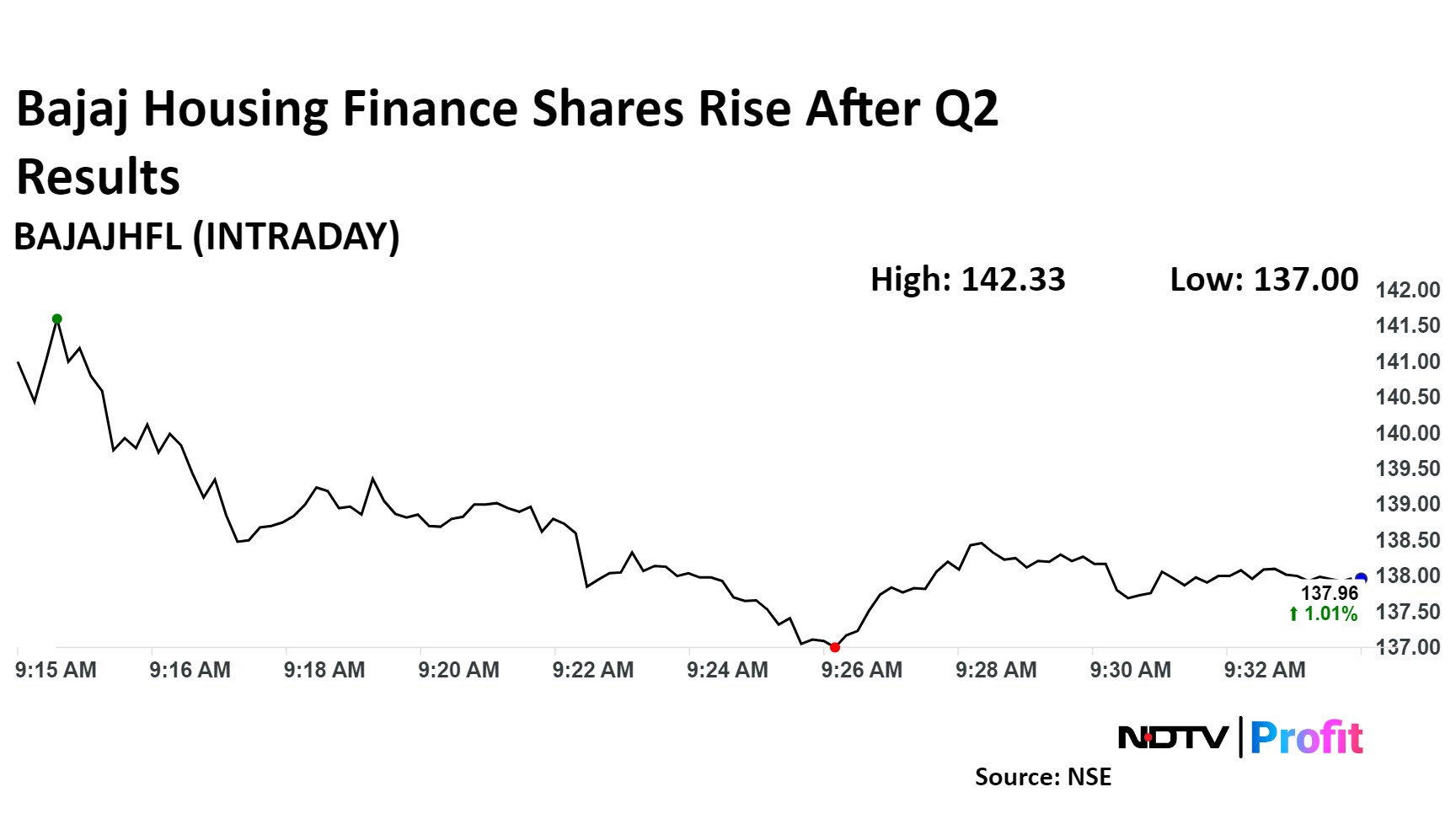

Bajaj Housing Finance share price rose 4.2% after market open to Rs 142.33 apiece.

Bajaj Housing Finance share price rose 4.2% to Rs 142.33 apiece. It was trading 1% higher at Rs 137.96 as of 9:25 a.m., compared to the benchmark Nifty 50 up 0.16%.

The stock had listed on the bourses on Sept. 16. This was the first quarterly results declared by the company after its Rs 6,560-crore IPO.

Out of the four analysts tracking the stock, one each has a 'buy' and 'hold' rating and two recommend a 'sell', according to Bloomberg data. The average of 12-month analyst price target is Rs 137.75, implying a potential downside of 0.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.