Bajaj Auto Ltd.'s share price dropped 10% in early trade on Thursday to the lowest since August, as analysts flagged high valuations remain a concern, even as the company clocked its highest ever quarterly revenue in the July-September period.

Standalone net profit of the Pulsar-maker rose 9% year-on-year to Rs 2,005 crore in the three months ended Sept. 30, on the back of revenue that surged 22% to Rs 13,127 crore. Analysts polled by Bloomberg had estimated the topline at Rs 13,253 crore and the bottomline at Rs 2,201 crore.

The operational profitability—measured as earnings before interest, tax, depreciation and amortisation—was at its highest ever. The company has clocked Ebitda margin of over 20% for four straight quarters now, despite an EV overhang.

Analyst Views

Better rural demand, positive urban demand, launches, better finance availability, and a favourable base will drive growth in domestic volumes in the two-wheeler segment, according to Nuvama Institutional Equities.

"We reckon domestic three-wheelers shall post an average growth of 7% over fiscal 2024–27, led by replacement demand and improved business activity," Nuvama said in a note on Oct. 16. The brokerage maintains its 'buy' rating with a target price of Rs 13,200 per share, up from Rs 12,000 apiece earlier, implying an upside of 13% from the previous close.

However, Emkay Research downgraded the stock to 'sell' from 'reduce' citing high valuations amid normalising growth. The brokerage raised the target price to Rs 9,500 per share from Rs 8,300 earlier, implying a downside of 18% from the previous close.

The gross margin contracted 130 basis points sequentially on a higher share of lower-margin electric two-wheelers, Jefferies said in a note. The brokerage remains more optimistic as registration data suggests about 12% year-on-year growth in two-wheelers, it said.

Jefferies is optimistic about continued sequential improvements in exports. It trimmed its fiscal 2025–27 earnings per share by 1-2%, but still expects a strong average growth of 16% EPS over the same period.

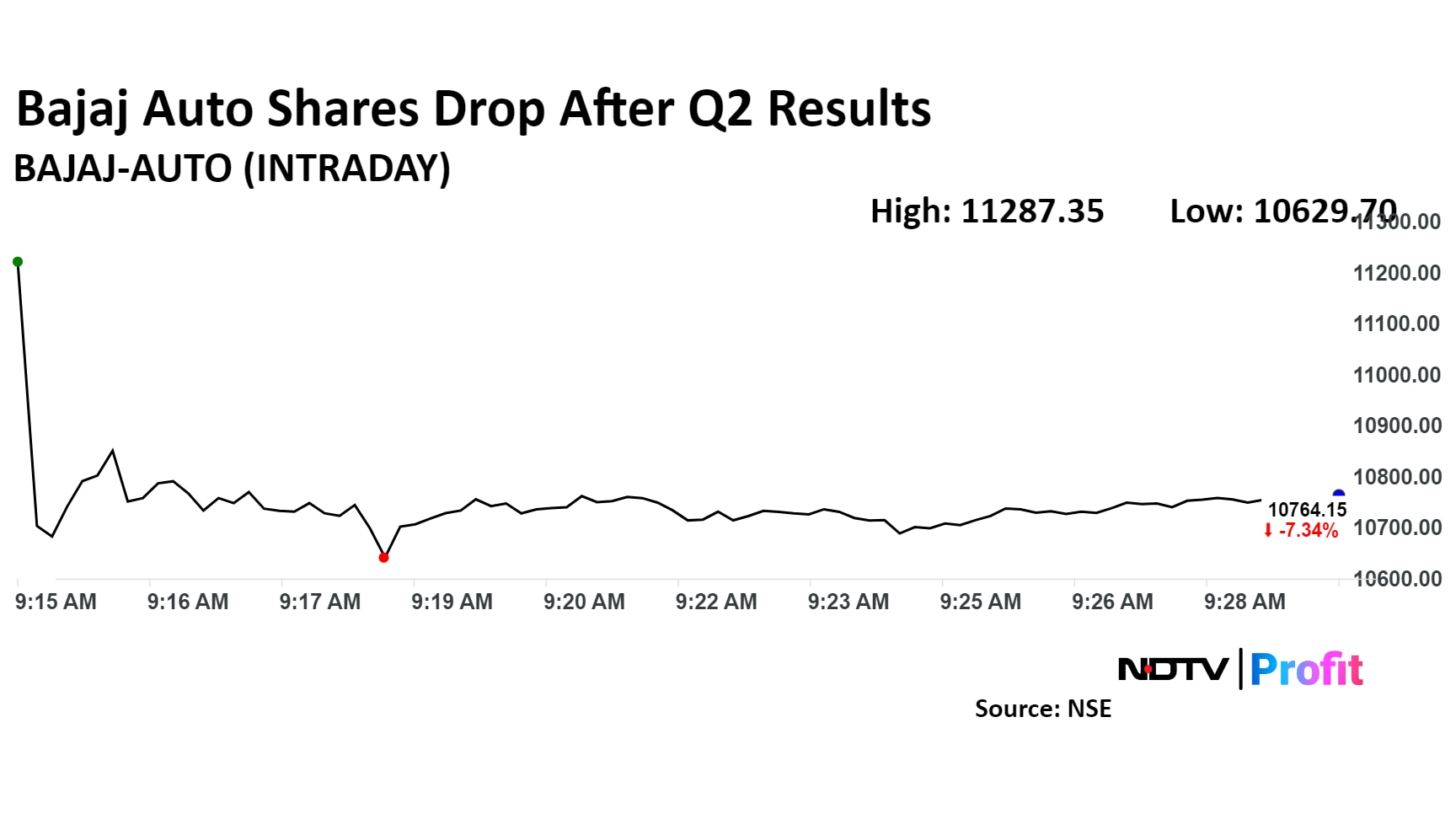

Bajaj Auto Share Price Today

Bajaj Auto share price declined 8.5% intraday to Rs 10,629.7 apiece.

Bajaj Auto's share price declined 8.5% intraday to Rs 10,629.7 apiece, the lowest since Aug. 29. The scrip was trading 7.3% lower at Rs 10,764 per share by 9:28 a.m., compared to a 0.16% decline in the benchmark NSE Nifty 50.

The stock has risen 108% in the last 12 months and 58% on a year-to-date basis. Total traded volume so far in the day stood at 18 times its 30-day average. The relative strength index was at 32.

Twenty of the 45 analysts tracking Bajaj Auto have a 'buy' rating on the stock, nine recommend a 'hold' and 16 suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 10,846 implies a potential downside of 3.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.