(Bloomberg) -- US stocks advanced with investors gearing up for Tuesday's reading on consumer prices. US Treasuries ended Monday lower, erasing earlier gains.

The S&P 500 jumped 1.4% and the tech-heavy Nasdaq 100 climbed 1.2%. Treasury yields rose, with the 10-year rate around 3.61%. The dollar advanced.

All eyes will be on the US consumer price index reading on Tuesday, which is expected to show prices, while still high, are continuing to decelerate. The S&P 500 — in a best-case scenario — could rally as much as 10% on a softer CPI reading, according to JPMorgan Chase & Co.'s sales and trading desk. However, the chances of that happening is about 5%, according to their analysis. A cooler inflation reading from the prior month spurred a 5.5% daily surge, with the S&P 500 index notching its best post-CPI day on record.

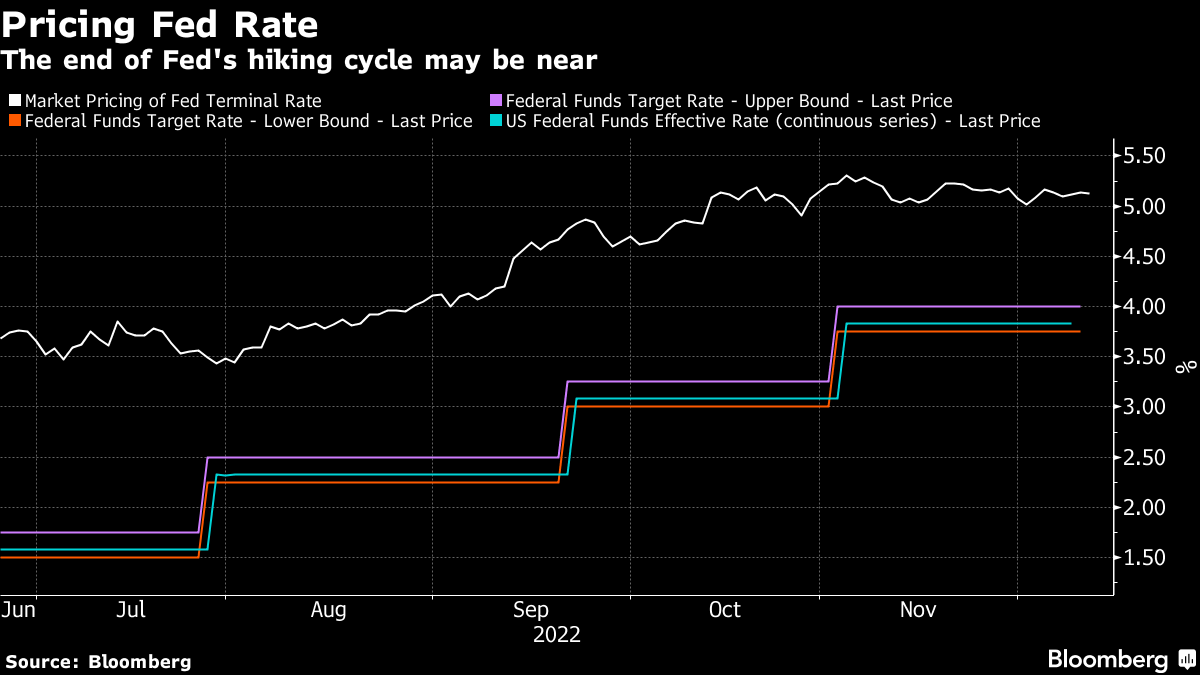

A subdued CPI print would justify the Federal Reserve's projected half-point move on Wednesday and shed light on whether markets can expect rate cuts in late 2023. While central bank officials have indicated a downshift in the pace of rate hikes, they have also emphasized that borrowing costs will need to remain restrictive for some time.

“I wouldn't read anything into the move today. The move will be after CPI, one way or another,” said John McClain, portfolio manager at Brandywine Global. “People are getting lulled into a false sense of security on a soft landing. The Fed isn't cutting anytime soon. This is just going to be a longer cycle compared to 2020.”

Read More: Big, Concerted Stocks-VIX Swing Is Sign Trader Nerves Fraying

Following the Fed, the European Central Bank will announce its rate decision Thursday. Markets will also contend with decisions from the Bank of England and monetary authorities in Mexico, Norway, the Philippines, Switzerland and Taiwan.

Key events this week:

- US CPI, Tuesday

- FOMC rate decision and Fed Chair news conference, Wednesday

- China medium-term lending, property investment, retail sales, industrial production, surveyed jobless, Thursday

- ECB rate decision and ECB President Lagarde briefing, Thursday

- Rate decisions for UK BOE, Mexico, Norway, Philippines, Switzerland, Taiwan, Thursday

- US cross-border investment, business inventories, empire manufacturing, retail sales, initial jobless claims, industrial production, Thursday

- Eurozone S&P Global PMI, CPI, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.4% as of 4:01 p.m. New York time

- The Nasdaq 100 rose 1.2%

- The Dow Jones Industrial Average rose 1.6%

- The MSCI World index fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.0535

- The British pound was little changed at $1.2271

- The Japanese yen fell 0.9% to 137.73 per dollar

Cryptocurrencies

- Bitcoin was little changed at $17,130.18

- Ether rose 0.2% to $1,267.06

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.61%

- Germany's 10-year yield was little changed at 1.94%

- Britain's 10-year yield advanced two basis points to 3.20%

Commodities

- West Texas Intermediate crude rose 3.4% to $73.41 a barrel

- Gold futures fell 1.1% to $1,791.40 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.