(Bloomberg) -- Stocks retreated, while bond yields climbed alongside the dollar, with the Federal Reserve signaling interest rates will be higher for longer after deciding to stay on hold in September.

The S&P 500 dropped almost 1%, while the Nasdaq 100 underperformed amid a slide in giants like Apple Inc. and Tesla Inc. Treasury two-year yields hit the highest since 2006. Swap contracts priced in fewer rate cuts next year than previously anticipated. The greenback erased losses. FedEx Corp., a barometer of global growth, rose in late trading on a bullish outlook.

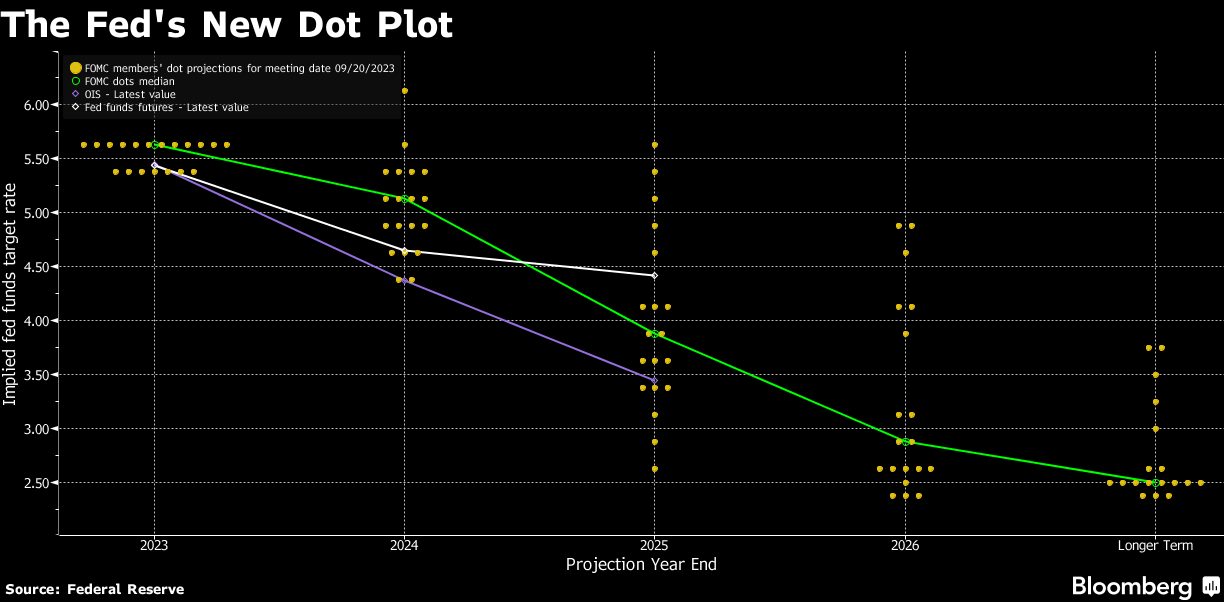

The Fed held its target range for the federal funds rate at 5.25% to 5.5%, while updated quarterly projections showed 12 of 19 officials favored another rate hike in 2023. Policymakers also see less easing next year. Jerome Powell said we're “prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we're confident that inflation is moving down sustainably toward our objective.”

“Powell to markets: This is a ‘skip,' not at a pause,” said Quincy Krosby, chief global strategist at LPL Financial. “He underscored numerous times that while the Fed remains data dependent and can proceed carefully, another rate hike remains on the table.”

More Comments:

- Will Compernolle, macro strategist at FHN Financial:

“Overall, this was the ‘hawkish skip' we were expecting. Just because the 2023 median dot shows one more hike, that doesn't necessarily represent the terminal rate. There could be more increases early next year.”

- Greg Peters, co-chief investment officer at PGIM Fixed Income:

“We're finally getting what we've been thinking for quite some time: higher rates for longer.”

- Brian Henderson, chief investment officer at BOK Financial:

“There's still some pressure on them to hike later this year. The longer the economy is able to remain this strong, even with these higher interest rates, it's going to put in doubt whether the Fed is doing enough to bring inflation down. But that doesn't necessarily mean the Fed has to keep hiking rates until inflation gets to 2%, either. Keeping rates at this level or slightly higher can bring inflation down to that point, but to ensure we're on the right track, month-over-month readings have to keep trending downward.”

- David Russell, global head of market strategy at TradeStation:

“Today's slightly hawkish Fed statement reflects the strength we've seen in the economy since their last meeting. Policymakers have zero incentive to get dovish now, especially with oil on the rise and the auto strike threatening to push up wages and potentially car prices.”

“Jerome Powell isn't ready to back down yet, but markets might look past the rhetoric. Investors know he's wary of declaring victory against inflation.”

- Seema Shah, chief global strategist at Principal Asset Management:

“In light of the still strong economic data, the hawkish pause and lingering threat of a November hike should not be a surprise to anyone. It's the 2024 projections where all the fun resides. The new projections suggest that the Fed has a fairly strong degree of confidence in its outlook for a soft landing and, in turn, that there will be very minimal space for policy easing next year. The dot plot for next year has certainly rammed home the message of higher for longer and reflects the continued wariness and fear of an inflation resurgence if it takes the foot off the brake too soon and too quickly.”

- John Lynch, chief investment officer at Comerica Wealth Management:

“This is consistent with our ‘higher for longer' expectation. To the degree the Fed holds rates steady, any improvement in core inflation measures leads to higher real rates, which serve to further constrain credit while eliminating the need for the Fed to raise rates during an election year.”

- Richard Carter, head of fixed interest research at Quilter Cheviot:

“With today's pause, we are now in the waiting game with the Fed to see if their action to date is enough to achieve the coveted ‘soft landing' in the US. Each and every data point released from now on will be scrutinized and pored over with a fine toothcomb to get any indication of if the Fed will raise rates again, or when in fact it is time to start cutting rates.”

- Alexandra Wilson-Elizondo at Goldman Sachs Asset Management:

“We, like many, expected to see the hawkish hold that Powell nodded to at Jackson Hole. However, the release was more hawkish than expected. While a share of past policy tightening is still in the pipeline the Fed can go into wait and see mode, hence the pause. We believe that their next meeting will be live, but not a done deal.”

- Charlie Ripley, senior investment strategist at Allianz Investment Management:

“While this meeting was widely viewed as a ‘skip' meeting, we think it still remains to be seen if another hike is in the cards later this year. Fed officials appear to be divided on whether higher policy rates are needed to bring inflation back down to their 2% target. In addition, there are significant risks to the economy on the horizon. Thus, there is a decent case building that the last rate hike during this cycle may already be behind us. However, the Fed's projections did show less rate cuts in 2024, which gives the Fed more optionality to keep policy rates higher for longer should the economy fail to materially slow.”

Corporate Highlights

- Marketing and data automation provider Klaviyo Inc. climbed 9.2% in its trading debut after topping its goal to raise $576 million in an initial public offering that could set the pace for listings by other startups.

- Instacart briefly sank below its IPO price on just its second day of trading, underscoring the difficulty the company will have convincing investors of its plans to expand into advertising and the grocery software business.

- Pinterest Inc. climbed, with analysts positive on the social-networking company in the wake of its investor day event.

- International Business Machines Corp. advanced after being rated outperform at RBC Capital Markets.

- Coty Inc. rose after raising its sales outlook for the current fiscal year, citing continued robust demand for higher-end fragrances.

- Chewy Inc. fell after the pet-supplies retailer was downgraded to market perform from outperform at Oppenheimer & Co.

Key events this week:

- Eurozone consumer confidence, Thursday

- Bank of England policy meeting, Thursday

- US leading index, initial jobless claims, existing home sales, Thursday

- China's Bund Summit, Friday

- Japan CPI, PMIs, Friday

- Bank of Japan rate decision, Friday

- Eurozone S&P Global Eurozone PMIs, Friday

- US S&P Global Manufacturing PMI, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.9% as of 4 p.m. New York time

- The Nasdaq 100 fell 1.5%

- The Dow Jones Industrial Average fell 0.2%

- The MSCI World index fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.2% to $1.0659

- The British pound fell 0.4% to $1.2340

- The Japanese yen fell 0.2% to 148.19 per dollar

Cryptocurrencies

- Bitcoin fell 0.9% to $26,944.88

- Ether fell 1.6% to $1,616.55

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.41%

- Germany's 10-year yield declined four basis points to 2.70%

- Britain's 10-year yield declined 13 basis points to 4.21%

Commodities

- West Texas Intermediate crude fell 1% to $90.28 a barrel

- Gold futures were little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Sophie Caronello and Emily Graffeo.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.