Shares of Apollo Hospitals Enterprise Ltd. hit a life high on Monday after Rasmeli Ltd., an affiliate of global private equity firm Advent International, bought 16.9% stake in the company's subsidiary Apollo HealthCo Ltd. for over Rs 2,475 crore.

This transaction has effectively reduced Apollo Hospitals' ownership from 94.91% to 78.87%, according to an exchange filing on Friday.

Additionally, the plan includes Apollo HealthCo acquiring an 11.2% stake in Keimed, a key distributor of pharmaceutical products, for Rs 625 crore. Apollo Hospitals' promoter, Shobana Kamineni, will be selling her personal shares in Keimed to Apollo HealthCo, according to the filing. Furthermore, Apollo HealthCo has given Keimed Rs 99.9 crore in primary investments to fuel its expansion plans.

The third component of this proposed transaction is Keimed's upcoming merger with Apollo HealthCo. This merger would create a more streamlined structure under the subsidiary, further strengthening Apollo's digital health ecosystem. These transactions involve the issuance of preference shares in multiple tranches, as per the filing.

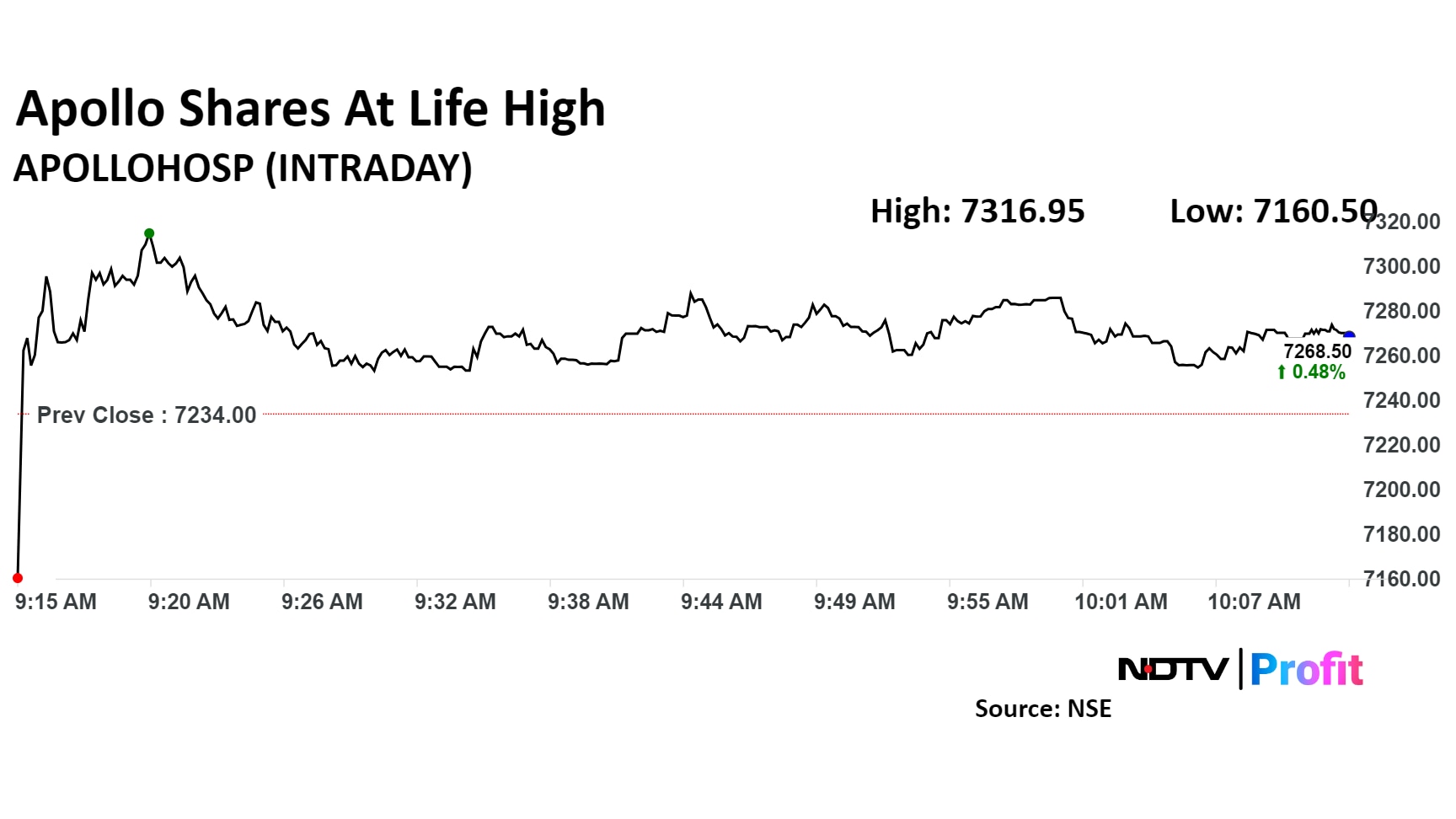

Shares of the company rose as much as 1.15% to Rs 7,316.95 apiece, the highest level since listing. The stock pared gains to trade 0.48 % higher at Rs 7,268.70 apiece as of 10:15 a.m. This compares to a 0.76 decline in the NSE Nifty 50 Index.

The stock has risen 26.49% on a year-to-date basis. Total traded volume so far in the day stood at 0.25 times its 30-day average. The relative strength index was at 73.62, indicating that the stock may be overbought.

Out of 28 analysts tracking the company, 23 maintain a 'buy' rating, three recommend a 'hold,' and two suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 0.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.