Shares of Ambuja Cements Ltd. gained over 4% on Friday after a promoter entity likely divested $500 million worth of shares.

Holderind Investments Ltd., a company owned by billionaire Gautam Adani and his family, plans to divest 2.84% of the of the equity, valuing the deal at Rs 4,197.8 crore at the floor price, according to the terms of the deal viewed by NDTV Profit.

The transaction is part of a strategic group portfolio management move aimed at diversifying the shareholder base and attracting long-only investors, particularly those interested in infrastructure assets.

The Group portfolio management—Holderind Investments—will sell approximately 6.99 crore shares at a floor price set at Rs 600 per share, reflecting a 5% discount to the last close price on the NSE.

The shares will be subject to a 60-day lock-up period, excluding transfers to another promoter or promoter group members, with the lock-up continuing in the hands of the transferee.

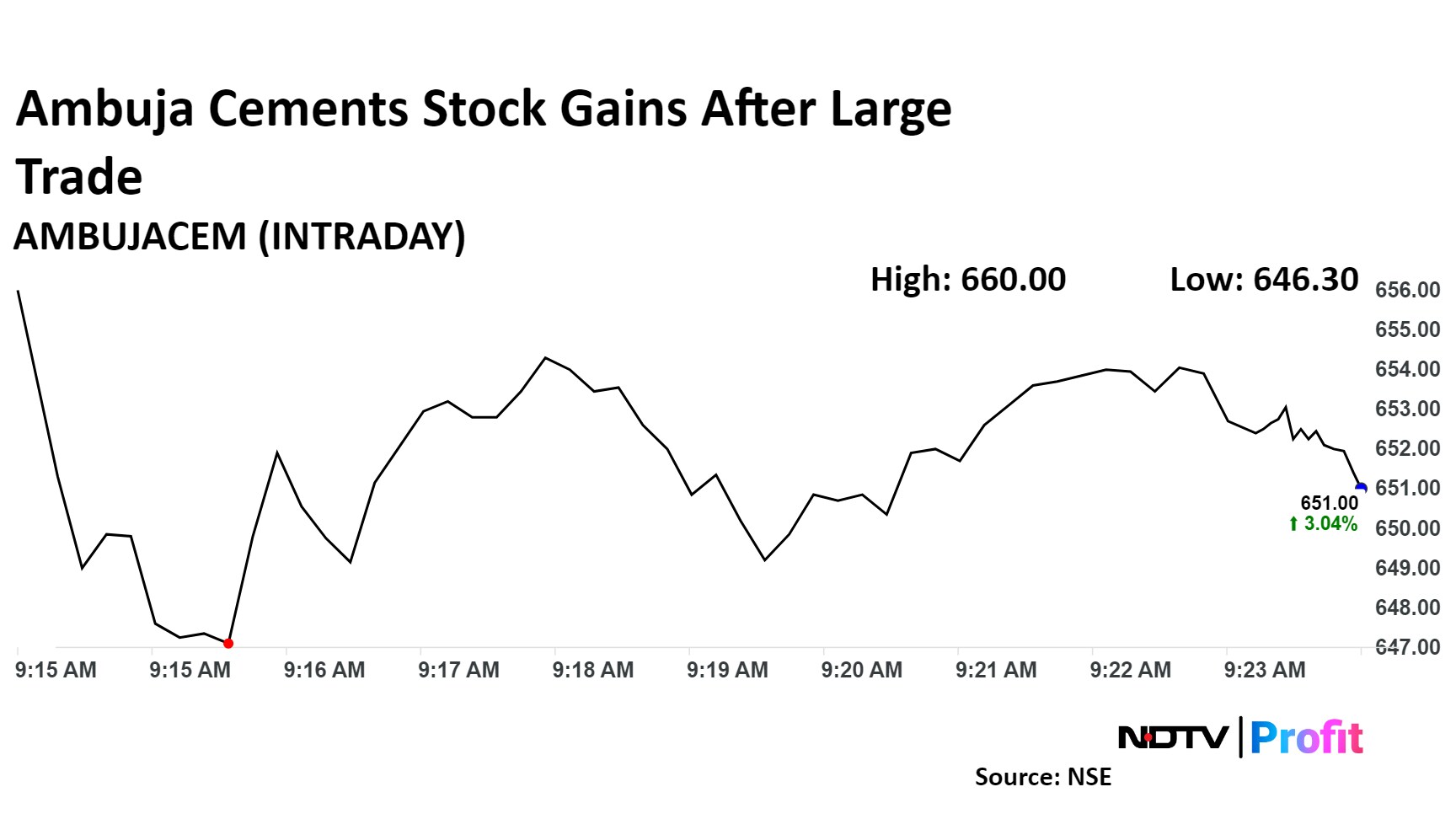

Shares of Ambuja Cements advanced as much as 4.7% to Rs 660 apiece before cooling off to trade 3% higher at Rs 651 by 9:24 a.m. The benchmark NSE Nifty 50 was trading 0.11% higher.

The stock has risen 43% in the last 12 months and 22% on a year-to-date basis. The total traded volume so far in the day stood at 115 times its 30-day average. The relative strength index was 51.

Twenty-two out of the 40 analysts tracking Ambuja Cements have a 'buy' rating on the stock, 10 recommend a 'hold' and eight suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 5.9%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.