Amber Enterprises India Ltd.'s share price rose nearly 10% on Wednesday as its revenue almost doubled, helping the company to report a net profit in the second quarter of the current financial year.

The company reported a net profit of Rs 20.9 crore in the quarter ended September 2024, compared with a loss of Rs 5.7 crore in the same quarter a year ago, according to an exchange filing.

Income from operations in the July-September quarter rose 81% year-on-year to Rs 1,685 crore, while Ebitda rose 91% to Rs 114 crore. A Bloomberg consensus had estimated a 30% and 41% rise in both revenue and Ebitda, respectively.

Over the past few quarters, Amber Enterprises launched new products like tower air conditioners, window top throw inverter series, tropical high efficiency split air conditioners, and cassette air conditioners, and that has aided in the sales growth this year.

The company's consumer and electronics division almost doubled in revenue terms compared to last financial year, while operating Ebitda tripled for these divisions.

The company has been showing strength in this division and has raised its full-year guidance to 45% from 35% earlier for fiscal 2025.

Amber Enterprises is a prominent solution provider for the heating, ventilation, and air conditioning industries. It has a presence in room air conditioners, complete built units, and major RAC components, with 27 manufacturing facilities across India focusing on different product segments.

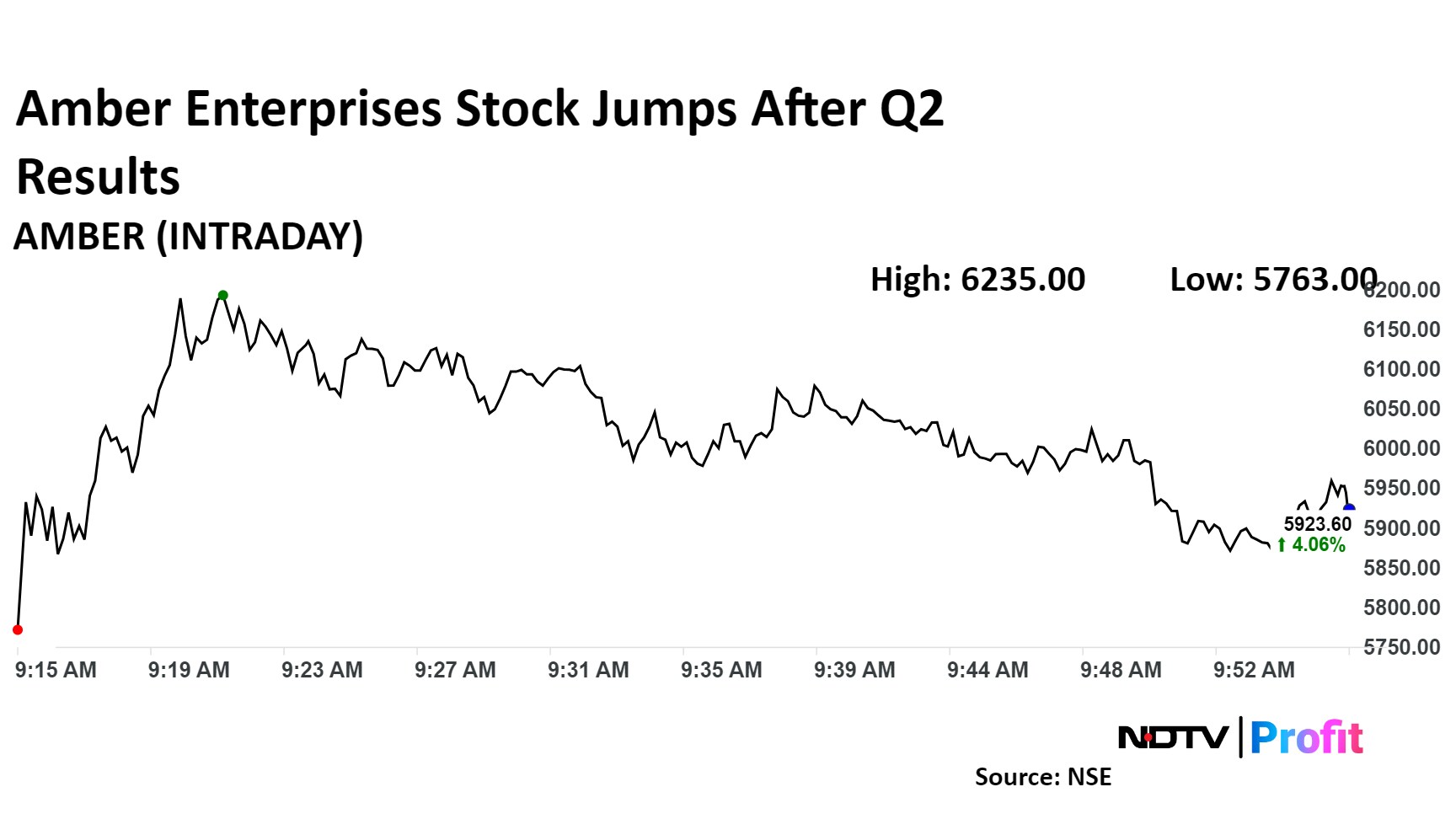

Amber Enterprises Share Price Movement

Amber Enterprises' share price was trading 4% higher at Rs 5,923.6 by 9:55 a.m.

Amber Enterprises' share price advanced 9.6% intraday to Rs 6,235 apiece. It was trading 4% higher at Rs 5,923.6 by 9:55 a.m. The benchmark NSE Nifty 50 was up 0.2%.

The stock has risen 112% in the last 12 months and 89% on a year-to-date basis. The total traded volume so far in the day stood at 6.8 times its 30-day average. The relative strength index was at 56.

Twenty out of the 26 analysts tracking Amber Enterprises have a 'buy' rating on the stock, four recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential downside of 16%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.