Amber Enterprises Ltd.'s share price dropped over 10% on Tuesday, ahead of the release of September quarter results.

The company is expected to post a revenue of Rs 1,205 crore, a year-on-year growth of 30%, according to analysts' consensus estimates compiled by Bloomberg. Net profit is projected to be flat at Rs 4 crore.

Earnings before interest, tax, depreciation and amortisation is expected to be Rs 84 crore, a growth of 7%. Ebitda margin will be 7%, compared to 6.4% in the same period last year.

Amber Enterprises is a prominent solution provider for the heating, ventilation, and air conditioning industries. It has a presence in room air conditioners, complete built units, and major RAC components, with 27 manufacturing facilities across India focusing on different product segments.

Last week, unit ILJIN Electronics (India) Pvt. signed a joint venture agreement with Korea Circuit Co. to establish a new company in India focused on the production and manufacturing of semiconductor substrates, including HDI and Flex PCBs.

ILJIN will hold a 70% stake in the JV, while the rest will be held by Korea Circuit. The newly formed company aims to leverage KCC's expertise in printed circuit boards to enhance local manufacturing capabilities, in line with India's 'Aatmanirbhar Bharat' initiative.

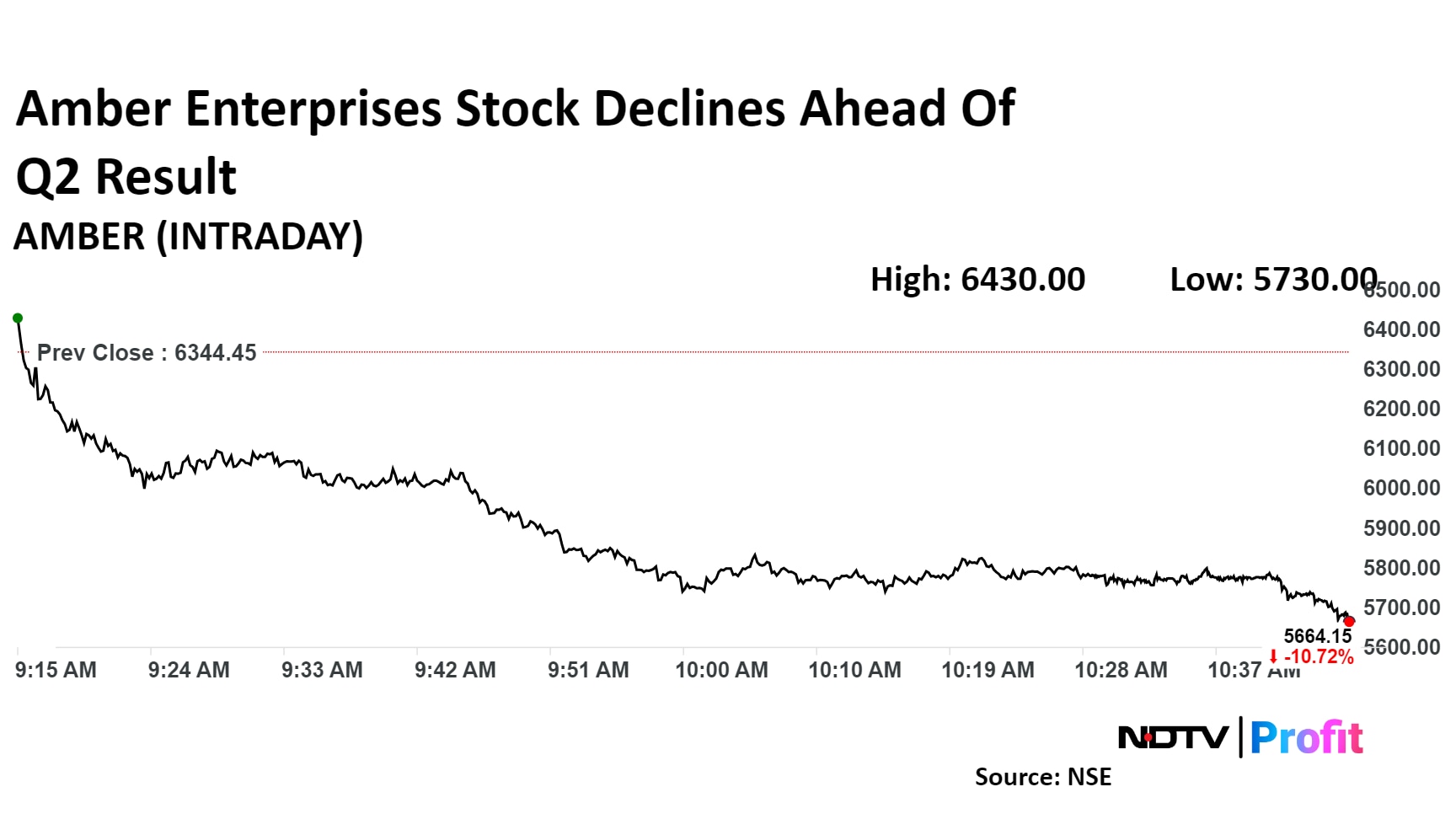

Amber Enterprises Share Price Movement

Amber Enterprises share price declined 10.7% to Rs 5,664.15 apiece at 10:45 a.m.

Amber Enterprises' share price declined 10.7% to Rs 5,664.15 apiece at 10:45 a.m. This is the lowest level since February 2019. The benchmark NSE Nifty 50 was down 0.4%.

The stock has risen 86% in the last 12 months and 80% on a year-to-date basis. The total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 70.

Twenty out of the 26 analysts tracking Amber Enterprises have a 'buy' rating on the stock, four recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential downside of 12%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.