AIA Engineering Ltd.'s board approved the buyback of 10 lakh shares worth Rs 500 crore. The share will be bought back at Rs 5,000 per share, a premium of 11% from the current price of Rs 4,500 per share on the BSE.

The board may raise the maximum buy-back price and decrease the number of securities proposed for buyback up to one working day before the record date, the company said in an exchange filing.

The public announcements will outline the process, timelines, and other necessary details of the buyback, it stated.

Furthermore, the company changed the record date for dividends to Aug. 20. The shareholders of the company were to receive a dividend of Rs 16 per share with a face value of Rs 2 apiece for the financial year 2023–24.

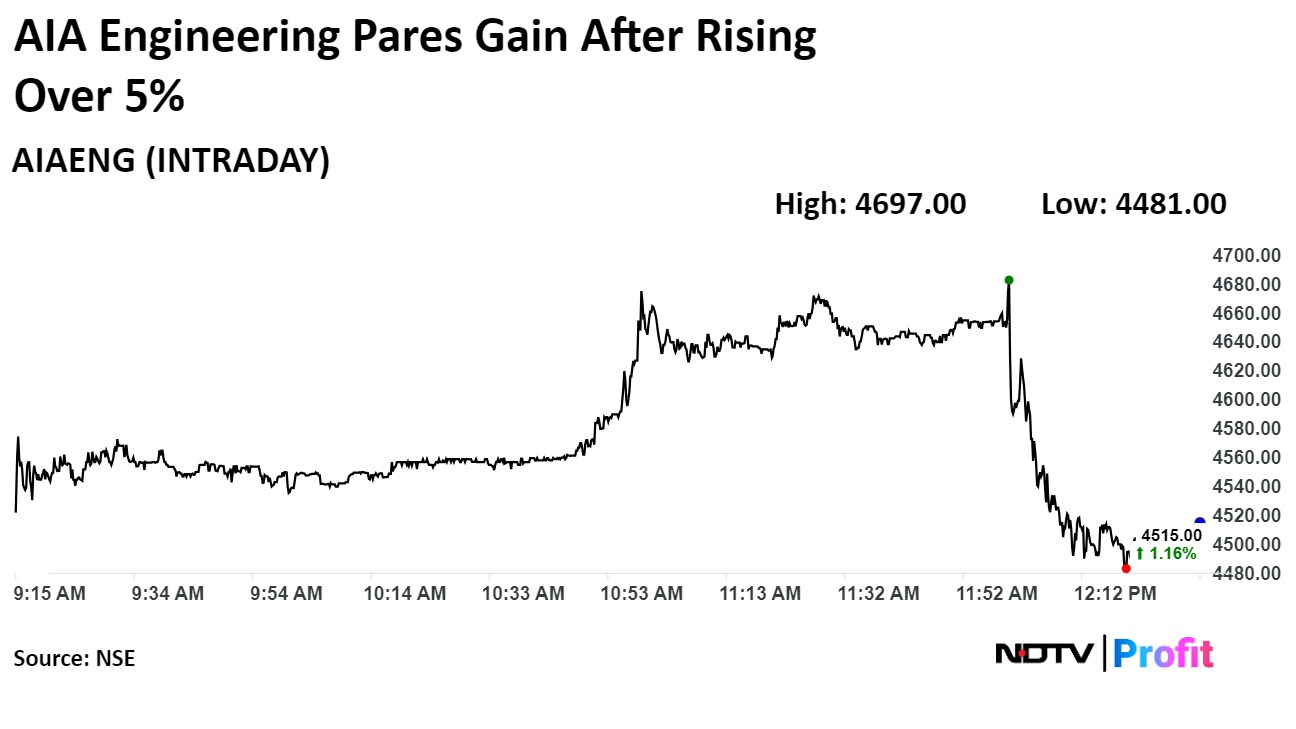

Shares of AIA Engineering rose as much as 5.2% during the day to Rs 4,697 apiece on the NSE. It was trading 0.93% higher at Rs 4,504.9 apiece, compared to a 1.1% advance in the benchmark Nifty 50 as of 12:29 p.m.

The stock has risen 27% in the last 12 months and 22% on a year-to-date basis. The total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 58.

Nine out of the 16 analysts tracking the company have a 'buy' rating on the stock, two recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential decline of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.