Aditya Birla Capital Ltd. got an 'outperform' rating as Macquarie initiated coverage on the stock.

The non-banking financial company is the brokerage's top pick in the segment, as it anticipates strong growth. It has set a target price of Rs 230 apiece on the stock, implying an upside of 26.48% from Monday's close.

Aditya Birla Capital is expected to witness robust growth in loans and earnings, driven by its lending and savings businesses over the next several years, the brokerage said in a note on Monday.

The stock, which is not widely covered by the street, has potential to double in the next three years, Macquarie said.

Aditya Birla Capital can also see its margin expand on the back of cheaper funding and leveraging group ecosystems, strong SME growth, and improvement in protection mix.

Strong parentage and 'AAA' rating are going to make it easy for Aditya Birla Capital to access competitive funding from the market, it said.

Large group ecosystem and diversified distribution mix are expected to result in robust loan and APE growth, higher than peers and average of listed peers.

Further, profitability in the NBFC segment will aid growth for the company, the brokerage said.

Key Takeaways

Macquarie expects Aditya Birla Capital to post AUM CAGR of 28%, with greater than 10 basis points ROA over FY23-FY26.

Aditya Birla Capital is leveraging the Aditya Birla Group and its ecosystem for cross-selling and upselling in NBFC, insurance, and other segments.

The company is avoiding concentration risk with diversified product suite and distribution, the brokerage said.

Aditya Birla Capital is likely to maintain strong AUM CAGR despite scaling down of personal loans.

Macquarie expects Aditya Birla Capital to show above 30% growth in AUM CAGR in the SME segment.

The company's stock price is expected to double in three years, the brokerage said.

Key Risks

Deteriorating asset quality in the NBFC segment may lead to higher credit costs and lower ROA.

Attrition in senior management may affect execution.

Change in holding company structure.

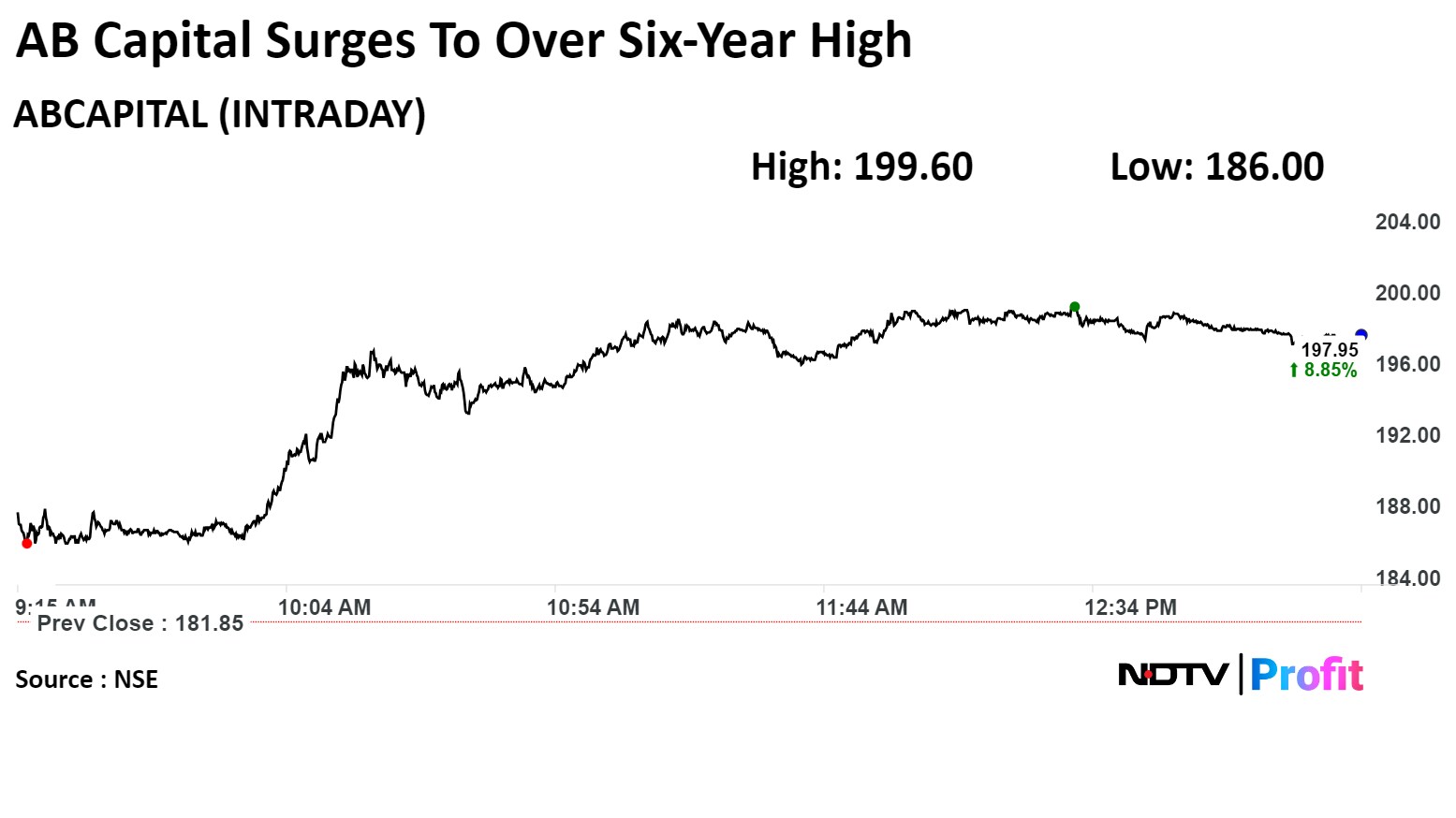

Shares of Aditya Birla Capital rose as much as 9.76%, the highest level since Nov. 29, 2017, before paring gains to trade 8.72% higher at 1:25 p.m. This compares with a 0.24% decline in the Nifty 50.

The stock has risen 28.51% in 12 months. Total traded volume so far in the day stood at 7.9 times its 30-day average. The relative strength index was at 68.28.

Of the 10 analysts tracking the company, nine maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 11.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.