The group stocks of billionaire Gautam Adani staged a comeback a day after the conglomerate's market cap nosedived as it categorically denied any wrongdoing in the alleged $250 million bribery scheme.

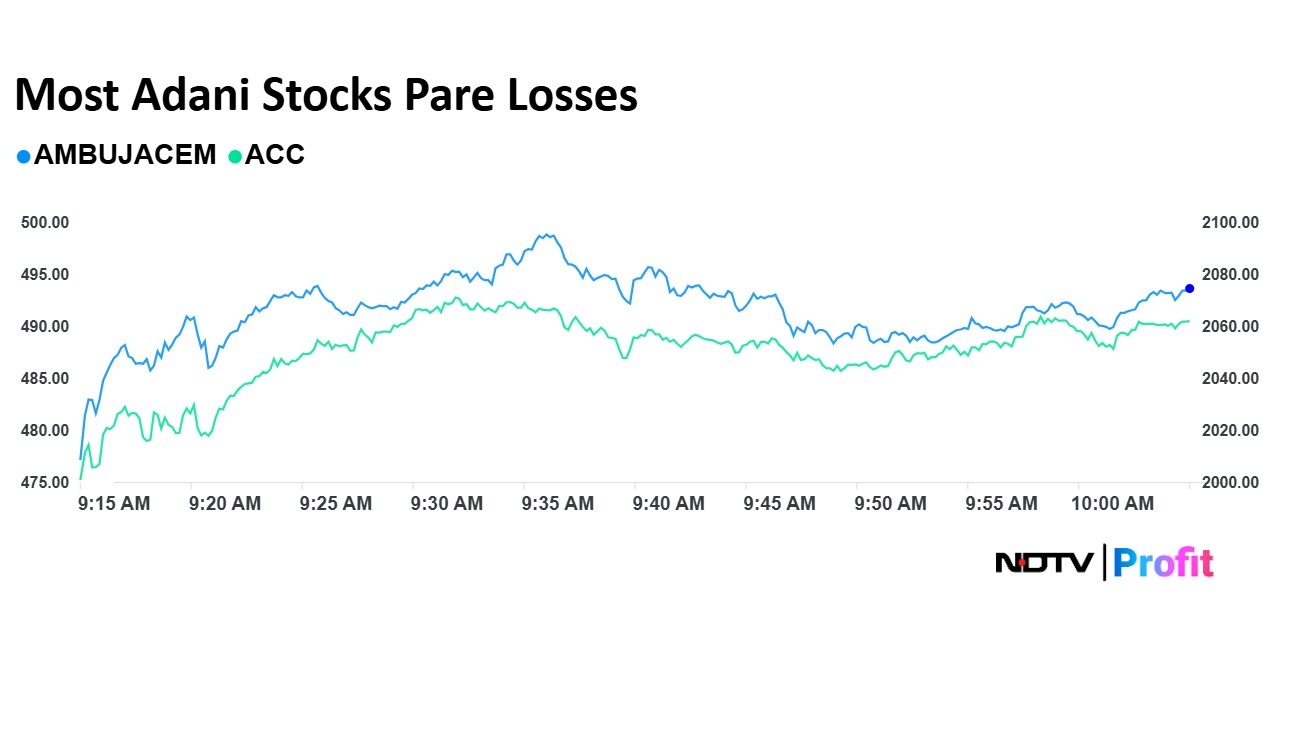

Shares of all its cement businesses led the gains for the conglomerate with Ambuja Cements Ltd. and ACC Ltd. rising 2.3% and 1.5% in early trade. Sanghi Industries Ltd. scrip was also trading higher, compared to the 0.58% advance in the benchmark NSE Nifty 50.

The counters of its media business NDTV Ltd. and Adani Total Gas Ltd. swung between gains and losses after the group assured stakeholders that it would pursue all available legal recourse to address "baseless" accusations against it.

Adani Green Energy Ltd.—against whom the charges were brought—and Adani Energy Solutions Ltd. posed the highest gain from their lows on Friday. Meanwhile, the flagship Adani Enterprises Ltd. and Adani Wilmar Ltd. also gained from their day's lows.

In response to the charges brought against Adani Green Energy and its directors, the conglomerate issued a statement emphasising that, as per the US Department of Justice's own statements, "the charges in the indictment are allegations, and the defendants are presumed innocent unless and until proven guilty."

The overall group market capitalisation of the conglomerate fell as much as Rs 75,380 crore which later pared losses to trade at a loss of 40,145 crore.

"The Adani Group has always upheld and is steadfastly committed to maintaining the highest standards of governance, transparency and regulatory compliance across all jurisdictions of its operations. We assure our stakeholders, partners and employees that we are a law-abiding organisation, fully compliant with all laws," the company statement read.

The allegations, which include charges of corruption and bribery related to the development of Adani's solar power projects in India, were made public as part of an indictment filed by the Department of Justice and a civil complaint by the Securities and Exchange Commission.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.