Adani Ports and Special Economic Zone Ltd. has revised its FY24 cargo volume guidance upwards, as it increased 42% year-on-year to 35.65 MMT in December 2023.

"We are now targeting over 400 MMT of cargo volumes in FY24, surpassing the upper end of the guidance range (370–390 MMT) provided at the start of the current financial year,” said Karan Adani, chief executive officer and whole-time director of Adani Ports and Special Economic Zone.

The company's annual cargo volume grew 23% to 311 MMT in the April-December period of FY24, an exchange filing said.

Ten ports in the company's portfolio delivered the highest-ever cargo volumes, marking new operating milestones, it said.

Mundra Port managed around 5.5 MTEUs in the nine-month period ending in December. Year-to-date, logistics rail volumes grew by 22% and GPWIS volumes were up by 47%.

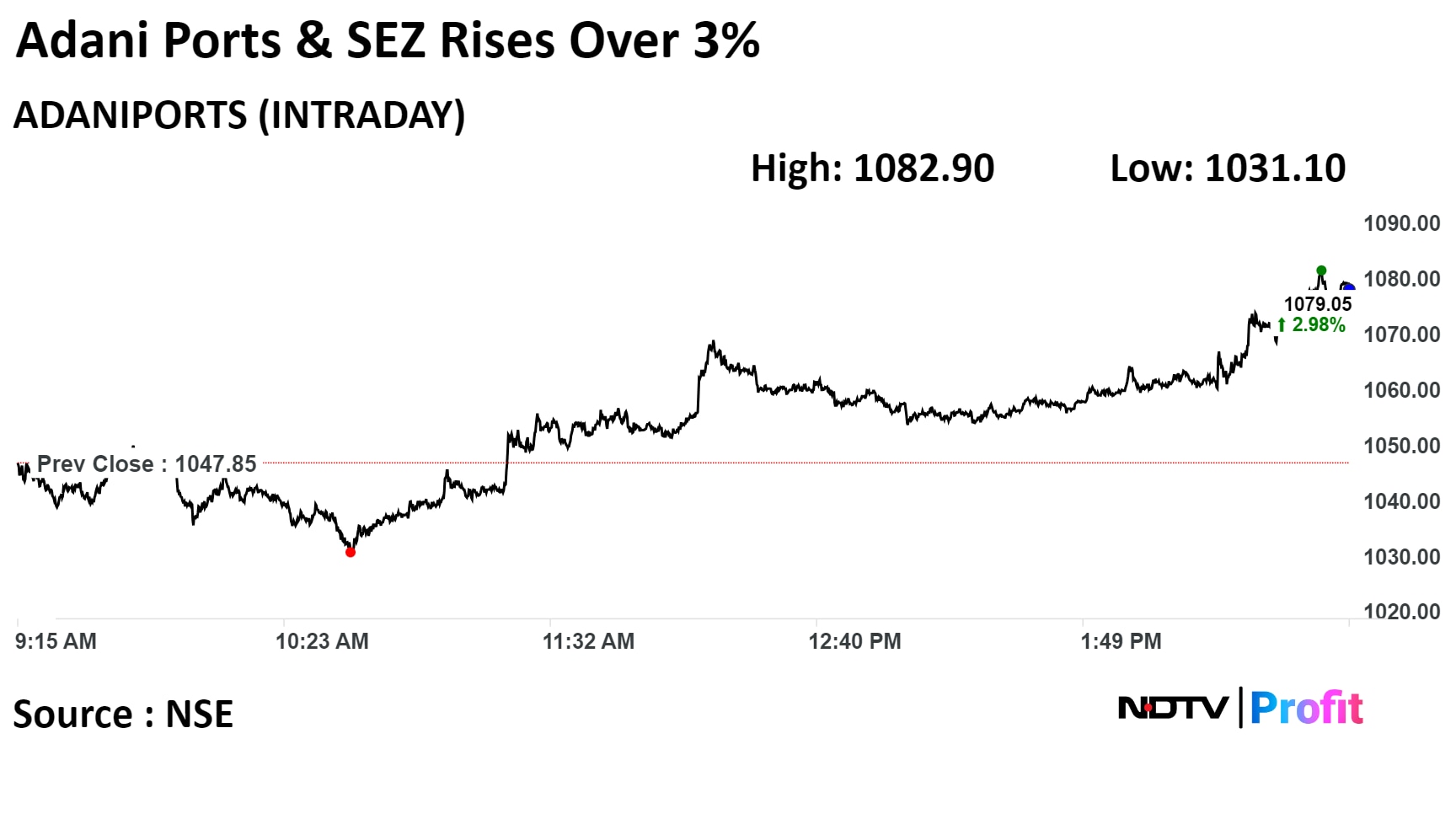

Shares of Adani Ports rose as much as 3.34%, the highest since Dec. 20, 2023, before paring gains to trade 3.16% higher at 2:55 p.m. This compares to a 0.35% decline in the NSE Nifty 50.

The stock has risen 5.32% year-to-date. Total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 70.15, implying that the stock may be overbought.

Of the 21 analysts tracking the company, 19 maintain a 'buy' rating, and two recommend a 'hold', according to Bloomberg data. The 12-month average consensus price target implies a downside of 8.1%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.