Adani Enterprises Ltd. has announced the first public issue of secured non-convertible debentures. The issue will open on Sept. 4, 2024, and close on Sept. 17, 2024.

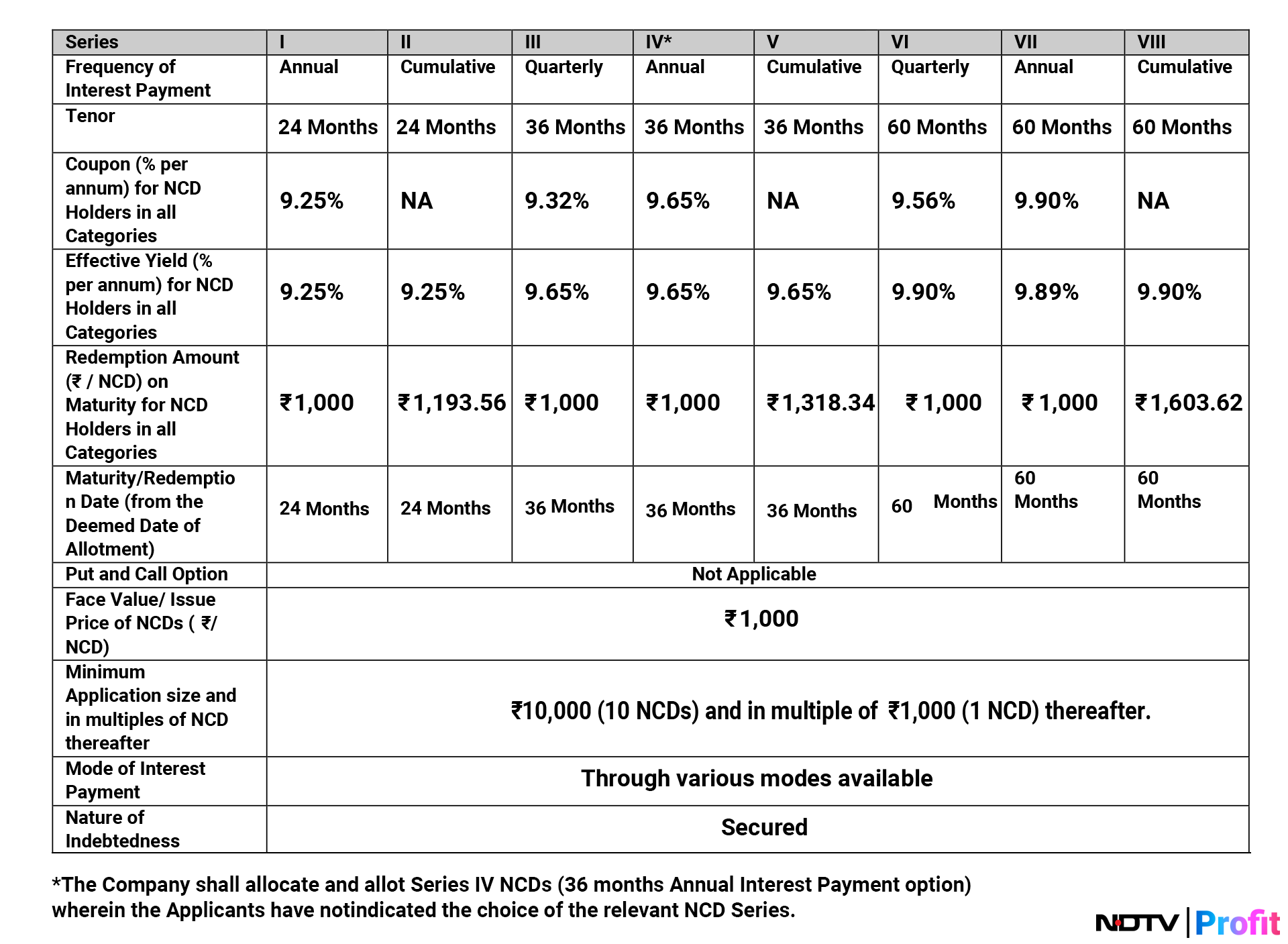

The debenture offering will consist of 80 lakh non-convertible debentures, each with a face value of Rs 1,000. The retail bond issue will carry an effective yield up to 9.90% per year.

The minimum application size for each application for the debentures is Rs 10,000 in all the series and multiples of Rs 1,000 thereafter.

The debentures will be available in 24-month, 36-month, and 60-month tenors, with quarterly, cumulative, and annual interest payment options across eight series.

The issue's base size is Rs 400 crore, with the option to retain oversubscription of up to an additional Rs 400 crore, also known as a greenshoe option, bringing the aggregate size to Rs 800 crore.

The company intends to use approximately 75% of the raised amount towards prepayment or repayment of the existing debt, in full or in part. The remaining 25% of the issue will be used for general corporate purposes as per SEBI guidelines.

Trust Investment Advisors Private Limited, A.K. Capital Services Ltd., and Nuvama Wealth Management Limited are the lead managers for this public bond issue that has been rated 'CARE A+' with a 'positive' outlook by CARE Ratings Ltd.

Non-convertible debentures are fixed-income instruments for specific terms and interest rates. This is a debt instrument where the issuer provides specific assets as collateral to secure the investment made by the debenture holders.

If there is a case of default by the issuer, then the debenture holder can claim the assets that are placed as collateral.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.