Adani Energy Solutions Ltd. could rally 130% with strong growth and diversified business, according to Cantor Fitzgerald. The research firm initiated coverage on the Adani Group's power transmission arm with an 'overweight' rating and has a target price of Rs 2,251 per share against the previous close of Rs 979.45 apiece on the BSE.

The diversified portfolio that includes transmission assets, distribution assets, and a smart metering business could be an attractive way to play the rapidly expanding energy market, Cantor said in a report on Sept. 19.

Adani Energy Solutions offers growth unlike any other publicly traded utility and energy company across the US, Europe or Asia, it said. The research firm expects the company's revenue to grow at a CAGR of 20% from fiscal 2024 to 2027.

The transmission business is poised to see strong growth as it completes the nine projects it has recently been awarded, the Cantor note read.

The distribution business should be able to grow near double-digit rates. "Smart metering business is just about to start generating meaningful revenue/profit as it works through its 22.8 million smart meters backlog, and it could win another 40 million smart meters."

The power transmission player will continue to outgrow peers for at least the next decade, Cantor said. This is a result of India being still underdeveloped relative to more mature markets, it said.

Adani Energy's shares currently trade at a 60% discount to peers, and should trade at an in-line multiple, the note said.

Meanwhile, Jefferies said that the power distribution is gearing up to capitalise on the booming smart metering market in India, with the government targeting the installation of 25 crore smart meters by 2026.

Jefferies has a 'buy' rating on the stock, with a target price of Rs 1,365 per share, implying an upside of 38%.

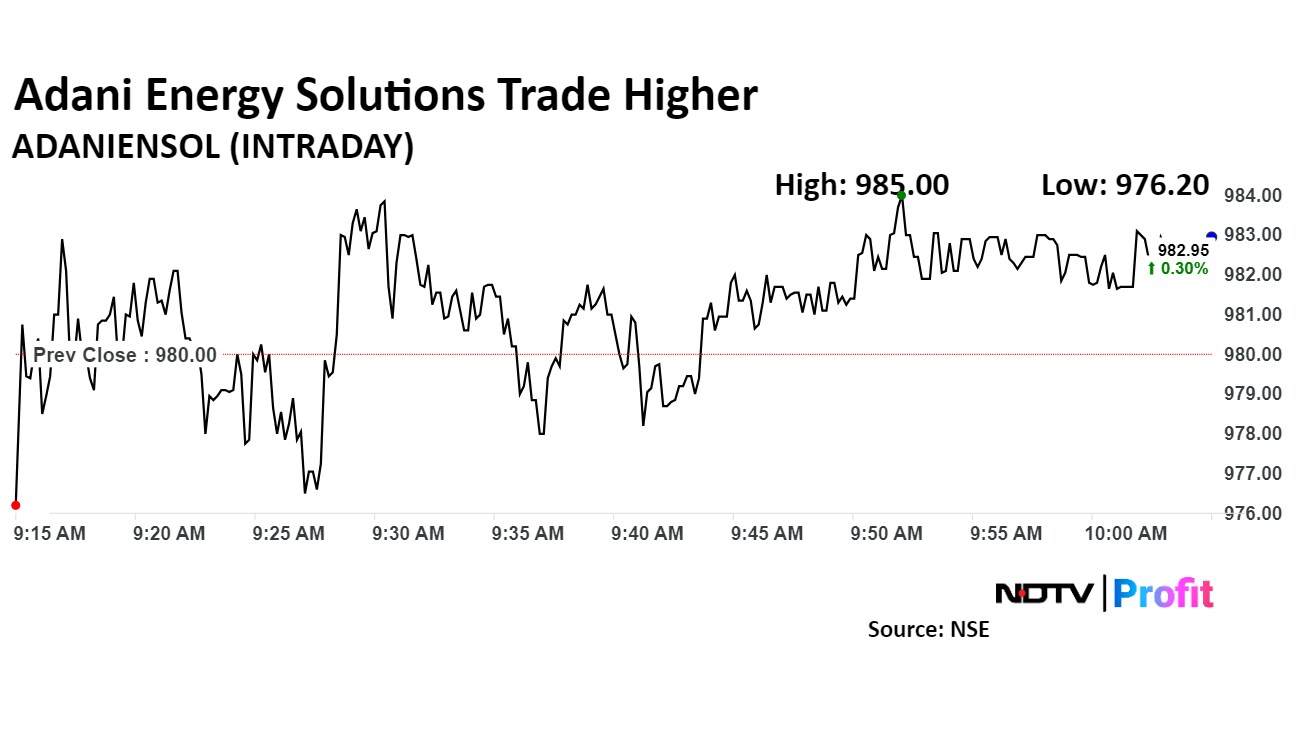

Adani Energy Solutions stock rose as much as 0.61% during the day to Rs 985 apiece on the NSE. It was trading 0.38% higher at Rs 982.7 apiece, compared to a 0.65% advance in the benchmark Nifty 50 as of 10:03 a.m.

It has risen 15% during the last 12 months and has declined by 6% on a year-to-date basis. The total traded volume so far in the day stood at one times its 30-day average. The relative strength index was at 39.

All three analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 84%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.